At last, FTSE 100 passes 7,000 again

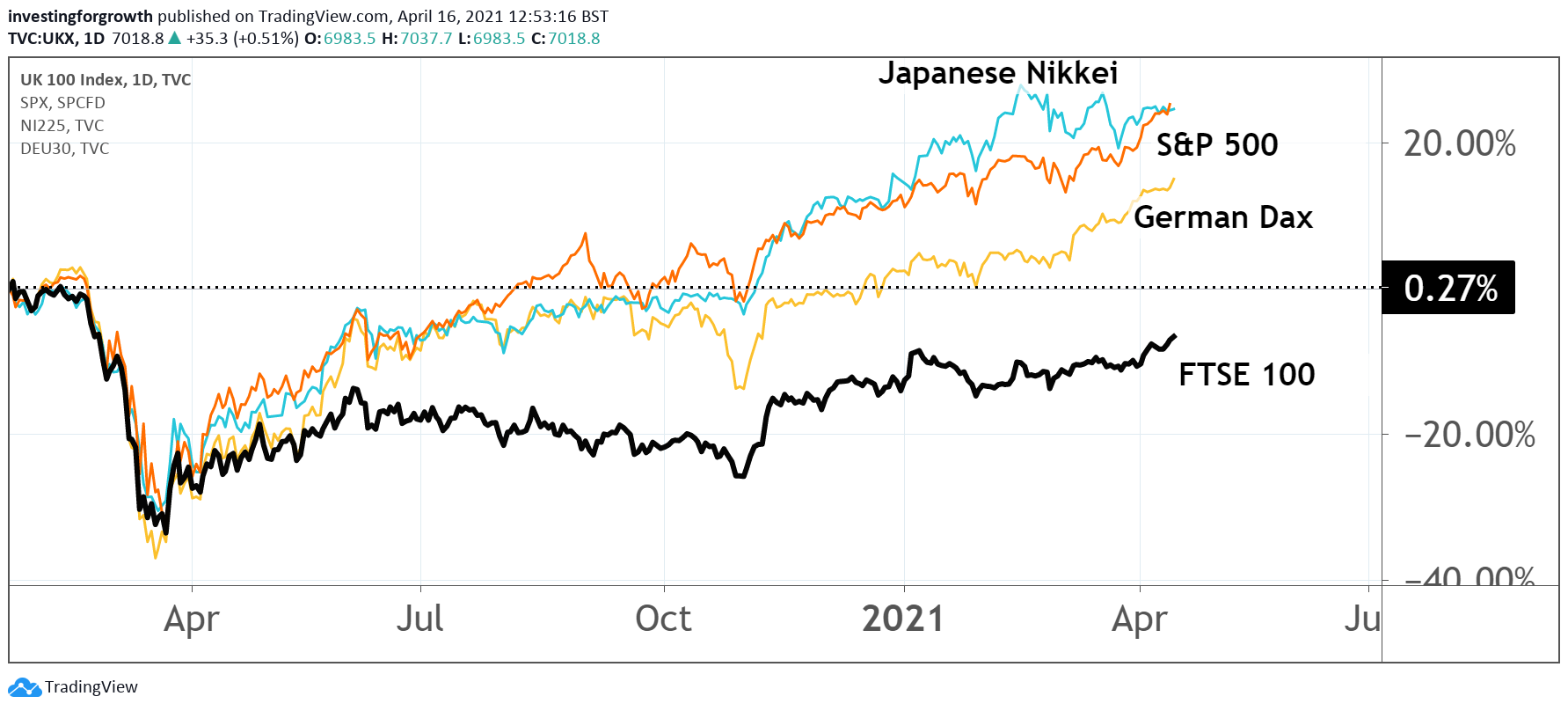

Other overseas stock markets passed their pre-Covid levels long ago, but at least the UK is catching up.

16th April 2021 12:55

by Lee Wild from interactive investor

Other overseas stock markets passed their pre-Covid levels long ago, but at least the UK is catching up.

