Nearly all sectors making gains, but all bets are now off

It was a profitable first month of the year for various fund sectors. However, Trump’s trade tariffs could bring an end to the party.

4th February 2025 09:00

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Most of the major stock markets posted one-month gains in January. The FTSE 100 rose by 6.1%, ending the month at an all-time high and closing above 8,600 for the first time. The more domestically focused FTSE 250 did not fare as well, but still gained 1.6% over the course of the month.

On the Continent, the Paris CAC 40 rose by 7.7%, while the German DAX did even better, gaining 9.2% and also achieving a new record high.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

Earlier in the month, the S&P 500 broke through its previous all-time high, set in December, and ended the month up 2.7%. The Nasdaq edged up by 1.6%, while the Dow Jones Industrial Average rose by 4.7%. South of the border, the Mexican IPC rose by 3.4%, and the Brazilian Ibovespa went up by 4.9%.

Unfortunately, the Asian markets did not perform as well. The Japanese Nikkei 225 and the Indian Sensex both fell by 0.8%, and the Shanghai Composite lost 3.0%.

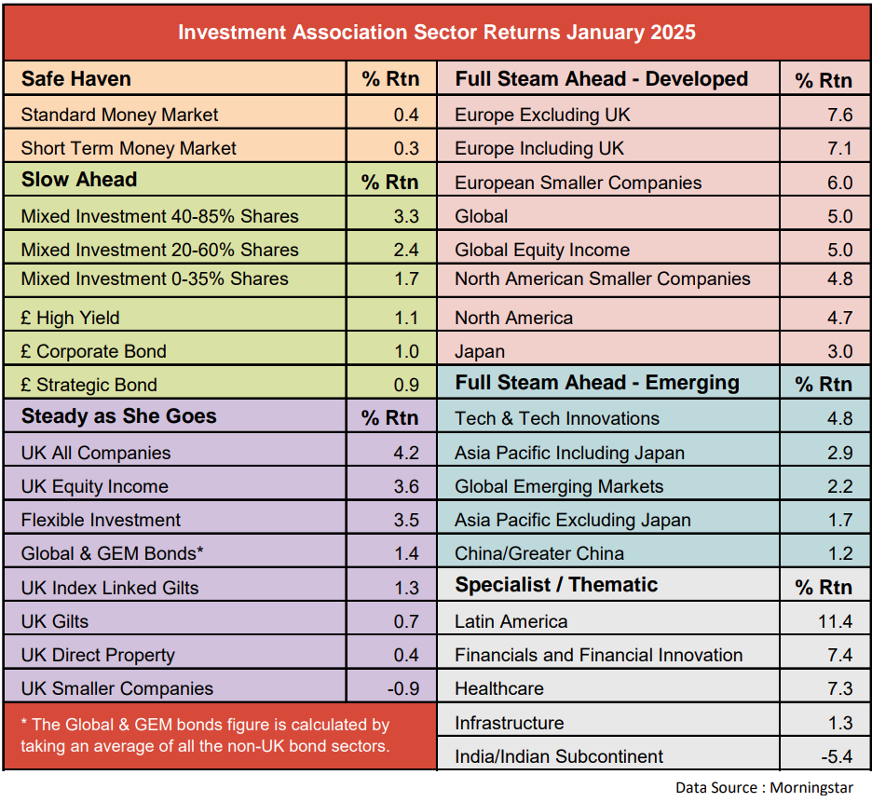

Our latest analysis also shows that most of the Investment Association (IA) sectors made gains in January.

Past performance is not a guide to future performance.

The star performers were the Latin America sector, up 11.4%, followed by the European excluding UK sector, which rose 7.6%. The Financial & Financial Innovation, Healthcare, and Europe including UK sectors, also went up by more than 7.0%.

The Latin America and European sectors made losses in September, October, November and December, so it is encouraging to see them rally in January. However, it will be interesting to see if they can maintain this upward trajectory.

US stock markets, and the technology stocks in particular, have performed well over the past couple of years and so are now relatively expensive. That makes the Latin American and European markets look reasonably cheap. Inflation has been falling, and central banks have started to reduce interest rates, which should benefit the global economy. However, there are some potential hazards.

- 10 hottest ISA shares, funds and trusts: week ended 31 January 2025

- Last year’s top sector can keep delivering

During his election campaign, President Trump, said that he would use tariffs to protect the US economy and “Make America Great Again”. This could push up inflation and slow global growth. No new tariffs were imposed during January, which may have helped Latin America and Europe, but that is all about to change.

Immediately after his inauguration, on 20 January, Trump issued his “America First Trade Policy” memorandum, outlining his administration's trade priorities. While signing the memorandum, he said that he would impose a 25% tariff on products from Canada and Mexico, and a 10% tariff on China, starting at the beginning of February. At the end of January, the White House confirmed that these tariffs would go ahead.

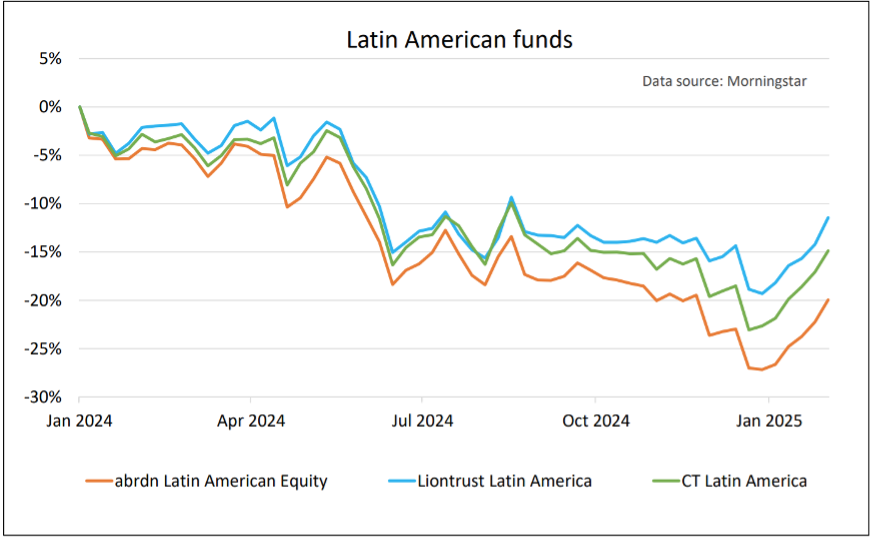

Although Latin American funds have risen sharply in the last month, they are still significantly lower than they were at the beginning of last year.

Past performance is not a guide to future performance.

There is the possibility that they could continue to recover, but we want to wait and see how they respond to the latest tariffs before considering them for our portfolios.

This weekend, President Trump also went on to say that new trade tariffs on the EU would “definitely happen”. No further details have been provided, but if implemented they could take the wind out of the sails of the current European recovery.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.