Nvidia stock tipped to smash through $1,000 barrier

Having just launched ‘the engine to power this new industrial revolution’, the AI chip giant could soon be worth $3 trillion. Graeme Evans explains why.

26th March 2024 13:13

by Graeme Evans from interactive investor

The remarkable run for NVIDIA Corp (NASDAQ:NVDA) shares has been backed to continue after a Wall Street bank said the semiconductor giant is on the cusp of an “entirely new wave of demand”.

- Invest with ii: Most-traded US Stocks | Buying US Shares in UK ISA | Cashback Offers

UBS forecast 16% upside for shares after Nvidia unveiled its new and more powerful Blackwell platform, which is expected to unlock generative AI for more organisations.

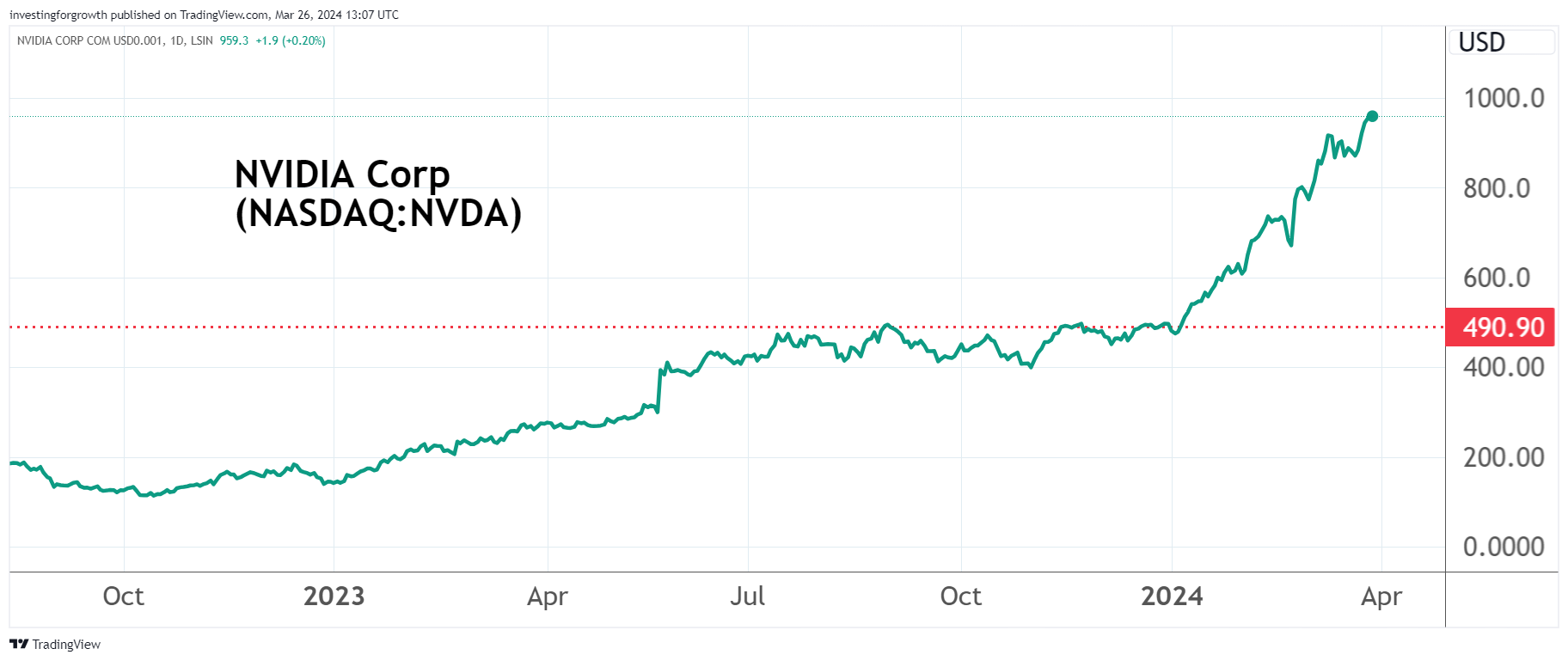

The shares have risen every day since the launch event at the start of last week, leaving Nvidia at $950 for a market value of $2.4 trillion (£1.9 trillion) by today’s Wall Street opening bell.

Fuelled by the latest knockout earnings figures in February, the Magnificent Seven stock has already doubled in value in 2024 and risen by more than 250% in the past year.

Source: TradingView. Past performance is not a guide to future performance.

It’s a journey enjoyed by many interactive investor customers as Nvidia last week jumped five places to fourth on our list of most-popular ISA investments, behind Rolls-Royce Holdings (LSE:RR.), Vodafone Group (LSE:VOD) and Phoenix Group Holdings (LSE:PHNX).

The base case at UBS is that shares deserve to be at $1,100, describing Nvidia as the only chip company that can create its own market. The upside valuation is $1,237, the downside $761.

The bank also raised its full-year revenue estimates ahead of the company’s first-quarter results on 24 May.

It said in a recent research note to clients: “We believe Nvidia sits on the cusp of an entirely new wave of demand from global enterprises and sovereigns - with each sovereign potentially as big as a large US cloud customer.”

At the launch, Nvidia named Amazon Web Services, Dell Technologies Inc Ordinary Shares - Class C (NYSE:DELL), Google, Meta Platforms Inc Class A (NASDAQ:META), Microsoft Corp (NASDAQ:MSFT), OpenAI, Oracle, Tesla Inc (NASDAQ:TSLA) and xAI among those expected to adopt Blackwell.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Nvidia’s just the start: Goldman says the AI boom will have four phases

- US shares to put in your ISA in 2024

- How to build a £1 million pension and ISA portfolio

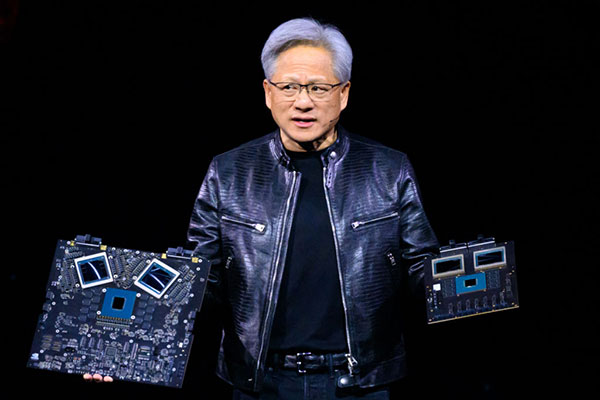

Founder and chief executive Jensen Huang (pictured) said: “For three decades we’ve pursued accelerated computing, with the goal of enabling transformative breakthroughs like deep learning and AI.”

“Blackwell is the engine to power this new industrial revolution. Working with the most dynamic companies in the world, we will realise the promise of AI for every industry.”

The new architecture features six technologies for accelerated computing in data processing, engineering simulation, electronic design automation, computer-aided drug design, quantum computing and generative AI — all emerging industry opportunities for Nvidia.

The company’s invention of the graphic processing unit in 1999 sparked the growth of the PC gaming market and helped to ignite the era of modern AI. It is also now a full-stack computing infrastructure company with data-centre-scale offerings.

UBS’s forecast is based on a valuation multiple of 32 times 2025 forecast earnings of $34.12.

This multiple is towards the low end of where Nvidia has historically traded due to concerns around potential data centre capacity constraints, though UBS has weighed these reservations against the fact that Nvidia’s demand pool is growing.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.