Myth bust that spending falls through later life

19th May 2022 09:25

by Rebecca O'Connor from interactive investor

interactive investor comments on findings of new IFS research.

- Report finds that contrary to popular perception, spending in retirement does not generally fall as people get older

- As a result, people planning their retirement should aim for an income from state and occupational pensions that is ‘roughly constant’ through retirement

- As state pension rises because of the triple lock, income taken from private sources could reasonably decline over time, particularly for low-income retirees, however anticipating big decreases in spending could result in people running out of money sooner

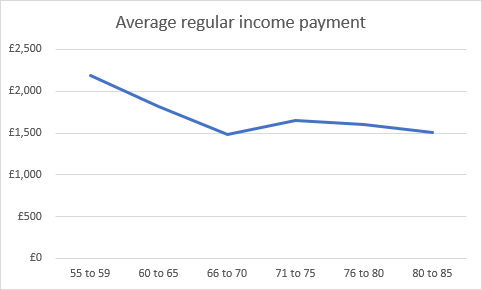

- interactive investor customer data reveals declining average income withdrawals among older customers, from an average £1,815 among 60- to 65-year-olds to an average £1,508 among 80 to 85-year olds.

Millions of retirees using drawdown for retirement income may be at risk of running out of money in later life because they have overestimated the amount by which their spending will fall as they get older.

A study by the Institute for Fiscal Studies (IFS) published today (Thursday 19 May) finds that contrary to popular belief, spending in retirement does not generally fall as people get older. However, because the amount of state pension people receive generally rises, they may still be able to take less from their private pensions to cover their living costs over time.

The findings expose how the current cost of living crisis, which has significantly increased bills for older people, together with stock market declines that reduce the value of private pensions as well as a state pension that in the last year, has not kept pace with rising prices, could throw the delicate balance between dependence on state and private pensions for retirement income off course. Without a reversal of fortunes for the stock market, this could mean pension pots run out more quickly.

Becky O’Connor, Head of Pensions and Savings, interactive investor, said: “Hundreds of thousands of newly retired people every year must try to predict what they are likely to spend when they retire. As many will choose income drawdown over an annuity, second-guessing what they are likely to need to spend on is almost a full-time occupation.

“There’s a risk people assume they won’t spend as much as they enter their 70s and 80s, which turns out to be false.

“People imagine they won’t want to go out as much and won’t be going on as many holidays. Even if that is true, new and unpredictable requirements to spend can come in later in life and blow the budget.

“If people end up spending more than they expected as they age, there is a chance they could exhaust their pension pots too soon.

“These findings suggest that people should err on the side of caution and plan as though they will always need the same amount of income each year, rather than that spending will go down dramatically, taking into account rises in the state pension they will receive over time.

“Rises in the state pension from the triple lock are there as an essential backstop. This research reveals how important the triple lock is to allowing retirees, who reach retirement age with an average of £132,464*, to manage their living costs in later life.

“The report may also support the case for a comeback for annuities, which pay a guaranteed income for life, but have fallen out of favour for over a decade as low rates meant they are often seen as an unpopular option.”

Are current defined contribution pension pots going to last a whole retirement?

interactive investor analysis suggests that a typical private pension pot could run out after around 10 years, assuming a value at age 65 of £135,000, full lump sum taken, 3% growth a year and an annual income of £11,000.

Decline in regular income payments with age from an interactive investor SIPP

Age group | Average regular income payment |

55 to 59 | £2,183 |

60 to 65 | £1,815 |

66 to 70 | £1,486 |

71 to 75 | £1,653 |

76 to 80 | £1,599 |

80 to 85 | £1,508 |

Source: interactive investor

Spending in general among new retirees expected to rise

The report comes with a warning that future generations of retirees may be set to spend even more, if recent cohorts of newly retired people are anything to go by.

When you were born makes a big difference to the retirement income you can expect and also whether you will spend more or less as you move through retirement, the study found.

More recent retirees spent more on holiday than their predecessors did at the same age. For example, while this spending made up 11% of household spending at age 65 for those born between 1924 and 1928, for those born between 1944 and 1948 it made up 15% of spending. The pre-boomers have also spent less on food inside the home than older retired people did in their early 60s.

Heidi Karjalainen, a research economist at the IFS and an author of the report, said: “As retirement incomes are increasingly funded by defined contributions pots, which can be accessed flexibly, more and more retirees face complex and consequential decisions about how quickly to draw down their pension wealth. If the spending patterns of current retirees are a good guide to how people in the future will want to spend, planning drawdowns on the basis of reduced spending needs in later retirement may not be wise as it may result in unexpected shortfalls in living standards at older ages.

‘While average pension incomes have grown strongly with age in recent years, leaving many retirees with more resources than they chose to spend, high inflation is reducing retirees’ spending power and – along with the more uncertain outlook – makes careful financial planning all the more important.”

Notes to editors

- The study is part of work being undertaken by the IFS and funded by the IFS Retirement Consortium for which interactive investor is a co-sponsor.

- interactive investor customer drawdown payment data covers all payments since 2017.

- *According to research by Opinium on behalf of interactive investor for the ‘Show Me My Money’ report https://www.ii.co.uk/pensions/SMMM.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.