M&S’s dividend shock, Games Workshop amazes

There’s more misery for income seekers, but Burford Capital is up 20% and Games Workshop keeps rising.

28th April 2020 13:29

by Graeme Evans from interactive investor

There’s more misery for income seekers, but Burford Capital is up 20% and Games Workshop keeps rising.

The prospect of no Marks & Spencer (LSE:MKS) dividend for at least 18 months darkened the mood of long-suffering investors today, having seen shares crash below 100p during the Covid-19 crisis.

To highlight how far the retail giant has fallen in recent years, Games Workshop (LSE:GAW) was today worth more than M&S after an encouraging trading update from the fantasy war games business sent shares 11% higher for a market value of almost £2 billion.

M&S shares, meanwhile, remain close to a record low amid the growing realisation that protracted disruption from the Covid-19 pandemic will delay its long-awaited transformation plan by yet another year to 2021 at the earliest.

- BP shares yield 10.6% after dividend retained

- HSBC profits dive: is there any hope?

- Chart of the week: FTSE 100 could do something spectacular very soon

In the meantime, M&S has secured the support of its lenders to relax or remove covenant tests on its £1.1 billion credit facility as part of a series of measures that should mean it is able to withstand the worst of the retail conditions over the next 18 months.

This comes at a price for investors, however, with M&S warning it is unlikely to pay a dividend for the 2020/21 financial year in order to generate a cash saving of about £210 million.

M&S has already ruled out a dividend alongside next month's annual results, leading to a saving of £130 million. It last paid an interim dividend of 3.9p a share in January, although this was 40% lower than a year ago due to the cost of its 50% acquisition of Ocado's (LSE:OCDO) retail operations.

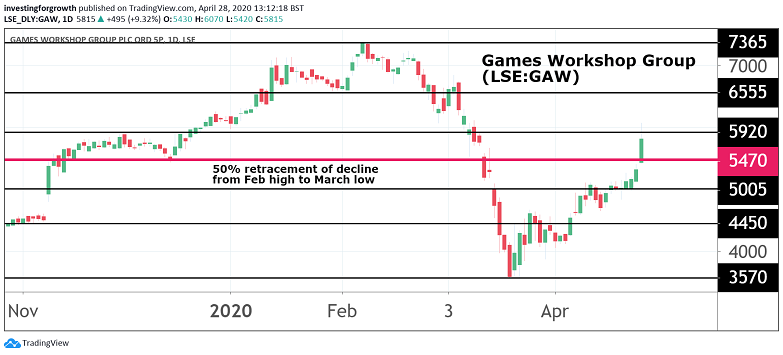

Source: TradingView Past performance is not a guide to future performance

At a time when companies are using government support schemes, it should come as no surprise to find consumer-facing businesses taking a hit on their dividend. What makes the M&S announcement more significant is that it is one of the first companies to extend the horizon of dividend cuts from Covid-19 into 2021.

As recently as 2018, M&S was paying its shareholders a total dividend of 18.7p a share, worth more than £300 million. Not only is there no prospect of a dividend, an investor voucher scheme ended in January, and there's little expectation that M&S's usually popular AGM will be open to shareholders in July.

In contrast, Tesco (LSE:TSCO) is still due to pay its shareholders 6.5p a share final dividend in early July, while Sainsbury's (LSE:SBRY) may unveil a £250 million dividend alongside results later this week.

M&S benefits from having a strong food business, but, unlike its supermarket rivals, is impacted by the lockdown due to the closure of cafes and slowdown in travel and some city centre locations. It expects demand for its clothing and home ranges will be “materially subdued” over the rest of 2020.

More details on its cost saving plans will be revealed with results on 20 May, alongside how it will accelerate the long-awaited transformation programme. The creation of a multi-channel food operation in partnership with Ocado will go ahead in September.

While M&S shares remained below 100p today, Games Workshop shares rallied another 11% to continue their recent recovery. The company, which has richly rewarded shareholders in recent years, revealed that online orders will resume from next week.

Source: TradingView Past performance is not a guide to future performance

Even though the majority of its stores remain closed, it is due to make trade sales in Europe and North America from this week and a number of stores have also re-opened in China.

This should mean profits for the year to May 31 will be at least £70 million, albeit lower than previous market expectations. It has secured an overdraft facility of £25 million for a six-month period in case it is needed to meet operational cash flow requirements.

Shares, which peaked at a record high of 7,300p in February before halving to less than 3,600p a month later, currently stand at 5,840p.

Drinks giant Diageo (LSE:DGE) is another on the recovery trail after seeing its shares rally from 2,181p in mid-March to 2,752p at lunchtime today. Today's 1% rise came after the Guinness and Johnnie Walker maker announced a bond issue to raise US$2.5 billion.

- Why Omega Diagnostics shares are up 700% in April

- 12 coronavirus stocks: another AIM share rallies 90%

- These 32 stocks are ‘clear winners’ from the corona crisis

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Elsewhere in the top-flight, Rightmove (LSE:RMV) shares rose 3% higher at 483p after the online estate agency portal said it not only had sufficient liquidity but was “well positioned to return to growth as markets normalise”.

As well as being eligible to access the UK Government’s Covid Corporate Financing Facility, Rightmove said its revolving credit facility had been extended to February 2022.

Weir Group (LSE:WEIR) shares were 3% higher at 888.6p after the engineering business said it had acted quickly to protect its oil and gas business from the steep downturn in market conditions.

Demand in the mining sectors remains robust, while there's been no impact on the company's ability to meet customer demand. It also has sufficient liquidity to manage through a range of downside scenarios.

One of the biggest risers of the session came from Burford Capital (LSE:BUR) after CEO Christopher Bogart said 2020 had got off to a “terrific start” for the AIM-listed litigation financier. The company said the first four months of the year had seen court results or arbitral awards that, if paid in full, would generate substantial income and cash receipts.

Shares jumped 22% to 495p as Burford added that it expected the aftermath of the Covid-19 crisis “to be a time of significant demand for its services”.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.