Is now a good time to pick up Purplebricks shares?

Shutting the property market hammered the AIM company, so our chartist looks at recovery potential.

13th May 2020 08:46

by Alistair Strang from Trends and Targets

Shutting the property market hammered the AIM company, so our chartist looks at recovery potential.

Purplebricks PLC (LSE:PURP)

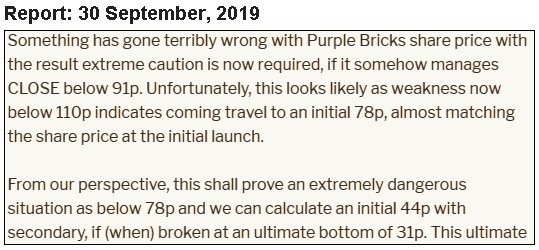

Purplebricks (LSE:PURP) joins a large club of shares where we produced analysis expressing unhappiness about their share price.

What we don't 'get' is all this misery dated from 2019, well before the pandemic. It was almost as if the markets were awaiting an accident to happen, any accident.

Very strange indeed. Regardless the sector, we would noticed many shares feeling like they needed an excuse to jump off a cliff.

We are pretty sure no one expected Covid-19, with the level of reversals sometimes breaking below our worst-case scenarios.

Purplebricks had calculated with a big picture bottom potential of 31p, a price level briefly exceeded on 18 March this year.

We could not comfortably calculate a point below 31p and the single day which reached 22p before a rebound wasn't noticed, thanks to the riotous panic pervading wider markets.

Our usual argument, if a price exceeds a drop target then any bounce risks being short-lived, is perhaps not valid against Purple, but we shall review the miserable side of life, despite the break below 31p proving (thus far) to be a fleeting event.

We can now calculate below 31p, thanks to movements since 18 March.

Price movement now below 29p looks capable of a downward drift to 20p next with secondary, if broken, at a bottom of 12.5p.

Once again, we can pronounce an "ultimate bottom" for Purple and it's at 12.5p. We cannot calculate below this level.

However, care has been taken to respect the 31p level, despite the little hiccup in March.

The situation now appears to suggest any recovery exceeding 47p should hear to an initial 63p.

Visually, this makes some sense. If exceeded, the longer-term secondary works out at 108p and theoretically returns the price to the level at the start of the current disaster.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of interactive investor.

All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.