Nick Train analyses his trust and names the stock he’ll buy more of

The star fund manager talks about a poor run of form at Finsbury Growth and Income Trust, what he blames for the underperformance and his plans to rectify the situation.

7th December 2023 15:54

by Graeme Evans from interactive investor

Finding the next RELX (LSE:REL) and Sage Group (The) (LSE:SGE) is a priority for investor Nick Train after the FTSE 100 pair offset a disappointing year for his Finsbury Growth & Income (LSE:FGT) Trust.

Train’s portfolio, which is focused on high-quality companies such as Diageo (LSE:DGE), Unilever (LSE:ULVR) and Burberry Group (LSE:BRBY), delivered a net asset value (NAV) per share return of 7.2% for the year to September against the FTSE All-Share benchmark at 13.8%.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

The gap widens to 11.8% versus the All-Share’s 39.8% after three years of underperformance, the longest run since Lindsell Train was appointed portfolio manager in December 2000.

In today’s annual report, Train said a big factor in the recent poor record has been a longstanding aversion to oil, metals and banks.

Whereas a big holding in “defensive” Unilever is little changed over the last three years, the rally by economically sensitive and more cyclical sectors has resulted in total returns growth of 203% for Shell (LSE:SHEL), 173% for BP (LSE:BP.), 255% for Glencore (LSE:GLEN), 48% for Rio Tinto Registered Shares (LSE:RIO) and 145% for HSBC Holdings (LSE:HSBA).

Train calculates that not owning these five companies has contributed to over two-thirds of the underperformance over the past three years.

In addition, Train says he underestimated the significance of technological change after Covid-19 acted as an “accelerant” for industry, consumer and stock market trends that had already been gathering pace in the second decade of the 21st century.

He said: “Finding UK-listed data, analytics and software companies that are beneficiaries of technology change has been and remains a priority for me and in RELX and Sage, for instance, there has been some success.

“In hindsight, at the start of the recent three-year period, I wish I had even more exposure to digital winners.”

- ii view: why Sage shares just rallied to all-time high

- Recent weakness is signal to buy either of these two stocks

- Diageo ditched in favour of cola and lager stocks

RELX, which provides data services to professionals in the scientific, legal and insurance industries, is Finsbury’s biggest holding and one of its best longer-term performers after shares recently hit an all-time high.

Today’s report notes a total return of 11.3 times since 2000 compared with 5.4 times for the Nasdaq. Train said: “Even now, some of our clients are surprised to see how well RELX has done, even compared with the “home” of technology, the Nasdaq.

“We believe there are other UK-listed data and software companies that can perform as well in the future as we hope RELX will continue to do.”

Finsbury’s other strong performer in 2023 was Sage as shares re-rated following a period of necessary investment in its core accounting software services.

Train said: “Sage is another UK-listed software/data company with a global business (the US is its biggest market and forecast to grow at 16% this year) that is not, or only recently, recognised by global investors.”

- Fund group holding hurts Lindsell Train trust performance

- Nick Train: the UK stock market has a dividend problem

- Nick Train on succession planning and the one share he expects to hold forever

About 44% of Train’s portfolio is invested in data, analytics and software, followed by 31% in luxury and premium consumer names and 18% in mass market brands such as AG Barr (LSE:BAG).

With only 16 holdings above 1% of net asset value, it is a concentrated portfolio. But Train says evidence that these are profitable and growing businesses can be found in the fact that 91% have increased their dividend this year. More than 75% of the portfolio by value is either buying back shares or has paid a special dividend in 2023.

He added: “Concentration can cut both ways, as the company’s shareholders have experienced over the last three years, but if we can continue to hold and find new positions that can do for us what these have done over the next 20 years, then the company certainly offers a differentiated and potentially rewarding portfolio and investment approach.”

One company Train has no intention of letting go is Diageo, whose share price total return is up over sevenfold in the past 20 years. Shares have struggled this year due to a slowdown in the consumption of premium spirits in the Americas, but with the valuation under 20 times earnings Train intends to add to the holding “whenever we can”.

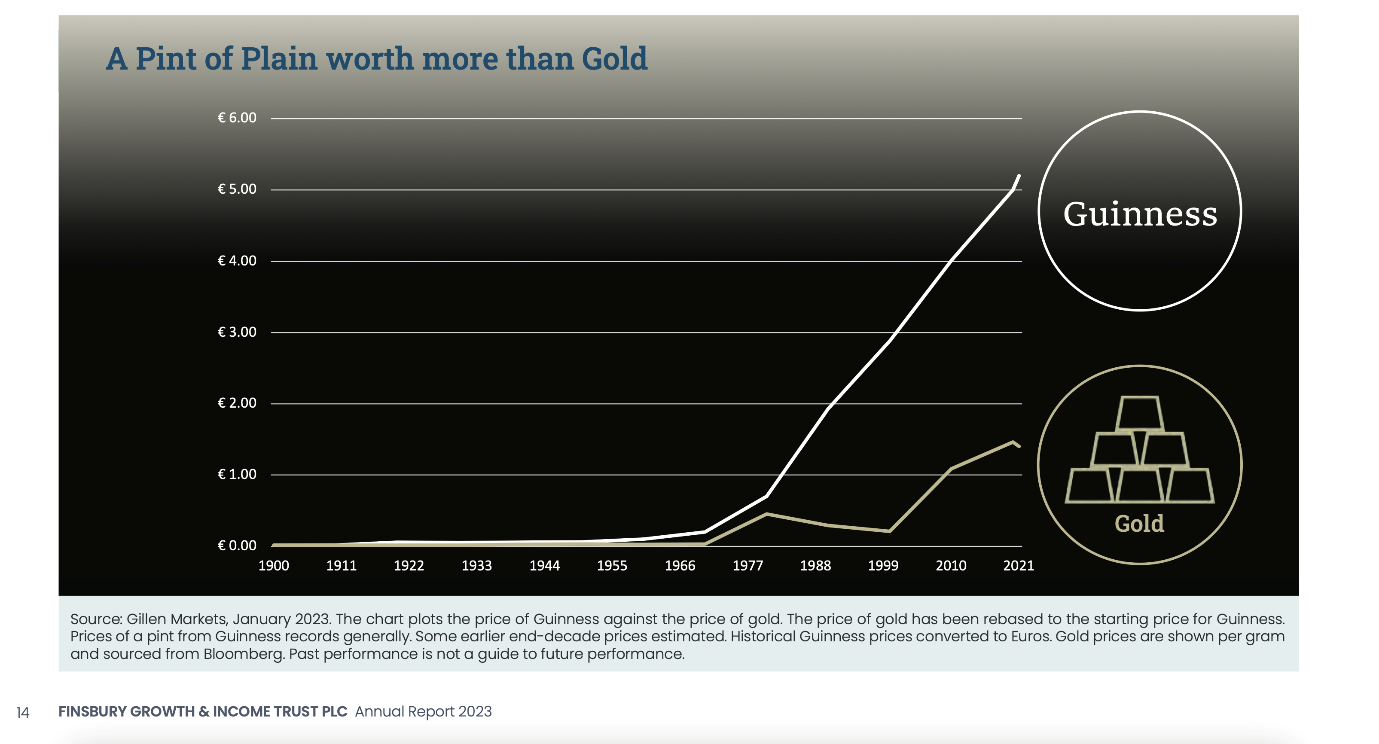

He produced a chart showing the price of a pint of Guinness — one of Diageo’s biggest brands — compared with the gold price, which he said was an important reminder of how a “great brand” can protect its owners against the malign effects of inflation over time.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.