The most consistent fund over the past three years

Saltydog identifies the one fund that has achieved a 5% gain every six months over the past three years.

16th November 2020 13:38

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog identifies the one fund that has achieved a 5% gain every six months over the past three years.

At Saltydog Investor, the performance data we provide to our members aims to help private investors, such as ourselves, spot trends in the financial markets and easily identify the best-performing funds in those sectors.

The financial industry generally promotes a “buy and hold” approach to investing, based on the premise that it is too difficult for the private investor to time the market. We disagree, and our performance over the last 10 years would tend to support our view, especially this year.

There have already been a couple of key events in 2020. The global stock-market crash at the end of February and beginning of March was apparently the fastest ever. According to Bank of America Securities data, it took the S&P 500 index only 22 trading days to fall 30% from its record high on 19 February. The second, third and fourth quickest 30% pullbacks all occurred during the Great Depression era in 1934, 1931 and 1929.

Since the lows in March, we have seen one of the fastest recoveries. Certainly in the US, the largest economy in the world, where the leading stock-market indices have not only rebounded, but gone on to set new all-time highs.

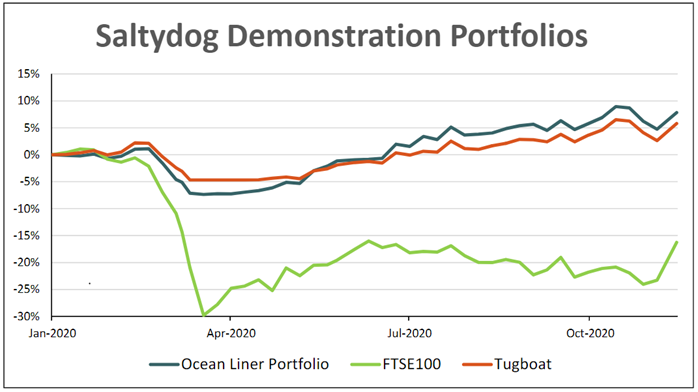

These are exactly the kind of events that we are told it is too difficult for private investors to handle, and yet in our demonstration portfolios we managed to avoid the worst of the crash and benefit from the rebound. Something that very few professional fund managers can claim to have achieved.

Past performance is not a guide to future performance

Every week, we review the performance of funds in our portfolios, but make changes only when necessary.

Although the process of reviewing our holdings every week has obviously been very successful, we appreciate that there are people who do not feel they can allocate the time required by this approach.

This is why we developed our “6x6” report. Every three months, we review the same funds that we cover in our usual weekly analysis, but we look for funds that have done consistently well over the last three years. There are many criteria that we could have used to select funds but, as is our way, we like to keep things simple.

We started by asking: how many funds had gone up by at least 5% in each of the last six-month periods? The answer tends to be very few, although from time to time they do appear.

When we ran the report a few months ago, covering the period from the beginning of August 2017 to the end of July 2020, no funds had managed the elusive “six out of six”, but we did highlight nine funds that had gone up by 5% or more in five out of the previous six-month periods.

We have just crunched the numbers again and this time there is one fund, Smith & Williamson Global Artificial Intelligence, that has achieved full marks.

| Saltydog Investor 6x6 Report - October 2020 | Nov 17 | May 18 | Nov 18 | May 19 | Nov 19 | Apr 20 | 3 year |

|---|---|---|---|---|---|---|---|

| to | to | to | to | to | to | return | |

| Name | Apr 18 | Oct 18 | Apr 19 | Oct 19 | Apr 20 | Oct 20 | |

| Smith & Williamson Global AI | 8.2% | 6.8% | 15.9% | 6.0% | 14.3% | 24.9% | 102% |

| Baillie Gifford American | 11.9% | 8.8% | 14.8% | -2.4% | 34.7% | 50.1% | 176% |

| Baillie Gifford Positive Change | 7.1% | 6.9% | 5.2% | 4.0% | 26.6% | 35.2% | 114% |

| Baillie Gifford Global Discovery | 7.0% | 8.7% | 14.8% | -6.5% | 21.3% | 32.7% | 101% |

| GAM Star Disruptive Growth | 5.6% | 6.7% | 14.6% | 4.0% | 11.5% | 28.1% | 92% |

| Liontrust Global Technology | 8.6% | 7.8% | 16.7% | -1.5% | 12.5% | 24.3% | 88% |

| L&G Global Technology Index | 1.2% | 10.8% | 11.1% | 6.6% | 13.6% | 18.9% | 79% |

| Fidelity Global Technology | -0.8% | 9.9% | 18.0% | 5.7% | 8.7% | 17.5% | 74% |

| AXA Framlington USA Growth | 7.3% | 9.7% | 13.5% | 0.2% | 10.2% | 16.9% | 73% |

| Janus Henderson US Growth | 4.9% | 8.8% | 12.8% | 6.0% | 5.6% | 16.3% | 68% |

| Investec USA | 3.0% | 9.7% | 12.4% | 6.1% | 6.6% | 7.3% | 54% |

| Data source: Morningstar |

Although there are a few funds that have managed higher returns over the three-year period, to perform so consistently is exceptional.

The Smith & Williamson Global Artificial Intelligence fund was launched in June 2017. Its objective is to “achieve capital growth by investing in companies engaged in the development and/or production of artificially intelligent systems or products, which enable third-party entities to sell or deliver their products and services through an online platform, and companies that produce, develop or deliver products and/or services that have an artificially intelligent component that can enhance an existing product or service”.

Its largest holdings are in Alphabet (NASDAQ:GOOGL) (the parent company of Google), Ocado (LSE:OCDO), Microsoft (NASDAQ:MSFT), NVIDIA (NASDAQ:NVDA) and Tesla (NASDAQ:TSLA).

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.