The next wave of AI plays, according to Morgan Stanley

Nine information services stocks have the most potential to benefit from AI’s next chapter, the investment bank says.

5th July 2024 10:19

by Stéphane Renevier from Finimize

- Information services companies are well-positioned to benefit from AI: the technology is making their exclusive datasets increasingly valuable – giving them a competitive advantage – while also offering them the opportunity to improve what they do.

- Stocks in this industry are now trading at a cheaper-than-usual premium and the upside from AI isn’t fully reflected by the market, suggesting now could be a good entry point.

- Morgan Stanley analysts recently rounded up a list of nine information services stocks that they see as having the best risk-reward profiles: Nasdaq, MSCI, TransUnion, Experian, Tradeweb Markets, S&P Global, London Stock Exchange Group, RELX, and Wolters Kluwer.

If you’ve ever seen a backyard swimmer do a masterful “cannonball”, you know that the big swells it creates eventually flow over the outer edges of the pool, one after another. And that’s a pretty good way to think about AI and its investment ripples. In fact, if Morgan Stanley were at your pool party, it’d tell you that information services companies will be part of the next wave of firms making a stock splash. Here’s how you can get in and get your feet wet.

OK, so what’s so exciting about information services?

There are tons of information services firms out there: most of them providing essential data and analytics to help businesses make informed decisions. They operate in all kinds of industries, like finance, healthcare, law, and insurance.

And Morgan Stanley says three factors make them perfectly positioned to benefit from AI:

Data-driven growth. These companies are sitting on gold mines of high-quality data. This enviable position lets them tap into AI’s insatiable demand for information and analytics. With more businesses leaning into data-driven decision-making, these firms are set for steady growth.

Generative AI upside. The technology itself is a potential game-changer. By weaving AI into what they do, these companies can up their pricing game, keep customers hooked, and roll out cool new stuff. Morgan Stanley sees this adding as much as $30 billion in revenue by 2028, bumping up the sector’s market potential by 4% to 7%. By integrating the technology into their platforms, these companies can offer seamless daily workflow solutions, giving them a clear edge over standalone AI vendors.

Strong competitive moats: These firms might not be the AI tech inventors, but they’ve got the data and delivery chops to bring AI solutions to market fast. Their deep customer relationships, essential tools, and quick integration will build barriers that would be tough for competitors to cross.

Why now?

Morgan Stanley says now’s a prime time to wade in. It sees this as a crucial, next stage in this tech revolution: traditionally, semiconductors benefit first, then infrastructure, and finally software and services. So that means it will soon be information services’ time to shine. And, yes, it’s still early days, but don’t be fooled – with the pace of this boom, you won’t want to be late.

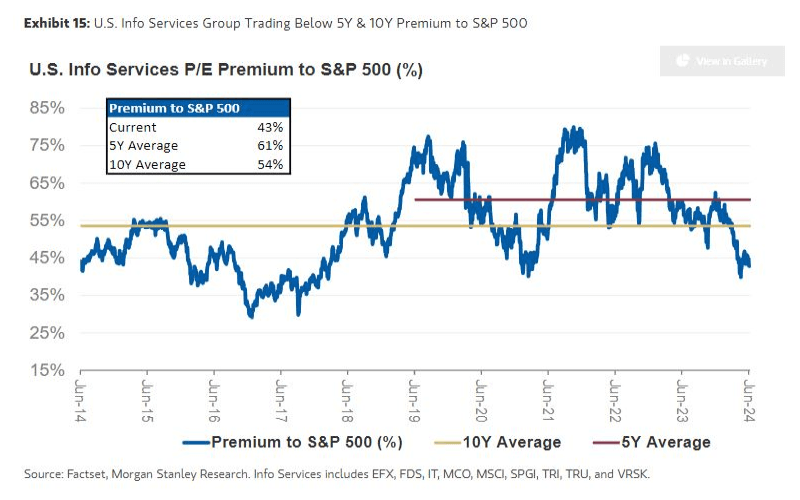

The good news is, the potential opportunity isn’t fully “priced in”, or reflected in the market. Sure, information services stocks are trading at a premium compared to the broader market, but considering they’ve outperformed by around 350% over the past decade, it may be justified. Even better, they could be at an attractive entry point: the premium on high-quality stocks from this industry is below its five-year and ten-year averages. With strong assets, rising demand, efficiency improvements, scalability, and AI-driven growth potential, there’s room for that premium to expand and for these stocks to continue outperforming.

US info services stocks trade at a lower-than-normal premium. Source: Morgan Stanley. Past performance is no guide to future performance.

What could go wrong?

Every silver lining has a dark cloud, so Morgan Stanley pointed out a few key risks for information services stocks. Regulatory changes, such as stricter data privacy laws or new regulations on AI usage, could curtail data collection and monetization, which could hurt sales streams. An economic downturn could reduce corporate spending on data services, which would hamper growth and profitability. The rapid pace of AI and tech advancements could leave some firms behind, rendering them obsolete. AI-driven replication could lead to data commoditization, essentially chipping away at the competitive advantage of firms that rely on unique datasets. Lastly, increased competition from traditional players and tech-driven newcomers could pressure pricing, squeeze margins, and lead to market share losses, ultimately threatening overall profitability.

