Nvidia’s just the start: Goldman says the AI boom will have four phases

The investment bank sees the AI trade unfolding in four broad stages. Russell Burns considers each one.

22nd March 2024 13:37

by Russell Burns from Finimize

- Goldman has separated the AI revolution into four phases, looking to identify the stocks and sectors set to benefit most after Nvidia.

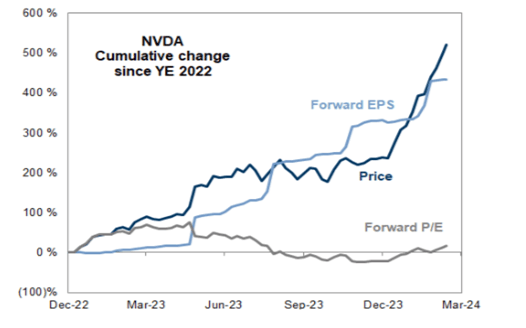

- Despite Nvidia’s massive share price rally, its forward price-to-earnings ratio remains virtually unchanged over the past two years – and that’s because its earnings outlook has managed to keep pace with its stellar stock rise.

- Goldman sees semiconductor-related firms, and software and services companies getting a huge boost from AI, and says the potential improvement in productivity across most sectors bodes well for the economy as a whole.

Sure, Nvidia’s been the poster child for the AI investing boom, rising 73% this year alone. But there’s a lot more to AI than this popular, green-logo chipmaker. Goldman Sachs, in a recent report, says the AI trade will unfold in four separate phases – and this stock is just chapter one. So let’s take a look at those phases, then, and the companies that are likely to win big in each.

Phase 1: Nvidia.

This part kicked off less than a year and a half ago, with the release of OpenAI’s ChatGPT. The generative AI bot took the world by storm, sparking a surge in demand for shares of Nvidia, whose AI-powering computer chips made it the market’s clearest near-term AI beneficiary.

Nvidia share price returns (dark blue), forward earnings per share (light blue) estimates, and forward price-to-earnings ratios (grey) since the end of 2022. Source: Goldman Sachs. Past performance is not a guide to future performance.

What’s the opportunity?

Despite Nvidia’s massive share price surge (dark blue line), its current valuation – judging by its forward-looking price-to-earnings ratio (or P/E, in grey) – is almost unchanged. And that’s because its estimated earnings per share (or EPS, in light blue) have been shooting rapidly higher too.

This chart looks great right now, but Goldman notes that as companies get bigger, they usually have a harder time achieving rapid growth and maintaining high margins. For now, it seems right to just enjoy the investing ride, knowing that, eventually, even Nvidia will see its growth slow.

Phase 2: AI infrastructure.

You can think of AI as its own little world, with a ton of firms involved in its infrastructure. These include semiconductor companies whose chips are the critical components needed to train and use AI. And there are sub-sectors within semiconductors, including design companies such as ARM, and fabless designers (who design but don’t manufacture) like Broadcom and Advanced Micro Devices. There are also memory companies like Micron, and semiconductor manufacturing equipment companies like Applied Materials and ASML.

Plus, there are data centre companies, such as Equinix, which own and operate physical places that contain the servers needed to train and run AI models. And there are hardware and equipment companies, like Vertiv, supplying the things needed to build and operate the data centers.

Utility companies, like Duke Energy, meanwhile, deliver vast amounts of electricity to power the data centres. Cloud providers, like Microsoft, Amazon, and Alphabet help train, run, and maintain AI models through their computing and data storage solutions. And security companies like CrowdStrike work to keep data safe.

What’s the opportunity?

