The next leg of Rolls-Royce's rally

One of the most incredible blue-chip rallies of all-time stalled late last year, so time for independent analyst Alistair Strang to consult his charts again. Here's what they say about share price potential.

22nd January 2025 07:33

by Alistair Strang from Trends and Targets

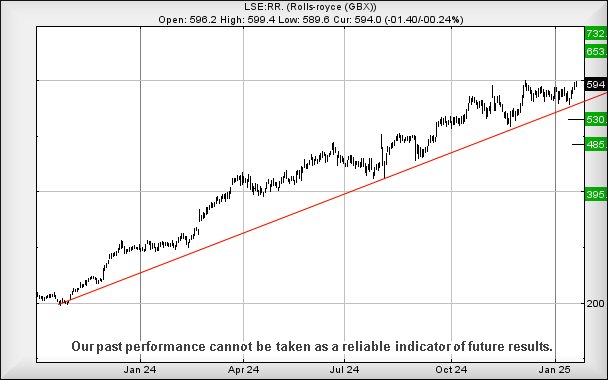

With Rolls-Royce Holdings (LSE:RR.)'s share price rises appearing to stall since the start of December last year, we’ve been awaiting any sort of secret signal things might start moving upward once again.

On Monday, the share price managed to close just 0.6p above its previous higher high on 4 December, a legendary “higher high” which shall surely open the floodgates which favour future share price growth.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

However, it may be an idea to get real as this difference of 0.1% is less than impressive, and we’re slightly concerned about exhibiting outright optimism for the future.

But if we rely on our software flagging this up for attention, it’s apparently now the case where movement above 600p should trigger the potential for movement to an initial 653p and some possible hesitation. Movement above this initial target now calculates with an impressive ambition of a future 732p, along with some almost certain hesitation and perhaps some volatility.

Our converse view demands some concern should this share wander below Red on the chart, currently around 561.143p, as this threatens reversal to an initial 530p with our secondary, if broken, calculating at a possible bottom of an eventual 485p.

For now, the bias our software allows is weighted on an expectation of further gains for Rolls, so it’s time to cross fingers or clutch whatever “lucky” token is available.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.