What’s the opportunity, then?

There aren’t any ETFs that directly target this theme, but luckily, Morgan Stanley has done the work and found nine standout global information services stocks.

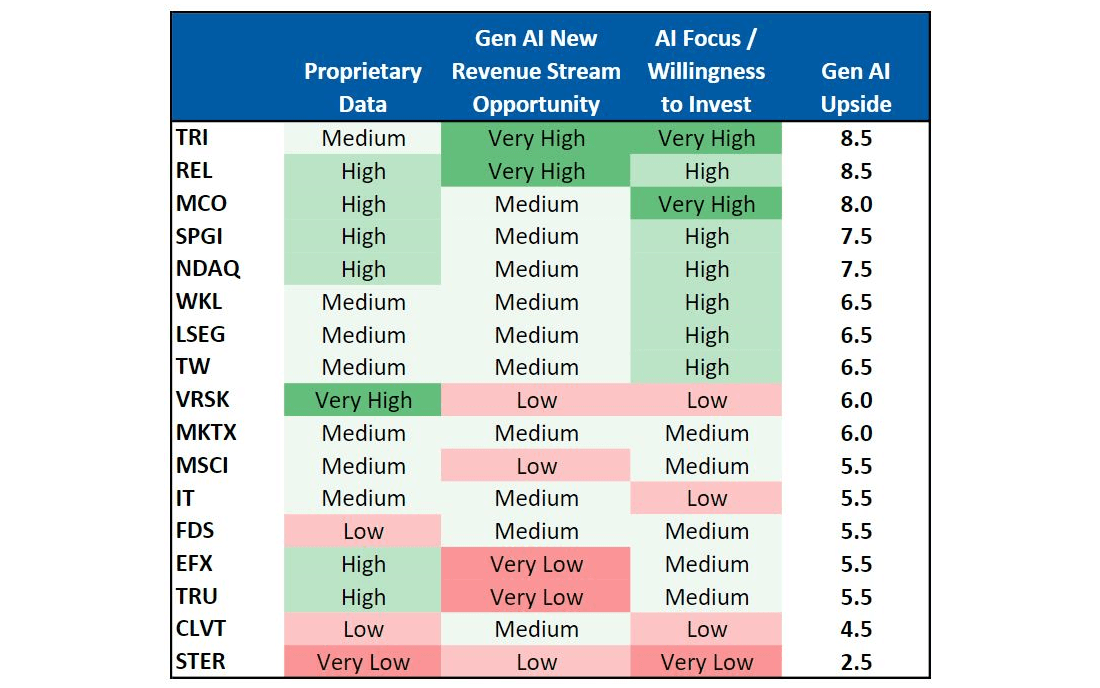

Its analysts considered both the quality and exclusivity of each firm’s data, plus the potential upside from generative AI.

Info services stocks, scored based on the value of their proprietary data, the potential for new AI-driven revenue streams, and the strength of their current AI focus. Source: Morgan Stanley Research.

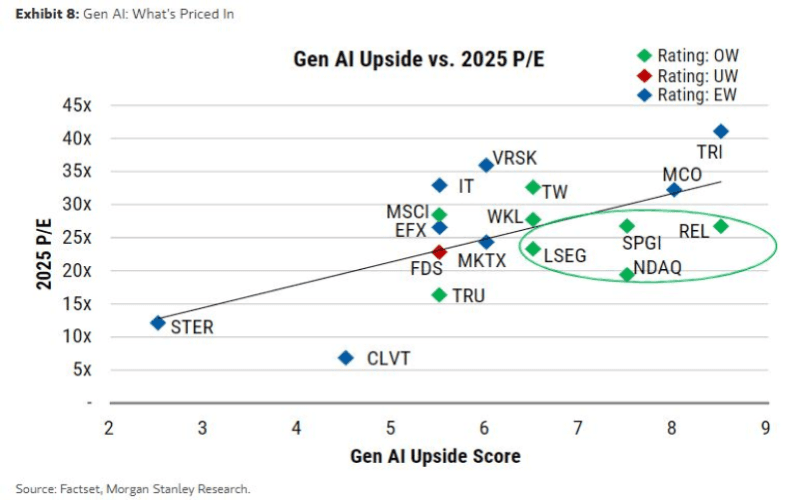

But they quickly saw that some stocks (such as Thomson Reuters and Verisk Analytics) already reflect an AI-fueled improvement, so their risk-reward proposition wasn’t as sweet. So the analysts drew up another chart, noting how much AI verve is already priced in and plotting, essentially, how cheap each stock is.

Stocks from the info services industry, according to their valuations (forward price-to-earnings, or P/E, ratios) and a score of how much upside it might see from generative AI. The circled group of stocks – below the line and to the far right – have strong upside potential, but their prices don’t appear to have fully factored that in. Source: Morgan Stanley.

