Mining shares in demand as gold and copper extend rallies

A further increase in the price of major metals has been reflected across the mining sector, although one analyst has revealed their favourites.

4th April 2024 13:49

by Graeme Evans from interactive investor

Landmarks for gold and copper prices today fuelled the FTSE 100 recoveries of Fresnillo (LSE:FRES) and Anglo American (LSE:AAL) and left shares in Chile’s Antofagasta (LSE:ANTO) at a fresh record high.

The trio’s progress came alongside a more measured improvement by Rio Tinto Registered Shares (LSE:RIO) as iron ore prices remain near a one-year low due to persistently weak steel demand in China.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

The commodities focus, which followed comments by Federal Reserve chair Jerome Powell on potential US rate cuts later this year, helped the FTSE 100 index reach lunchtime back near the 8,000 threshold following a gain of 38 points to 7,975.

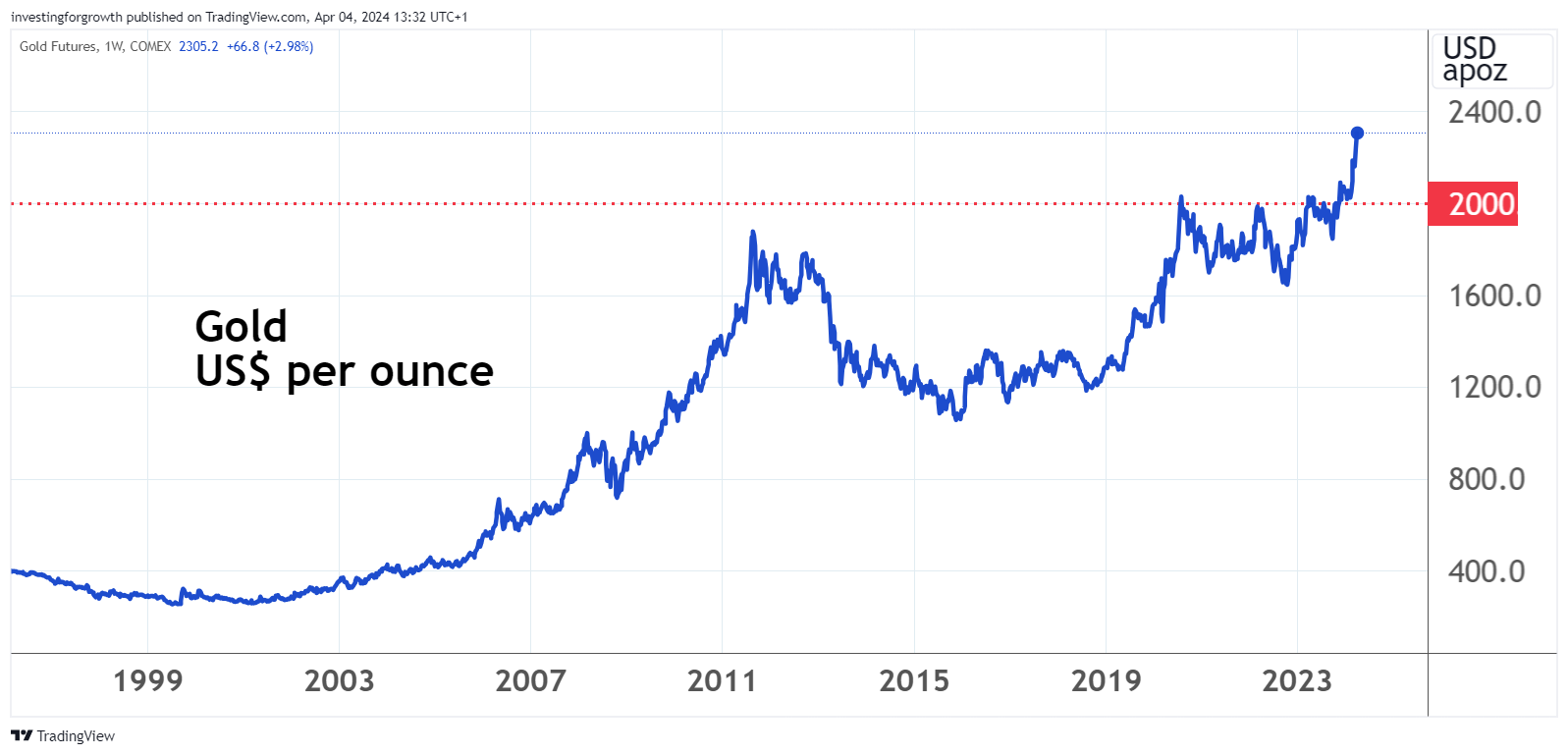

Gold hit $2,300 an ounce in Asia trading hours, taking the rise so far this year to more than 11% as the outlook for looser US monetary policy boosts the appeal of non-interest bearing bullion.

Source: TradingView. Past performance is not a guide to future performance.

Other factors driving the recent increase include the ongoing geopolitical uncertainty, strong levels of central bank buying and demand from China, where alternative options such as equity markets and housing are still not appealing for investors.

Bank of America sees the potential to reach $2,400 an ounce, noting this week that the traditional relationship between real rates and gold prices appears to have broken down.

Beneficiaries include Fresnillo, which is the world’s leading silver producer and one of Mexico’s largest gold firms. Its shares are up more than 20% in the past fortnight, having recently fallen to near a 15-year low due to the impact of the revaluation of the Mexican peso against the US dollar and inflation headwinds that affected costs across the business.

