The myth of the 'typical' female retail investor

To mark International Women’s Day, interactive investor’s Camilla Esmund explores whether the assumptions made about female investors stand up to scrutiny, and whether these assumptions are helpful or a hinderance.

8th March 2024 12:20

by Camilla Esmund from interactive investor

To mark International Women’s Day, interactive investor’s Camilla Esmund explores whether the assumptions made about female investors stand up to scrutiny, and whether these assumptions are helpful or a hinderance.

It’s been two years since ii became a founding sponsor of Money Movers (run by Huddlecraft) a peer learning initiative helping women embark on their investment journeys. I believe the genius of the organisation’s work is in its simplicity; women of all ages and stages of life coming together in informal spaces to talk about money. At ii, we advocate for more open conversations about money – after all, it helps inspire, inform, and build confidence. Without investment confidence, it’s harder to build the long-term financial futures that all investors deserve.

The conversations within Money Movers sessions are lively and animated – I’ve witnessed it first-hand! It’s encouraging that participants aren’t afraid to ask the ‘silly questions’ which, if more of us were honest, many of us would like to ask. But it got us thinking – would the questions raised in these sessions be vastly different if they were male peer groups? After all, there are plenty of generalisations made about female investors, and male investors for that matter. These assumptions can sometimes frame how investment products and services are marketed towards male and female investors.

With International Women’s Day upon us, it is an apt time to investigate these assumptions, and whether they are helpful or more of a hindrance for end-investors.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Let’s kick off with a very broad, but common, assumption – men and women behave very differently when it comes to investing.

In short - our data paints quite a different picture.

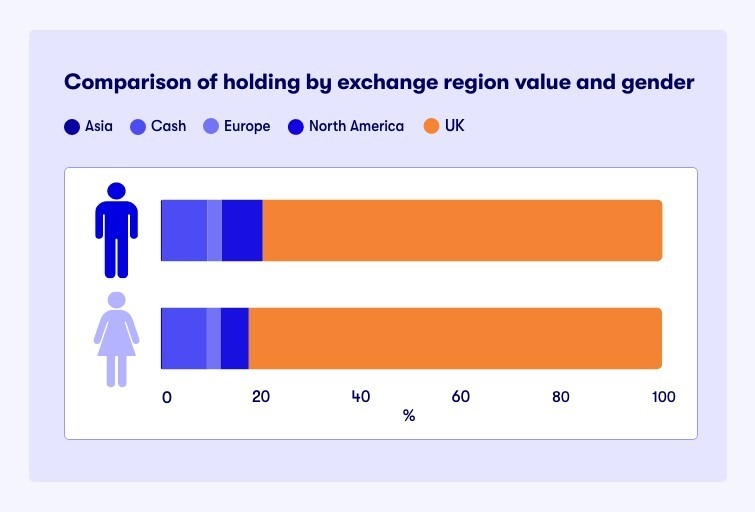

Taking our quarterly Private Investor Performance Index* as an example, the portfolio breakdowns for both our male and female customers are often very similar. Any differences are subtle. And performance is similar, too. In fact, most recently – our female investors slightly outperformed.

Source: interactive investor Q4 2023 Private Investor Performance Index

Although you can see our customers run their portfolios across similar lines, interestingly, one of the few differences is that women tend to have a higher exposure to investment trusts (22.6% versus 17.9% for men) – this may well have helped drive that slight outperformance.

Assumption 2: Women are risk averse (and perhaps even need more handholding) when it comes to investing, compared to men

Let’s take a deeper look at portfolio differences, as risk appetite and exposure to riskier assets is a key theme which often comes up when discussing male and female investors.

We looked at exposure to AIM on interactive investor - a risker area of the market. We can see that men on ii have 4% exposure compared to 2% of women. Therefore, they do have double the amount of exposure, but 4% is still a small allocation overall.

We can also see from the data that interestingly, male customers on ii also appear to have more diversification overseas. But are there standout differences that prove a cautious approach from female investors, and – on the other side of the coin – a high risk strategy from male investors…?

Segment Group | Female | Male |

% of portfolio | ||

FTSE 100 | 26% | 23% |

FTSE 250 | 20% | 16% |

International | 9% | 12% |

AIM | 2% | 4% |

ETPs | 8% | 9% |

FTSE Other | 8% | 7% |

Fixed Income | 2% | 3% |

LSE International | 0% | 0% |

Default | 25% | 24% |

Source: interactive investor (12 month data – to 29th January 2024)

This data tells one part of this story, but we also wanted to ask investors how they’d describe their risk approach to see if it reflects what we see in our numbers.

We asked men and women in a poll on the ii website** what term most accurately describes their investment approach, and the results are thought provoking.

‘Moderately Adventurous’ was the most popular answer for both male and female respondents – with 51% of male respondents describing themselves as such, and 43% of female respondents. This is near a 10% difference, which is quite significant, but not a colossal difference.

