More fun to come at this glamorous company

This iconic Italian firm is trading at a record high in New York, but investing expert Rodney Hobson advises shareholders to stay put. There could even be an opportunity here. Meanwhile, an American legend could be a speculative buy.

29th November 2023 08:43

by Rodney Hobson from interactive investor

Four wheels good, two wheels bad was very much the message from two motor makers who appeal mainly to the affluent.

First, the success story. Italian luxury carmaker Ferrari NV (NYSE:RACE) raised its full-year sales target to €5.9 billion (£5.1 billion) after another record quarter in which sales rose 24% to €1.54 billion. Europe, the Middle East, Africa and the United States all saw sales rise in defiance of the squeeze felt by other luxury goods makers. Only China, Hong Kong and Taiwan slipped back marginally.

Net profit leaped like its prancing horse badge by 46% to €332 million, clearly beating analysts’ forecast of under €300 million.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

The big boost has come from a switch to hybrid vehicles, which in September accounted for more sales than petrol vehicles for the first time. The rise is meteoric, with 43% of sales being hybrids in the previous quarter and only 19% a year ago.

The first fully electric sports model should roll off the production line in 2025 and is likely to be in heavy demand among those wealthy enough to be able to afford to be different. That will mean purely petrol-driven cars accounting for only 40% of sales as early as 2026. A purpose-built facility for making electric vehicle parts is under construction.

The total number of cars sold between July and September was 8.5% higher and the order book remains at its highest level, with strong demand across all markets. Ferrari is set to be running at full production for the next two years, with the first all-electric car due in 2025.

The big plus at Ferrari is that sales of personalised vehicles, which sell at a higher price with bigger profit margins, remain popular among drivers with large wallets.

Ferrari shares were less than $100 five years ago but have accelerated over the past year or so to reach $370, where the price/earnings (PE) ratio quite understandably has an awful lot of good news built in at 52, while the dividend is only 0.54%.

Source: interactive investor. Past performance is not a guide to future performance.

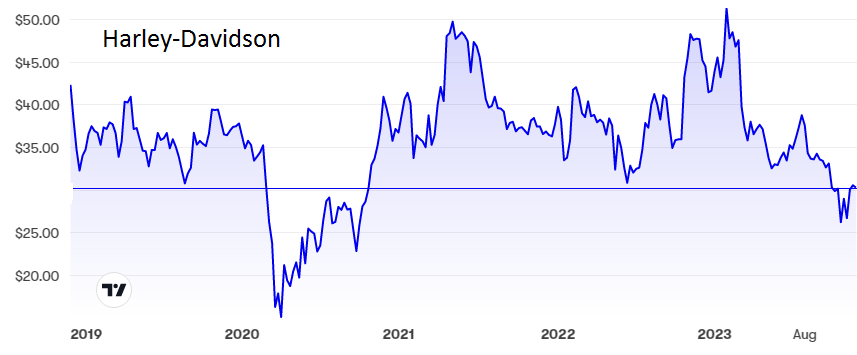

In sharp contrast, my hopes for motorcycle maker Harley-Davidson Inc (NYSE:HOG), as expressed in February, have turned into dust. Profits fell by a quarter to $198.6 million in the third quarter, with sales in the main market of North America falling for the third quarter in a row. Total sales were down 9% to $1.3 billion.

Shipments of motorcycles fell 20%, partly as a result of a suspension in production at the York, Pennsylvania, factory in June because of a shortage of parts. Although wealthy older customers retain their enthusiasm for the premium brand, younger enthusiasts are feeling the pinch of higher interest rates.

The shares have slumped from $50 in February to around $30 now. They hit a three-year low at $26 in October. The PE is a very lowly, but entirely understandable 6.2, while the yield has risen to 2.14%, which is hardly compelling.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: Ferrari looks fully priced to me but although the shares, like the cars, are very expensive, I would not advise holders to sell. There could be a lot more fun to come. New buyers should hope for a correction that provides an opportunity to get in below $350.

I rated Harley-Davidson as a hold back in February. Mercifully I suggested that anyone thinking of buying should hold off “to see if a better buying opportunity comes along.” It has done so with a vengeance.

Although the shares have come off the bottom, they still rate only a hold until there is better news on sales and profits. However, those with an appetite for risk could consider a modest speculative purchase in the hope that the worst really is over.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.