Lloyds Bank shares: what you need to know after Q1 profits dive

With profit sunk and the dividend already suspended, our head of markets analyses quarterly results.

30th April 2020 10:00

by Richard Hunter from interactive investor

With profit sunk and the dividend already suspended, our head of markets analyses quarterly results.

Often seen as a barometer of the UK economy, this first-quarter update from Lloyds Banking Group (LSE:LLOY) underscores the scale of the challenges ahead.

At a headline level, the impairment provision of £1.4 billion is up from a previous figure of £275 million, and has all but obliterated first quarter profit.

Pre-tax profit of £74 million is a decline of 95% year-on-year and is also considerably short of expectations.

The impairment figure itself is, of course based on a combination of factors, such as a sharp contraction in UK GDP, a rise in unemployment and a continuance of interest rates at historically low levels which turn the screw further on margins. It also factors in losses on loans on both its existing book as well as any new lending.

- FTSE 100: the index strikes back

- How FTSE 100 rally reached 1,200 points, or 25%

- Ian Cowie: by far the biggest question facing investors now

Meanwhile, net income has also reduced by 11% due to lower levels of customer activity and increased competition, although the number is in line with predictions. The Return on Tangible Equity (ROTE) figure has slumped to 5% versus a previous 12.5% and a decrease in mortgage and credit card activity will crimp some lending growth. as with many of its peers.

Even some of the increased corporate lending is simply a factor of companies drawing down credit facilities to bolster their own capital positions, although Lloyds has been making additional loans through the recently introduced Government schemes.

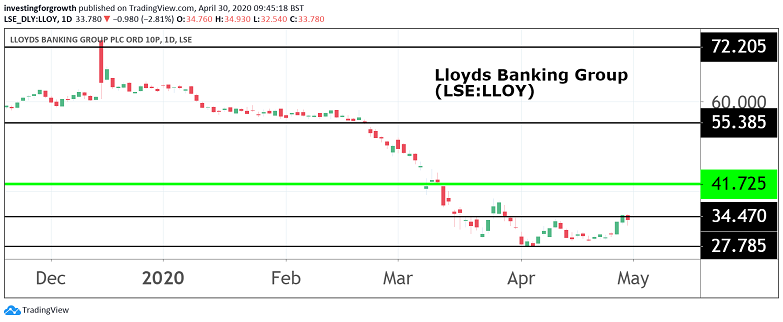

Source: TradingView Past performance is not a guide to future performance

Lloyds Banking has long been regarded as a tightly-run ship and there are elements of cautious optimism. Without doubt, the banks face this adversity from a stronger position, having learned some uncomfortable lessons from the previous financial crisis of over a decade ago.

For its part, Lloyds’ capital cushion has improved to 14.2% from a previous 13.9% and Net Interest Margin has held up reasonably well given the circumstances.

At the same time, its sector-beating cost/income ratio remains at an impressive 49.7%. While this represents an increase year-on-year, it is an improvement from the previous quarter (55.1%) and is testament to the bank’s ability to control costs despite income having fallen.

Given the nature of the pandemic, the group’s leading digital presence could also prove to be a boon to its efforts, while there is also a currently unused PPI provision of £1 billion which, if released, could also contribute to an already flush liquid asset buffer of £132 billion, which represents a covered ratio of 138%.

- Nine in 10 UK shares have cancelled or suspended dividend payments

- Bank dividend cuts: Top analysts give their opinion

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Lower customer activity could worsen going into the second quarter, where fee forbearance from the bank such as payment holidays on mortgages, credit cards and personal and business loans will also negatively affect income.

This has already had a severe impact on the share price, which has fallen 45% over the last year, as compared to a decline of 18% for the wider FTSE 100 index, and 40% in the last three months alone.

Despite there being no income for investors in the immediate future, the bank is on an undemanding valuation and its likely ability to weather a crisis such as this provides some longer-term comfort.

As such, and in spite of a tinge of disappointment allied to the profit figure, the market consensus of the shares remains resolute at a “buy”.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.