At the top-end of the risk scale, 9% of female respondents said they’d say they are ‘Adventurous’ with their investment approach, and only 3% more – 12% - of male respondents said the same. We can see that really, across the board, results look quite similar, and the exact same amount of male and female respondents (2%) said they were not sure. This suggests that the risk gap identified by our poll is not as significant as the common perception.

Which of the following best describes your risk preferences when it comes to investing? | Female | Male |

Adventurous | 9% | 12% |

Balanced/medium risk | 39% | 29% |

Cautious | 7% | 5% |

Don`t know | 2% | 2% |

Moderately adventurous | 43% | 51% |

Source: interactive investor poll**

Assumption 3: Men are active traders but women ‘buy and hold’

We also wanted to assess whether there are vast differences when it comes to male and female behaviour towards active trading versus a more ‘buy and hold’ approach.

From our analysis, generally ii’s female customers have indeed been happier to buy and hold whereas male customers on ii tend to trade more regularly. Interestingly though, when we looked at the ratio of female and male ii customers who have traded in the last 12 months (to 29 January 2024) there was less disparity. Over the last 12 months, ii’s male customers traded slightly more frequently than our female customers, but you’d expect the differences to be much more staggering if they are to live up to the stereotype more broadly.

Ratio of female and male customers who have traded on ii (12 months to 29 January 2024)

Not Traded | Traded | |

Female ii customers | 51% | 49% |

Male ii customers | 47% | 53% |

Source: interactive investor (12 month data – to 29th January 2024)

Active investors and ‘buy and hold’ on ii

Female | Male | ||

Active Investors | 5% | 11% | |

Engaged Investors | 45% | 44% | |

Buy and Hold | 18% | 13% |

So - are we ‘babying’ women when it comes to investing?

Again, data only tells us part of the story, so in the same poll conducted on the ii website**, we asked how men and women felt about some of these assumptions, and how they’re used in financial marketing. It really stands out that 40% of women find investment marketing patronising, compared to 16% of men. If women are noticing this more, it potentially emphasises the importance of female writers and commentators in this industry and the influence they have voicing these stereotypes which do not resonate with end-investors.

22% of female respondents felt patronised by the assumption that women do not know what they are doing, or need more handholding. 10% pointed to the generalisation that women are risk averse (which goes back to the points made earlier around risk), and 8% noted the use of pink in advertising.

Do you ever find investment marketing aimed at women patronising? | Female | Male |

No – I haven’t noticed this | 53% | 75% |

Yes – especially the suggestion that women don’t know what they are doing/need more hand-holding | 22% | 9% |

Yes – especially the generalisation that women are risk averse | 10% | 3% |

Yes – especially the use of pink in advertising | 8% | 3% |

What would you say is one of the main barriers you face when investing? | ||

Difficulty finding information | 10% | 9% |

I do not face many barriers when it comes to my investments | 28% | 29% |

Lack of cash to invest | 12% | 16% |

Lack of time | 18% | 12% |

Worrying about making the wrong decision | 30% | 33% |

We also asked about barriers to investing. Are women truly facing greater challenges than men when it comes to confidence in making the right decision, or finding the most useful information for them?

Our poll data suggests not. We know our industry isn’t always the easiest for end-investors to navigate; it’s something that ii is particularly passionate about – breaking down jargon, which is a key barrier to investing. Both men and women pointed to the difficulty finding information – with only 1% difference. This helps debunk the idea that women need greater hand-holding or help making the right decision, compared to men. And when we look at confidence - 33% of men said ‘worrying about making the wrong decision’ was one of the main barriers they face when it comes to their investments. That’s a higher number than the female respondents (30%). This is significant.

Time to ditch the generalisations

Of course, the data outlined here is just a snapshot. But it is indicative of how the assumptions that women are fundamentally more risk averse and that they need more help in understanding investment are ones we need to move away from.

Tackling the persistent pension gap and investment gap is absolutely vital, but the reasons for these gaps are not necessarily due to fundamental differences between men and women. There’s a plethora of well-researched and documented reasons for this gap which needs closing, but it’s not because of capability or even, necessarily, approach. If our industry continues to market investment products along these generalisations, we may not be allowing investors to truly find the investment products that meets their goals and expectations. And this is what all investors, and aspiring investors, deserve.

Commenting on the research, Zoe Burt, Financial Content Specialist, Female Invest, says: “Today’s research from interactive investor is both important and thought-provoking! We often find when speaking with our community that they're consistently frustrated that they are deliberately excluded from conversations and marketing surrounding finances and investment. When speaking with financial professionals, they say they often defer to the man in the room (even if they, themselves are also a financial professional). The more empowered we can make women, the more we can drive change and start to close the financial and investment gender gap.”

For more information on Money Movers - see here - https://www.wearemoneymovers.com/

*ii publishes a quarterly Private Investor Performance Index, available on its wesbite. With data going back four years, its a barometer of how investors are faring - most recent data is to 31 December 2023.

**interactive investor’s poll was conducted on the ii website from Friday 23rd February- Monday 26 February, and had over 1,500 respondents.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.