Not too late to buy this fun stock

A focus on playing at home during global lockdown could be a boost for this iconic American firm.

15th April 2020 10:53

by Rodney Hobson from interactive investor

A focus on playing at home during global lockdown could be a boost for this iconic American firm.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Sensible investors are looking for companies that have been dragged down in the coronavirus scare but which provide goods or services that remain in demand.

Swimming against the tide, Hasbro (NASDAQ:HAS) may actually have seen sales rise in the lockdown.

Hasbro is a toys, games and entertainment company with some strong brands in its portfolio, including what is arguably the greatest board game ever invented, Monopoly, and two of the best-selling and much-loved toys, Action Man and My Little Pony.

Its ownership of Backflip Studios and the animation studio Boulder Media means it can produce television programmes and cinema pictures.

It’s true that people in many countries have been unable to visit the cinema over the past few weeks, but the stay-at-home edicts have reawakened interest in having fun at home, and forced hours of TV watching on those trying to fill the long hours.

Parents trying to balance working from home with the demands of young children off school need all the help they can get.

Those parents who cut back on future spending as their income is reduced could possibly buy fewer toys.

However, it is more likely that they will forgo trips out when life returns to normal. Toys can cost less than £10; most are priced at under £25; toys can be shared. A trip out with two or three children can easily tot up to £100.

Hasbro has bought Entertainment One, a UK company formerly quoted on the London Stock Exchange, in what would have been a transformational acquisition in other circumstances, bringing many children’s characters such as Peppa Pig into the fold.

The £3.3 billion cash acquisition was agreed last August, and it was completed in mid-January when the UK regulator decided not to refer the deal to a monopolies investigation.

While there are always concerns that bidders have to pay a full price in order to gain the recommendation of the target company’s board, Hasbro did get an exciting range of pre-school brands. The acquisition will come good.

Live Co Group (LSE:LVCG) quickly announced that its subsidiary Bricklive International had signed a licence agreement to produce Peppa Pig themed tours in the UK and the Republic of Ireland, up to the end of September 2023.

The first Peppa Pig tour was expected to launch in the third quarter of this year, although the lockdown will almost certainly cause a delay. In return, Bricklive will pay a royalty fee.

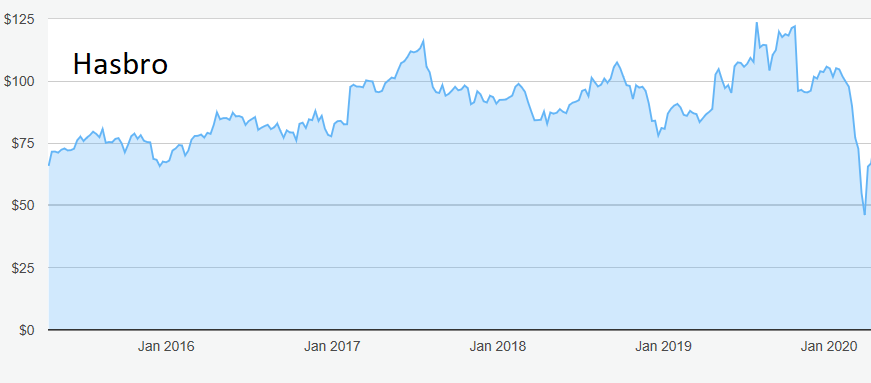

Last May, I warned subscribers not to pay more than $100 for Hasbro shares, little realizing at the time that even that valuation would be badly overtaken by events.

It was actually possible for short term traders to cash in a nice profit at $126 in late July, but long-term holders suffered a fall to $45 in March, surely too low a valuation for a company with great prospects.

Source: interactive investor Past performance is not a guide to future performance

Well done if you bought at the bottom, but it is not too late to get in as the stock makes up lost ground.

The current price around $75 is still a bargain, with a theoretical yield of 3.6% and the price/earnings ratio a comfortable 18.4, and the next ceiling could be around $95, which proved to be a floor until the market carnage.

Although some analysts have reduced their target price for the stock, most still see the near-term potential at $90 or more.

Figures for the first quarter will be released towards the end of this month. They could be much better than many investors are expecting – and, if they are, the best chance to buy the shares will be gone.

Hobson’s choice: Buy Hasbro up to $79. The shares will top $100 again when the coronavirus scare starts to become an unpleasant memory.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.