Less than 3% of funds make gains in September

3rd October 2022 14:26

by Douglas Chadwick from ii contributor

Saltydog Investor sits on his hands as markets keep posting losses. The strategy is not rocket science, but it does prevent owning funds that might fall by 20%, 30%, or maybe even more.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

At Saltydog Investor, we have been tracking the performance of most of the readily available UK domiciled unit trusts and OEICs for more than 10 years. In all that time, I cannot remember many months as difficult as this September.

Only 2.7% of the funds that we monitor went up, and that included some funds from the Standard Money and Short Term Money Market sectors, which are basically cash.

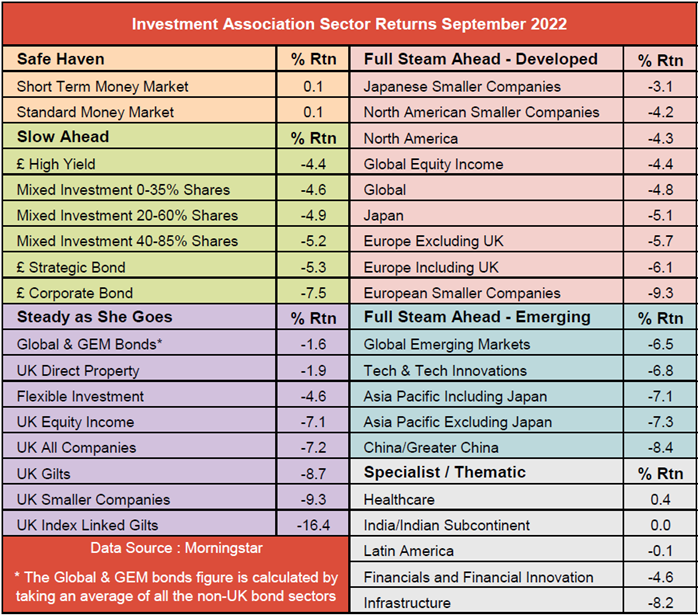

As you would imagine, most of the Investment Association sectors also fell.

Some of the UK sectors had a particularly difficult time. UK Equity Income fell by 7.1%, UK All Companies was down 7.2%, UK Gilts lost 8.7%, UK Smaller Companies dropped by 9.3%, and UK Index Linked Gilts ended the month down a staggering 16.4%.

The only sectors that went up were Short Term Money Market, Standard Money Market, Healthcare, and a couple of the new bond sectors.

We still group all the non-UK bond sectors together and classify them as Global and Global Emerging bonds.

However, a couple of years ago the Investment Association introduced some new sectors. They have divided them by region, (Euro, US, Global, and Global Emerging Markets) and by type (e.g. High Yield, Corporate, Government, Inflation Linked). Last month the USD Corporate Bond sector went up by 0.9%, USD Government Bonds made 1.8%, USD High Yield Bonds rose by 0.4%, and USD Mixed Bonds gained 0.8%. Unfortunately, there are not many UK domiciled funds specialising in these areas.

- Saltydog: our new fund purchase even as markets fall

- Saltydog: the niche investment sectors attracting our attention

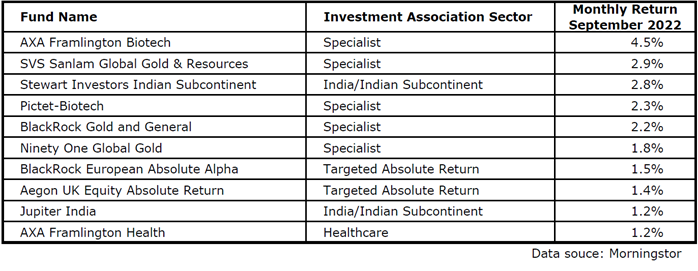

There are some sectors that the Investment Association thinks are so diverse that it does not make sense calculating an average, and so they do not feature in the table above. Two sectors that fit into this category are ‘Specialist’ and ‘Targeted Absolute Return’, and that is where we found some of the best performing funds last month. When you look at our Top Ten funds from last month, five came from the Specialist sector, and two were from Targeted Absolute Return.

There were also two funds from the India/India Subcontinent sector, including the Jupiter India fund, that one of our demonstration portfolios has recently invested in.

As a private investor, it is difficult to know what to do when almost everything is going down. The perceived wisdom is to sit tight and wait for things to get better. At Saltydog Investor we disagree. If our investments are going down we sell them, and then only invest in things that are going up. It is not rocket science, but it does stop us holding on to funds that might fall by 20%, 30%, or maybe even more.

- Saltydog: the funds benefiting from the energy crisis

- Saltydog: the two Baillie Gifford funds we’ve just bought

I appreciate that when markets have fallen by so much it is painful to take the loss, but we are in the fortunate position that in our demonstration portfolios we have only had a limited exposure to the markets for some time. In our Tugboat Portfolio, our cash level is currently 90% of the total investment and in the Ocean Liner, it is 85%.

Making a loss is uncomfortable, but it is an inevitable part of investing. If one of your investments is going down and you cannot put forward a convincing argument supporting the fact that it will start to go up fairly soon, then why hold on to it.

As one of the most famous American momentum traders, Jesse Livermore, said: “Losing money is the least of my troubles. A loss never troubles me after I take it. I forget it overnight. But being wrong – not taking the loss – that is what does the damage to the pocketbook and to the soul.”

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.