This massive healthcare business should be worth even more

3rd May 2023 09:42

by Rodney Hobson from interactive investor

Currently the 13th largest company in America, overseas investing expert Rodney Hobson thinks its luck is about to change and sees light at the end of the tunnel.

A tub of talcum powder can go a long way one sprinkle at a time, as maker Johnson & Johnson (NYSE:JNJ) has found to its considerable cost. This particular nightmare for an otherwise highly successful pharmaceutical and consumer goods company could at last be coming to an end.

Some of the talc-based baby powder in question allegedly contained traces of asbestos, sparking thousands of lawsuits claiming the product caused cancer. Despite J&J’s protestations to the contrary, it is generally cheaper in the long run to settle litigation in the US and move on, which is what J&J hopes to do now. Unfortunately, the price of settling all claims has gone up, from the $2 billion originally proposed and rejected by claimants, to $8.9 billion to be paid over the next 25 years.

- Invest with ii: Open a SIPP | Are SIPPs worth it? | SIPP Offers & Cashback

If approved by the courts and by 75% of claimants, which seems highly likely, this would rank for size alongside compensation paid by tobacco companies and opioid manufacturers. J&J had already set aside $2 billion to cover claims, so has now had to put away another $6.9 billion, more than wiping out profits in the first quarter and producing a loss of $68 million.

What is especially annoying about this settlement is that consumer goods are the smallest part of the three divisions at Johnson – the others being pharmaceuticals and medical devices – and the one that brings in least cash.

Yet shareholders can take comfort that there is light at the end of the tunnel. For a start, excluding the settlement, first quarter profits rose from $5.2 billion in the previous first quarter to nearly $7 billion this time, beating analysts’ expectations. Sales, too, were better than expected, up from $23.6 billion to $24.8 billion.

J&J promptly increased its quarterly dividend payment by 5.3% to $1.19 a share and ungraded its sales and profits guidance for the full year, claiming the latest results “demonstrate strong performance across all three segments” of the business. Sales are now expected to be up about 6% as opposed to the anaemic 1% previously indicated.

Costs rose in the quarter, but by only 3.4%, a highly satisfactory outcome in these inflationary times.

- American Football and investing – can you pick a winning team?

- Ask ii: what is the best way to invest passively in the US stock market?

- Fundsmith buys world’s largest consumer goods company – again

J&J had a good pandemic followed by a mediocre 2021, when sales tailed off. It is good to see them firmly on the rise again, indicating that this is a solid company with products across a number of sectors. Over half its sales are in the United States, so there is reasonable protection from exchange rate movements, although these were a negative factor last year.

Meanwhile, J&J is pressing ahead with bringing new drugs to market. It has just received European Union approval for a prostate cancer treatment after successful trials. Similar approval in the US is likely soon. Early tests from a bladder cancer drug are promising, although there are many more hurdles to clear.

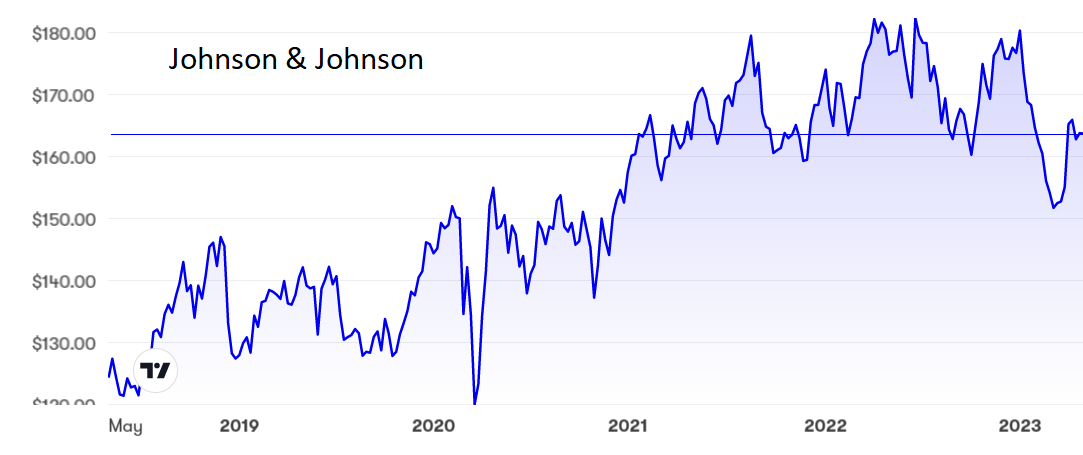

Source: interactive investor. Past performance is not a guide to future performance.

The shares took a nasty dip to $151 in March, but they have reacted well to news of the admittedly expensive proposed legal settlement for the talc product, which in any case is no longer sold in the main markets of the US and Canada where litigation is more widespread than in other countries.

- Here’s what investors are getting wrong about tech stocks

- Where to invest in Q2 2023? Four experts have their say

They are now back to $165 and, despite a somewhat challenging price/earnings ratio of 34.3, should edge back towards their peak of $180 if 2023 continues as it has begun. The yield is 2.8%.

Hobson’s choice: I recommended the shares at $170 and again after they had slipped to $163, expecting the previous support level around $160 to hold. This company is still a buy up to $170, with the increased dividend offering adequate compensation for any possible short-term slippage in the share price.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.