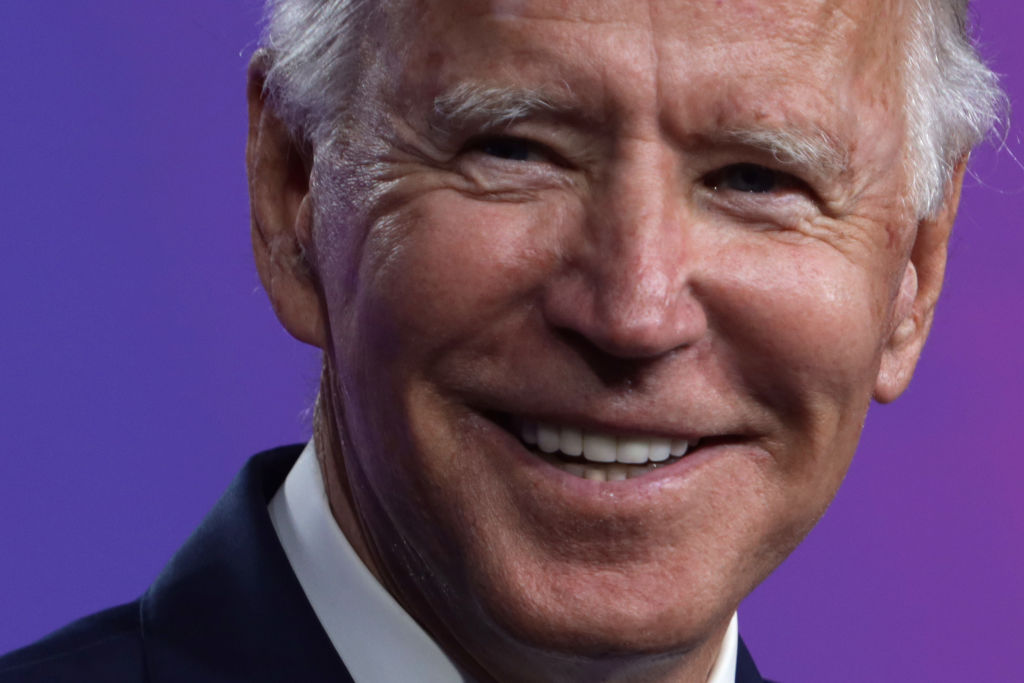

Market snapshot: FTSE celebrates Biden win with surge above 6,000

Stocks are racing higher as traders get a first chance to react to Trump's defeat and Brexit talks.

9th November 2020 08:12

by Richard Hunter from interactive investor

Stocks are racing higher as traders get a first chance to react to Trump's defeat and Brexit talks.

It is the first opportunity for markets to react to the Biden news from the weekend and the early signs are promising.

Asian markets had a brisk and positive session on hopes of a less fractious relationship between the US and China in the immediate future. Meanwhile, extremely early indications on the Dow Jones index futures pointed to an opening some 300 points, or just over 1%, higher as investor hopes for a Biden victory were confirmed.

Despite the likelihood of the election result being contested, the fact that Congress will be divided is now being priced in, which is seen as a tailwind for markets since sweeping changes are more difficult to introduce. In particular, the previous concerns of higher taxes and less regulatory interference have subsided, while an early boost to the economy from further fiscal stimulus is seen to be on the immediate agenda.

Friday’s non-farm payroll numbers were ahead of expectations, with 638 000 jobs added as against the consensus of 600 000, and an unemployment rate which fell to 6.9% versus projections of 7.7%. While the numbers were ahead, they did little to nudge the market dial on Friday, and the perception remains that the US economy is still in need of a fiscal shot in the arm, particularly given the fresh uncertainties resulting from Covid-19 concerns.

As a result, the year to date performance for the US indices is similar to that running up to the non-farms, with the Dow Jones down by just 0.8%, the S&P 500 up 8.6% and the Nasdaq ahead by 32.6%.

For the UK, attention will turn once more to the discussions between the EU and the UK, with hopes of a last gasp compromise stubbornly remaining. Sterling has made another positive move, although this in turn will likely cap any sustained gains for the FTSE 100. Amid the global celebration of a change in power at the White House, the index may enjoy an initial spike on the news, but has many rivers to cross and remains down by 20% in the year to date.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.