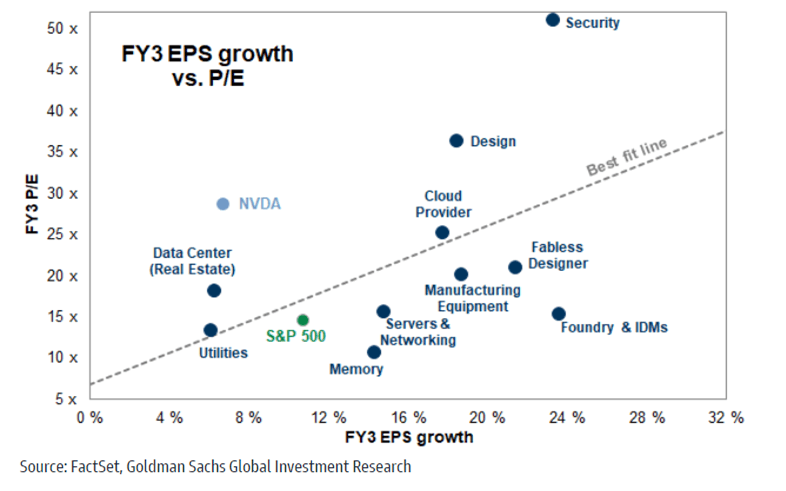

Goldman looked closely at these companies’ EPS estimates and P/E ratios three years into the future – and then accounted for various unforeseen factors. After all, lots of things can impact valuations and stock prices. And this is how the investment bank sees things panning out.

Growth and valuation for median stocks in the “Phase 2” categories. Source: Goldman Sachs.

The companies that fall below the “best fit” gray diagonal line are potentially more attractive to investors, because they have higher expected profit growth relative to their P/E valuations.

For example, in the bottom right corner of the chart, “foundry and integrated device manufacturers” look to have a relatively good-looking setup of strong expected EPS growth with modest valuations. The companies in that subsector are TSMC, Intel, and Global Foundries.

Meanwhile, security stocks, which appear in the top right of the chart, have strong earnings expectations but could struggle to perform, since they already trade at very high valuations, with their prices above 50x their earnings (that’s more than double the average for companies in the S&P 500).

Utilities, at the bottom left of the chart, could represent an interesting opportunity because they look cheap in valuation terms. But since they operate in a highly regulated industry, they could continue to struggle to make meaningful gains.

Overall, it’s worth noting that semiconductors are still a big component of Phase 2 companies, and so the iShares Semiconductor ETF (ticker: SOXX; expense ratio: 0.35%) could be a good place to look for some broad-based AI exposure.

Phase 3: AI-enabled sales.

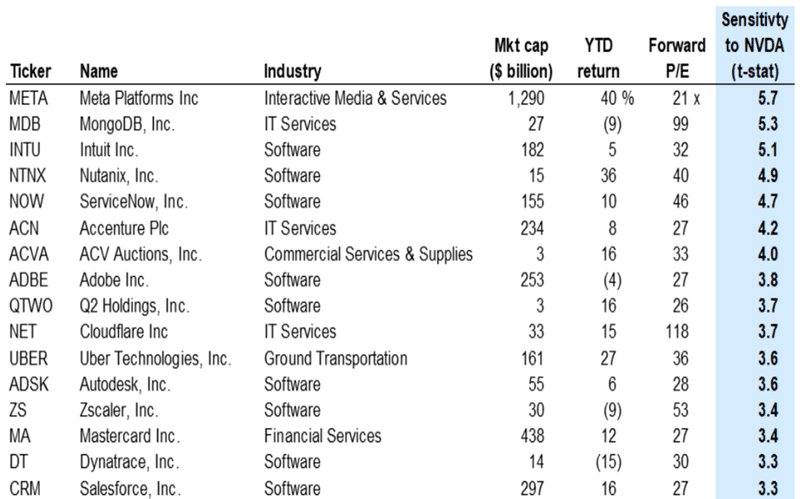

The companies that will benefit at this stage are the ones that can add AI into their product offerings to boost what they sell. Many of them are software and IT services companies, like Meta, MongoDB, Intuit, Nutanix, ServiceNow, and Uber.

What’s the opportunity?

Loads of software and IT services firms have already described how they’ll take advantage of AI. So Goldman had a look across the industry, scouting for companies whose share prices have high beta (or volatility), and have been rising with Nvidia’s. Then they zeroed in on the ones whose executives specifically mentioned AI in their latest quarterly earnings calls with investors. That left the bank with a long list of companies. Here are the top 15.

These companies are likely to boost revenues with AI-enabled offerings, have shares that are strongly correlated with Nvidia’s, and have discussed AI during earnings calls with investors. Source: Goldman Sachs. Past performance is not a guide to future performance.

You could invest in the firms individually or gain access to a broad batch of software and IT services companies through an ETF.

Phase 4: AI productivity.