- Six mining companies to follow in 2024

- Merryn Somerset Webb: investing doesn’t have to be all about America

- Gold: record prices and what happens next

- Critical minerals: a market update

Among the London market’s other gold producers, Peru’s Hochschild Mining (LSE:HOC) is up more than 30% in the past month, while fellow FTSE 250-listed stock Centamin (LSE:CEY) has lifted about 22%.

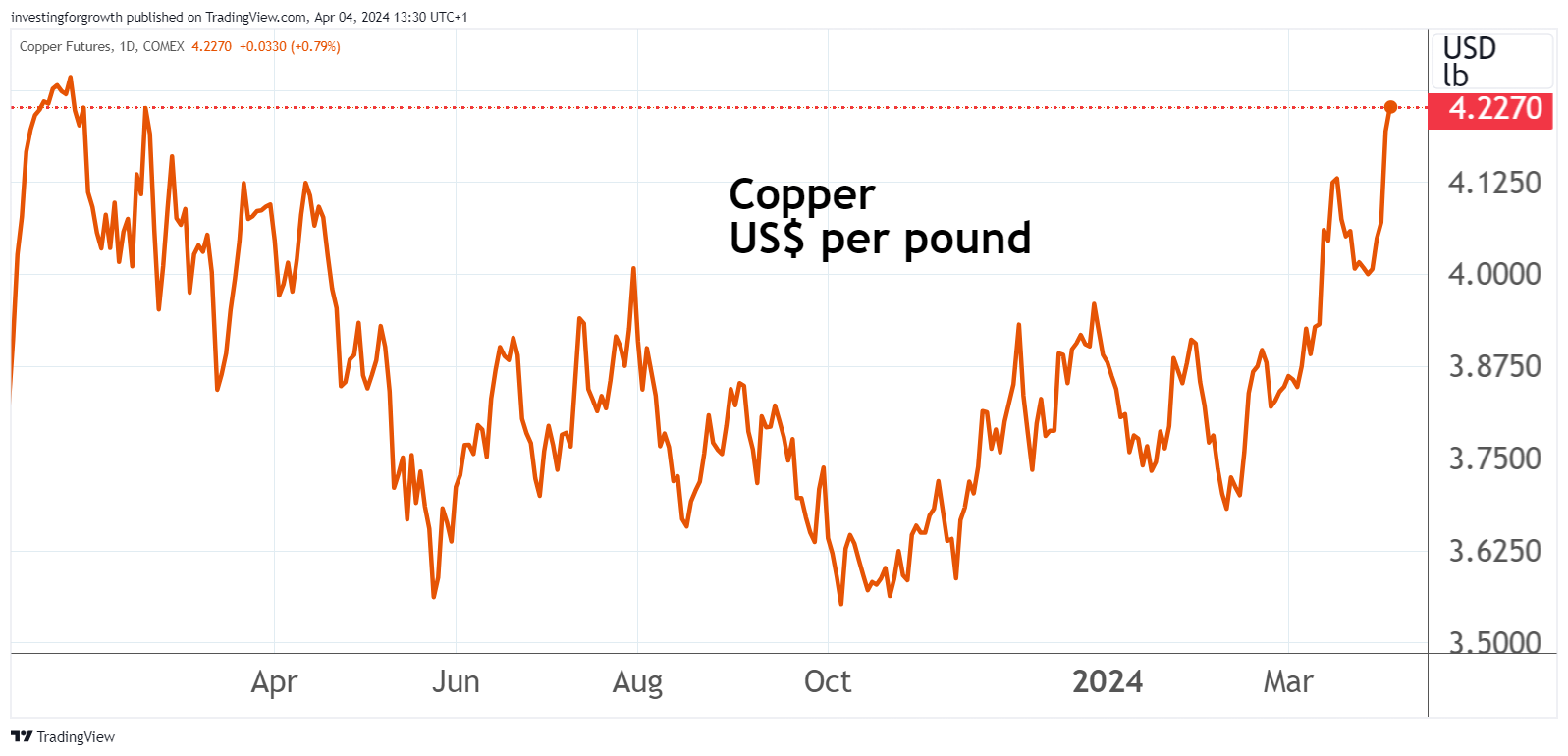

Copper’s rise in price towards a one-year high reflects US dollar weakness, supply risks and interest in its structural growth story as the most needed of the energy transition metals.

Higher prices and lower operating costs have underpinned the recent record run for Antofagasta, with shares in the Chile-focused copper and gold producer up by more than 60% since last autumn. The company recently declared a total dividend payout ratio of 50% for 2023, which it said reflected its confidence in future prospects.

Source: TradingView. Past performance is not a guide to future performance.

The higher price has also helped Anglo American as the mining giant ramps up production of its Quellaveco copper mine in Peru. Overall copper production of 826,200 tonnes increased by 24% last year, offsetting declines for its platinum group metals and De Beers rough diamonds.

Anglo shares hit a three-year low of 1,670p in December as disappointing guidance at a capital markets day added to concerns about high capital expenditure and weaker prices.

Shares have since rebounded to 2,115p, with Deutsche Bank today backing the shares with a “Buy” recommendation and price target of 2,600p.

Looking across the commodities sector, the bank’s analysts expect rangebound prices in the first half before a recovery in demand outside China drives base metals higher into 2025.

The bank continues to have a “buy” stance on Rio Tinto, although with a lower target price of 6,000p after the iron ore price this week neared a one-year low at close to $100 a tonne.

Prices have been squeezed by a combination of falling Chinese steel output, high inventories and demand concerns. Rio, whose portfolio includes the Oyu Tolgoi copper mine in Mongolia and its Pilbara iron ore operations in Western Australia, rose 44p to 5,122p in today’s session.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.