Lloyds and the UK bank sector: Full-year results preview

Barclays kicks off bank reporting season next week. Our head of markets analyses the major lenders.

7th February 2020 09:22

by Richard Hunter from interactive investor

As Barclays prepares to kick off full-year reporting season for UK banks next week, our head of markets analyses the major lenders.

Back in late October, the third quarter reporting season for the banks was largely forgettable, whereas these upcoming results will both summarise the direction of travel over the past year and, equally importantly, give some guidance on current and future prospects.

There may have been a collective sigh of relief in banking boardrooms when the Monetary Policy Committee decided not to cut UK interest rates in January – lower rates typically mean lower profits - but this could yet prove to be a stay of execution, depending on how trade negotiations progress with Europe and, indeed, how the UK economy reacts in the meantime.

Otherwise, the usual key metrics will be under scrutiny as ever.

These range from the strength of the capital cushions, the Returns on Capital, the Net Interest Margins (still under severe pressure from historically low interest rates), the level of impairments (a significant rise could herald the onset of an economic slowdown) and the cost/income ratios.

Each of the banks has a different story to tell, and the full-year updates will be scrutinised with interest.

| Scheduled results day | Share price 6 months | Share price 1 year | Dividend yield (%) | Market consensus | |

|---|---|---|---|---|---|

| Barclays (LSE:BARC) | 13 February | +20% | +10% | 3.9 | Strong buy |

| The Royal Bank of Scotland (LSE:RBS) | 14 February | +13% | -9% | 6.2 | Hold |

| HSBC (LSE:HSBA) | 18 February | -9% | -12% | 5.4 | Sell |

| Lloyds Banking Group (LSE:LLOY) | 20 February | +15% | -1% | 5.7 | Cautious buy |

| Standard Chartered (LSE:STAN) | 27 February | +2.5% | +1% | 2.7 | Hold |

| FTSE 100 | +4.5% | +4.5% | 4.4 | N/A |

Barclays

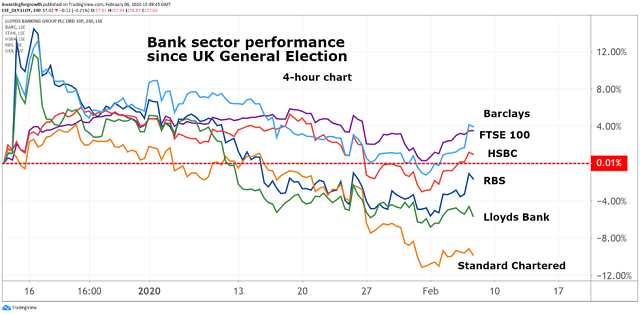

In general, bank share prices have been beneficiaries of the “Brexit bounce”, with Barclays most strongly positive over the last six and 12 months. To put this in perspective, the bank remains 24% down over the last three years despite this spike. However, the market believes its fortunes could be changing and, in terms of market consensus, Barclays is now most favoured in the sector.

At the third-quarter update, there were certainly signs of recovery, with hopes now rising of a return to form at the investment bank in particular.Barclays (LSE:BARC) had previously stated that cost control was a priority for the year, and a stable 62% cost/income ratio, despite continuing investment in its digital presence, was a worthy achievement.

Meanwhile, the Consumer, Cards & Payments business impressed again, the overall ROTE (return on tangible equity) number exceeded 10% in the quarter, and the Corporate & Investment Bank performed particularly well, with Markets and Banking Income spiking by 13% and 33% respectively.

- 10 shares to deliver a £10,000 annual income in 2020

- Outlook for Lloyds Banking Group shares in 2020

- How interactive investor's SIPP millionaires invest

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Royal Bank of Scotland

At The Royal Bank of Scotland (LSE:RBS), it may be something of a saving grace that the bank delivered a strong performance in the first half of the year, with the third quarter disappointing on any number of fronts.

There was an additional PPI charge of £900 million (although at last the line has been drawn in the sand), both Net Interest Income and Net Interest Margin reduced against a backdrop of historically low interest rates, the cost income ratio spiked to 93%, undoing some of the progress made, and the PPI provision also put a slight dent in the capital cushion, which fell to 15.7%.

Total income was 20% lower year-on-year (and 29% lower quarter-on quarter),with NatWest Markets having a particularly challenging time amid market volatility, and there was also a reduced ROTE.

It remains to be seen whether the third quarter was more of an anomaly than a trend. There were some positives (the full-year target of £300 million cost savings remained on track, and the bank was comfortably ahead in terms of pre-tax profit at £2.7 billion at the nine-month stage).

Source: interactive investor Past performance is not a guide to future performance

HSBC

It is fairly unusual to see a market consensus sell on the banks, but HSBC (LSE:HSBA) still finds itself in that position, while also being the standout underperformer in the sector over the last six and 12 months.

Third-quarter numbers were light of expectations, with a downbeat assessment for the rest of the year. Operating and net profit fell sharply, as did the ROTE (6.4% from a previous 10%). As such, the bank has implicitly abandoned its 11% target for 2020. In its own words, areas of continental Europe, the UK and the US provided unacceptable performances which in turn is likely to mean that restructuring charges in the final part of the year are likely to hurt.

Somewhat surprisingly, the performance in the Asia region, where HSBC derives the vast majority of its profits, held up well, including a resilient performance from Hong Kong. Overall, the capital cushion remained stable, there was evidence of growth in loans and advances and the Global Private Banking division added $19 billion of net new money. Elsewhere, the dividend yield remains attractive.

Lloyds Banking Group

One of only two favoured stocks in the sector at present, Lloyds Banking Group (LSE:LLOY) should update on its previously guarded (but cautiously optimistic) outlook, and may refer to any early benefits from the Schroders tie-up and/or the acquisition of the Tesco mortgage book.

A sector-beating cost/income ratio of 47.6% in the third quarter and high hopes for the bank’s investment in the digital platform, where Lloyds is in a fairly dominant position, could provide some highlights. In the meantime, a dividend yield of 5.7% is ample compensation for income-seeking investors.

Other warning lights at the nine-month update may flash again. The booked £1.8 billion charge for PPI was at the very top end of the previously guided range, all but wiping out Q3 profit.

Elsewhere, impairments rose by 31% and the capital cushion also declined slightly, although still ample at 13.5%. Meanwhile, compression on asset margins remain and the mortgage market, in which Lloyds is a significant player, still suffers from intense competitive pressure.

- ii Winter Portfolios 2019: Half-time update

- This indicator has improved returns for dividend investors

- 10 stock ideas from a market master

- You can also invest in UK equities via ii’s Super 60 recommended funds. Click here to find out more

Standard Chartered

The possibility that the Chinese economy is coming off the boil, political protests in Hong Kong and latterly the as yet unknown ramifications of the coronavirus have also weighed on Standard Chartered (LSE:STAN).

The bank had previously, and quite successfully, been concentrating on cost reduction, before switching its sights to some ambitious targets, such as annual income growth of between 5% and 7% and a “relentless” focus on achieving a 10% ROTE figure by 2021.

There is also a market suggestion that there will be another $1 billion buyback programme this year, which would mirror last year’s buyback as announced in April and completed in September 2019. In addition, management has suggested that it is capable of double dividend payments by 2021. Given the economic and political backdrop in the region, the general market view is “neutral” towards what was once a market darling.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.