An oil giant's cheap shares look ready to bounce back

ExxonMobil has disappointed so far this year but the Permian basin in Texas offers great potential.

28th August 2019 09:56

by Rodney Hobson from interactive investor

ExxonMobil has disappointed so far this year but the Permian basin in Texas offers great potential.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Figures so far this year from international oil giant Exxon Mobil (NYSE:XOM) have been disappointing, but the shares look cheap, the future is promising and the yield suggests a rerating is likely before the year is out.

The main damage was done in the first quarter, when earnings excluding exceptionals almost halved from $4.65 billion to $2.35 billion, well below analysts’ expectations, although revenue was down only 6.7%.

Figures covering the first half were issued this month and they showed a better performance in the second quarter, though not good enough to offset the poor start to the year – earnings were 21% lower. So for the first half as a whole, earnings were off 36% to $5.48 billion.

Like all oil companies, Exxon is at the mercy of changes in the oil price. While production increased during the six months, from 3.8 million barrels a day to 4 million, revenue fell from $73.5 billion to $69 billion as margins remained under pressure and unscheduled shutdowns affected several refineries.

Unfortunately, capital and exploration expenditure increased 30% in the first half but that is money well spent. Oil companies cannot stand still; the search to bring new revenue on stream is continuing. A positive sign is that other costs were actually lower.

Much now depends on the shale oilfields in the Permian basin, situated mainly in Texas but extending into New Mexico.

The terrain is pretty bleak and is subject to sandstorms, thunderstorms and excessive heat but at least there is no one around to protest about the fracking. Output from there is already keeping Exxon's US Gulf Coast cracker - a facility that readies oil and gas for use in plastic products - which came onstream less than 12 months ago, running 10% above the capacity it was designed for.

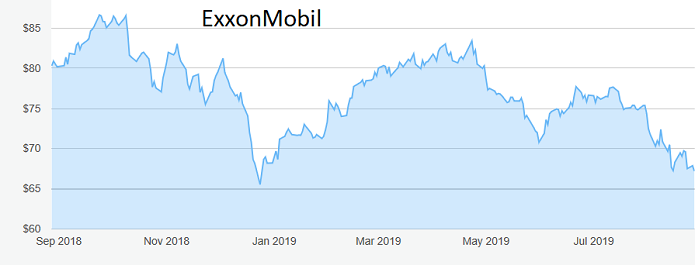

Source: interactive investor Past performance is not guide to future performance

Earlier this year, Exxon upgraded its growth plans for the basin, reckoning it could produce more than 1 million barrels a day by 2024, an increase of 80% over the previous estimate. Exxon's share of the basin's resources is about 10 billion barrels but that, too, could well be an underestimate.

The oil major remains one of the most active operators in the Permian Basin. It has nearly 50 drilling rigs currently in operation and plans to increase its rig count to about 55 by the end of this year.

This investment is expected to produce double-digit returns even at low oil prices. At a selling price of $35 per barrel, Permian production will have an average return of more than 10%.

- The three oil majors worth buying

- High-yielding BP shares chased higher after results

- Royal Dutch Shell promises shareholders $125 billion windfall

Another exciting development is in Guyana, where phase 1 is about to start up and the estimated recoverable oil and gas has been increased to more than 6 billion barrels.

The big imponderable is the price of crude oil, which can be quite erratic and which has a disproportionate effect on the profits of oil explorers. In the past 12 months alone, WTI crude has been as high as $76 a barrel and as low as $42. It currently stands at around $55.

Exxon received a vote of confidence this month from ratings agency Moody's when its proposed offering of fixed and floating rate senior notes received an Aaa rating with a stable outlook. Proceeds from the offering will go towards the refinancing of outstanding commercial paper borrowings and as working capital. Moody's said the top rating reflected Exxon's extensive proved reserves, cash flow and its ability to borrow at low interest rates.

Hobson's choice: I first suggested buying ExxonMobil at $75 in February and there was a chance to take a $6 a share profit in April. Long-term investors who have earned dividends in the meantime should not be disheartened that the shares have slipped back to $68. This is an even better buying opportunity with a yield of 5%.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.