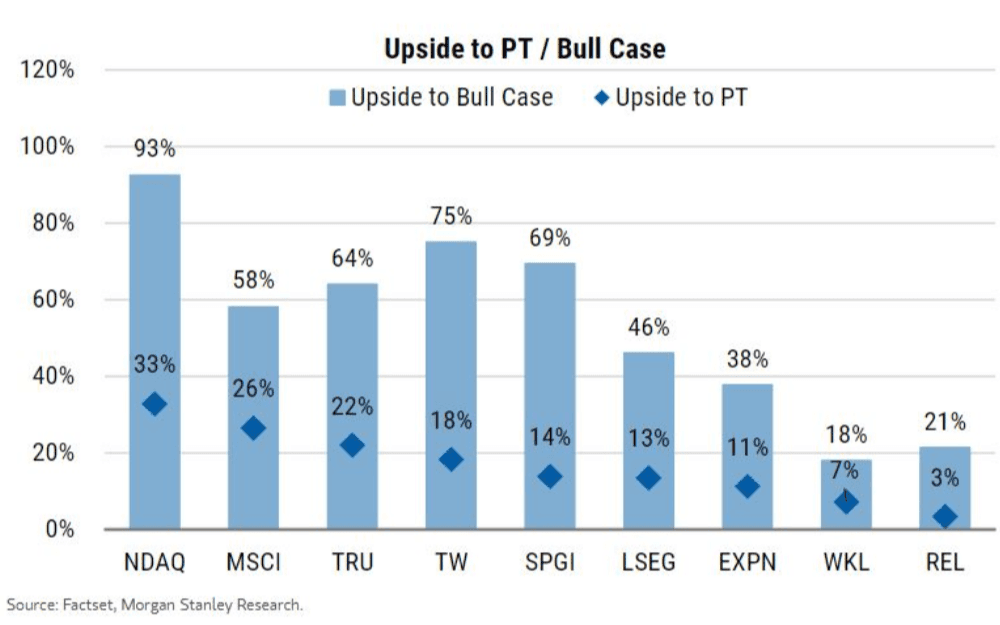

From this, they concluded that their favorite stocks were those with the most attractive risk-reward ratios – balancing high-quality data, strong AI potential, and attractive valuations. All nine of their favs are rated “overweight” by their analysts, an implicit recommendation that investors go bigger-than-benchmark on each.

Here they are:

The expected gains Morgan Stanley sees in its base-case scenario (upside to price target, blue diamonds) and more optimistic, bull-case scenario (bars). Source: Morgan Stanley.

Nasdaq (NDAQ) is transforming from a stock exchange to a global tech provider. It offers a mix of data, analytics, software, and exchange services to its corporate and financial institution clients. The firm has also made some strategic acquisitions that have led to high-quality, recurring revenue streams, making it a key player in market technology, anti-financial crime solutions, and regulatory tech software.

MSCI (MSCI) is a top provider of benchmark indexes, portfolio analytics, green research, and private market solutions. With a business model that’s focused on recurring revenue (fully 97% of its intake), MSCI benefits from high retention rates and scalable work. The company’s strong brand and comprehensive datasets help investors build better portfolios and manage risks, making MSCI a leader in sustainable investing and private market data services.

TransUnion (TRU) and Experian (EXPN) are global leaders in credit reporting and data analytics, holding extensive data on consumers and businesses. Experian’s databases have information on 1.1 billion consumers and 150 million businesses, with strong market share in places like Brazil. TransUnion’s data is highly proprietary and considered essential for making informed lending decisions. Like Experian, it’s also got a strong presence in emerging markets, such as India. Both companies leverage their vast data to provide critical insights for risk management, fraud prevention, and credit decision-making.

Tradeweb Markets (TW) operates a global electronic fixed-income trading platform, connecting a vast network of bond investors and other clients. Its exclusive technology supports data and analytics capabilities, and its integration of AI in trading automation is positioning it to make the most of the shift toward electronic buying and selling.

S&P Global (SPGI) is a behemoth in information services, offering credit ratings, benchmarks, analytics, and market data. Its proprietary data assets cover a wide range of financial markets and economic sectors. The company’s diversified revenue streams and strong growth potential in areas like sustainable investing and private markets position keep it primed for growth.

London Stock Exchange Group (LSEG) has become a leading global financial data provider since acquiring Refinitiv. The company generates much of its revenue from data and analytics, with a big footprint in indexes, risk intelligence, and capital markets. What’s more, its partnership with Microsoft aims to enhance data access and integration, which could drive new growth through better client services and product offerings.

RELX and Wolters Kluwer (WKL) are European leaders in professional information services. RELX manages huge datasets across risk, legal, and scientific functions, providing valuable analytics and decision tools. Wolters Kluwer focuses on solutions that combine domain expertise with technology, particularly in healthcare, tax, law, and financial compliance. Both companies have strong market positions and are proving adept at integrating AI into what they do.

Stéphane Renevier is a global markets analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.