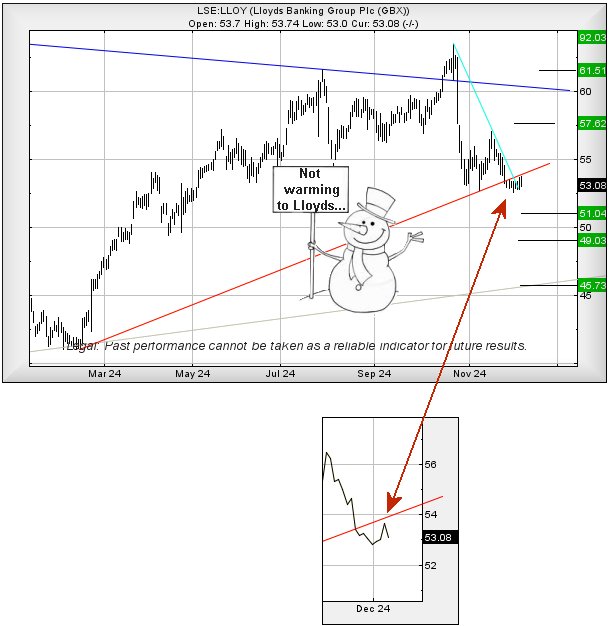

Lloyds Bank shares: the important levels to watch

A motor finance scandal torpedoed this lender's share price which had been near a five-year high. Independent analyst Alistair Strang investigates the likelihood of a turnaround.

9th December 2024 07:41

by Alistair Strang from Trends and Targets

Lloyds Banking Group (LSE:LLOY)'s share price is misbehaving on a massive scale (from our perspective).

When we previously reviewed the share, we expressed a longing for the price to close above 57.2p but, unfortunately, the highest closing price achieved has been 56.48p, along with the best intraday price being just 57.06p.

All things considered, it’s not a great situation, especially as the share price has now broken below Red on the chart, the uptrend since February of this year.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Interestingly, the trend-break level was at 53.4p but, by some sort of miracle, the share has closed at 53.7p since, allegedly making the trend break a fake – according to our rules.

However, if we adhere to our other rules, the situation now should suggest weakness below 52.5p should promote reversal to an initial 51p with our secondary, if broken, at a very, very, probable bottom by 49p. Movements since July of this year indicate 49p as a potential bottom target, this calculation remaining correct with reversals in October and again, the recent plunge below Red.

Perhaps this shall prove correct, making it worthwhile keeping an eye on this share as the market is indicates a reasonable chance for a bounce at 49p. Be warned, closing below such a target level would be a bad thing as we can advance 45.7p as a potential third level target. Reaching such a level would effectively undo all the work of 2024, indicates next year shall kick off at virtually the same level of this year.

Returning to our comment above about Lloyds marginally exceeding the trend break level, perhaps we should attempt to concentrate on “what if”, just in case the market is playing games.

Currently, closure above Red at 54p shall be treated as important, calculating with the potential of recovery to an initial 57.6p with our secondary, if bettered, working out at 61.5p. Neither ambition is particularly spectacular, dumping the share price into a zone where proper future growth becomes difficult and, once again, indicating the risk of the market spending time teasing traders until some sort of game-changing reason for share price growth comes along.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.