My favourite stock in this fiercely competitive sector

Two of America’s big companies have been fierce rivals for decades, but which stock does overseas investing analyst Rodney Hobson like best? A chart breakout could be on the cards.

24th July 2024 08:53

by Rodney Hobson from interactive investor

While many cola drinkers still regard Coca-Cola Co (NYSE:KO) as the real thing, PepsiCo Inc (NASDAQ:PEP) continues to put some fizz into the competition with its wider range of well-known drinks and snacks. It has produced another satisfactory set of quarterly results and remains positive about the future.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Net income rose 9.1% to $5.15 billion in the six months to 15 June on revenue just 1.4% higher at $40.75 billion. Investors were, however, concerned that the second quarter did show some slowdown compared to the first.

Revenue edge up only 0.8% in the latest three months and net income by 1.15%, but one must remember that comparisons were against strong figures last time. Also, the figures were adversely affected by a product recall by the Quaker Foods division.

That slightly subdued second quarter has prompted Pepsi to scale back its guidance for the full year, citing subdued demand in North America for convenience foods. Even so, Pepsi is still expecting revenue growth of 4%, as opposed to its previous forecast of “at least 4%”, so this is more of a subtle nuance than a major revision. The new guidance still implies a serious pick-up in sales over the next six months, although that may not imply a similar increase in profits, as heavier spending on advertising and marketing is promised.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Ian Cowie: why it’s unwise for investors to bet against the US

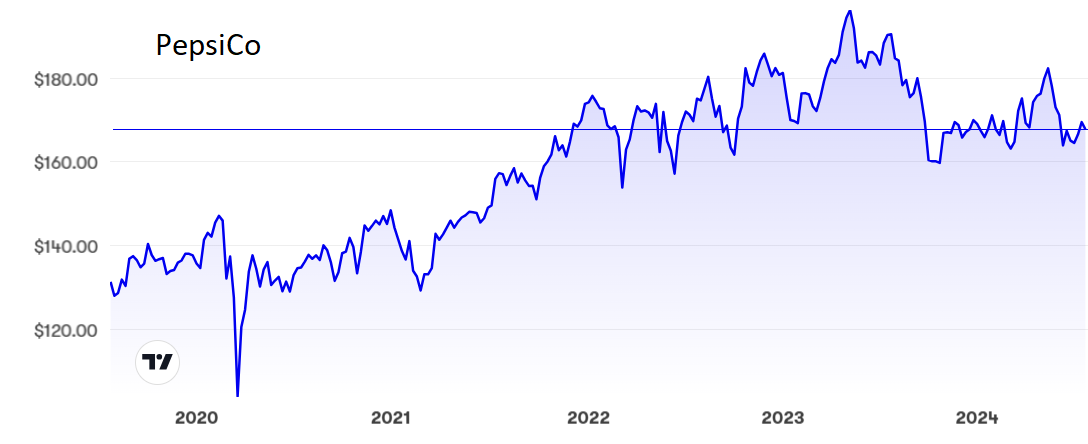

Pepsi shares performed well in 2021 but have since levelled off and seem to be settling just below $170, though they have been as high as $190 in the meantime. The price/earnings (PE) ratio is still quite demanding at just over 24 but the yield is better than for most American stocks at a shade above 3%

Source: interactive investor. Past performance is not a guide to future performance.

Coca-Cola followed up with a more encouraging second quarter and, in contrast, it raised its guidance for the full year.

Revenue for the latest three months rose 3.3% to $12.4 billion, thanks partly to a 6.6% increase in sales of concentrates. Price increases plus a change in the sales mix towards higher priced products contributed an extra 9%. Sales would actually have shown a 15% increase but for adverse currency changes and the disposal of some parts of the business.

Having pretty much saturated developed markets – but at least holding its own in those countries – the drinks maker is expanding in emerging markets, most notably India, Brazil and the Philippines, where large young populations offer scope for additional thirst quenching.

Operating margins were helped by a more lucrative refranchising of bottling, so pre-tax profits were 5.1% higher at just over $3 billion.

- ii view: Coca-Cola beats Wall Street forecasts

- Where to invest in Q3 2024? Four experts have their say

The forecast for growth in organic revenue, which had already been upgraded from 6-7% to 8-9% less than three months ago, was further raised to 9-10%. Earnings per share are now expected to come in 5-6% higher compared with previous guidance of 4-5%.

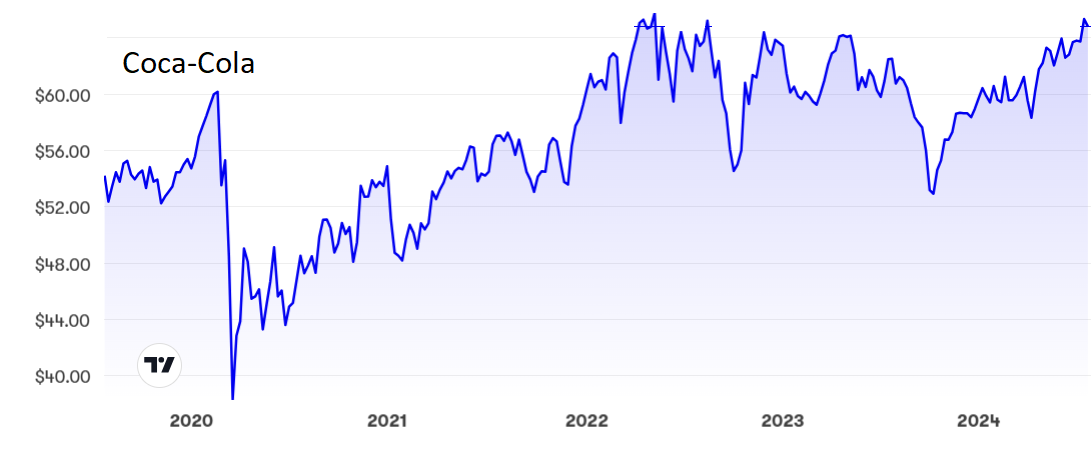

Coca-Cola shares have had a strong run over the past nine months and now stand at $65, where the fundamentals are not quite as favourable for investors as at Pepsi: a PE of 26.2 and a yield of 2.9%. The current share price has proved to be a ceiling several times over the past two-and-a-half years.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I have generally favoured buying Coca-Cola rather than Pepsi, and the former is certainly doing better at the moment. However, that seems to have been the view of other investors, hence the better performance of Coca-Cola shares. Although the choice is tougher at this stage, I am going to stick with the real thing – it has to be Coke. The shares have risen after my two previous recommendations and I believe the ceiling will be broken. Pepsi is just about a buy, as the dividend offers consolation if the shares refuse to budge.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.