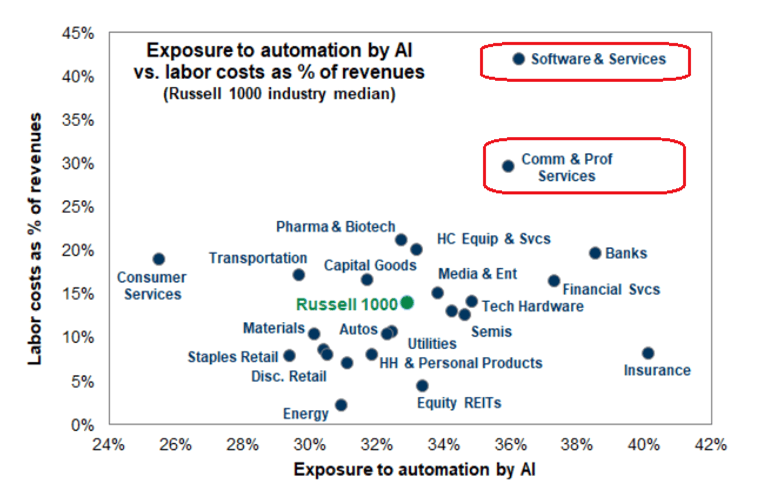

Eventually, the AI trade will focus on companies that are using AI to improve productivity – across a wide range of industries – with the biggest potential likely to be in more labor-intensive industries.

Goldman crunched the data and estimated that profits at software and IT services, and commercial and professional service companies could benefit the most. After all, a hefty segment of their well-paid workers are in jobs that could be replaced by AI automation, which could dramatically reduce those firms’ labor costs. Goldman’s report highlighted Match Group and News Corp. as a couple of prime examples.

What’s the opportunity?

Phase four is about the grand promise of the technology: the way things shift when AI is adopted by a wide range of companies. Goldman sees software and IT services firms, and commercial and professional services firms affected the most, as AI adoption improves their labor productivity and dramatically shrinks their wage costs. This next chart plots the potential productivity gains that could be felt across various sectors and industries.

Potential productivity gains from widespread AI adoption. Source: Goldman Sachs.

To bet on AI’s fourth phase, you could dip back into the 15 companies from phase three’s handy chart or beef up your allocation to a Tech-Software Sector ETF.

And, last, a look at the big picture.

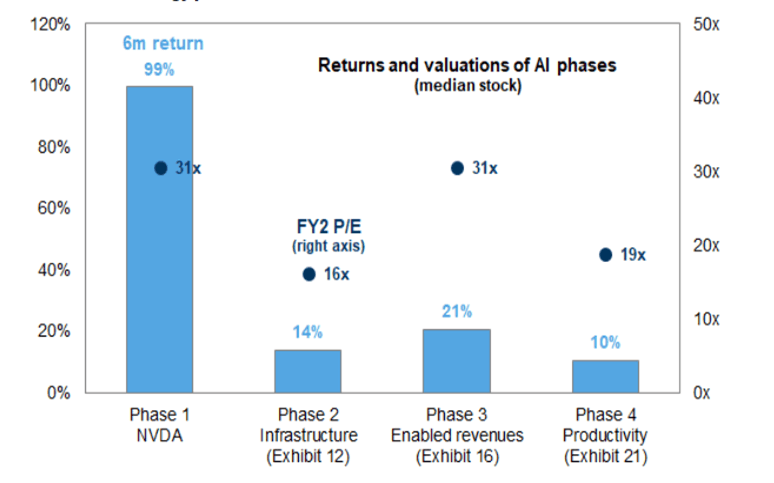

The important thing to remember is that we’re still in the early stages with AI. Phase one star Nvidia has been the standout performer, by far, but there have been gains in stocks from across each of the tech’s phases.

The six-month median share price performance and forward valuation across the Goldman Sachs AI portfolio strategy phases. Source: Goldman Sachs. Past performance is not a guide to future performance.

Taking on more risk can potentially bring bigger returns. And picking stocks and sectors is generally riskier than choosing the broader market index. If AI is set to improve productivity across a huge number of sectors and the wider economy, as suggested in phase four, owning the S&P 500 through a tracker fund could well prove to be a good long-term bet.

Russell Burns is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.