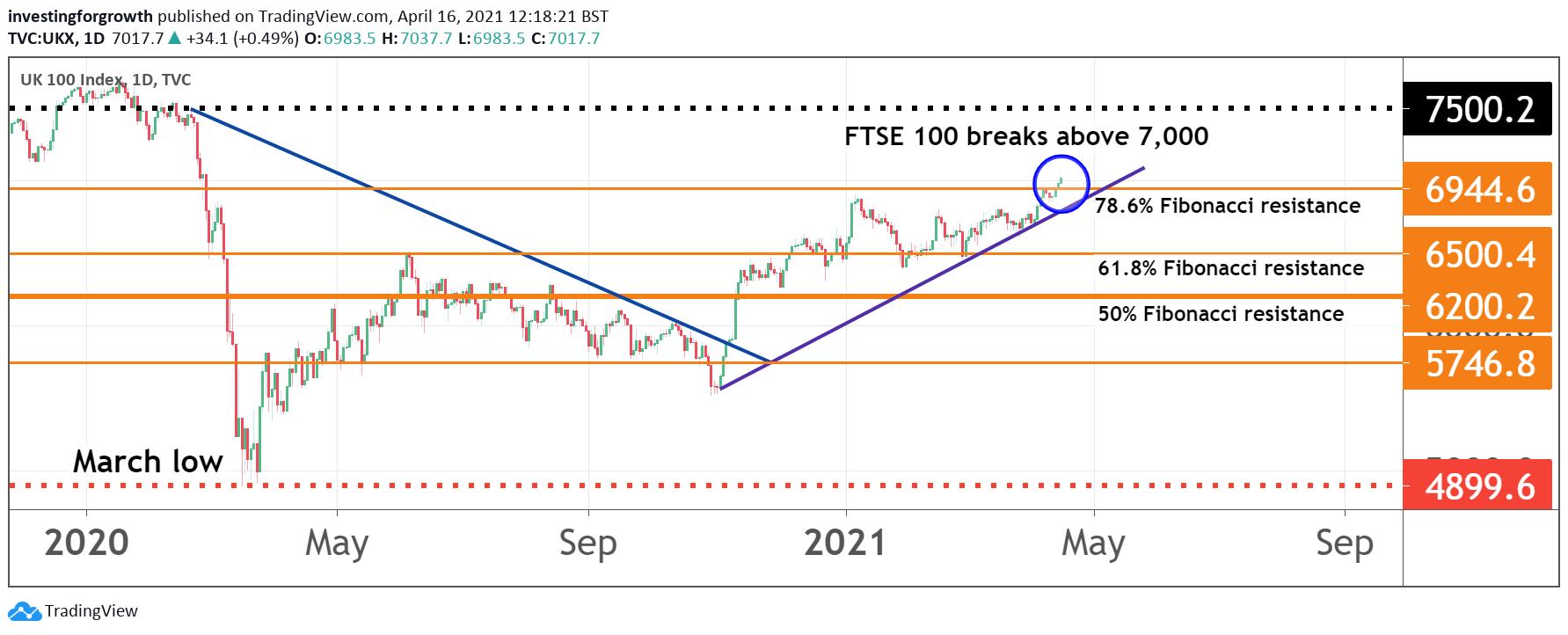

It’s lagged global rivals for many months, but the UK’s premier index, the FTSE 100, is finally catching up and generating big gains for patient investors. Today it reached a major milestone, breaking back above 7,000 for the first time in almost 14 months.

Last time the blue-chip index closed above 7,000 was 26 February 2020. Within a few weeks it had fallen as low as 4,898 as the Covid crisis unfolded and the true scale of its impact became clear.

Source: TradingView. Past performance is not a guide to future performance

While there was a dramatic recovery up to early June, the volatile FTSE 100 then trended lower. It was only five months later, in early November, that the uptrend resumed in earnest.

That, of course, was triggered by the first coronavirus vaccine, issued by Pfizer (NYSE:PFE). Since late October, the index is up around 1,500 points, or 27%, peaking today at 7,037.

Source: TradingView. Past performance is not a guide to future performance

Of course, these gains will be helping lots of investors recoup big losses suffered during the initial sharp sell-off. But brave investors who bought FTSE 100 stocks when it recorded its closing low on 23 March 2020 will be quids in. Of the 100 constituents, 96 have generated a positive return since then, not including dividends, with 27 of them more than doubling in value, and 61 up 50% or more.

- FTSE 100: time for real recovery?

- Will bulls have more to cheer in April after strong March?

- Bestselling ISA investments in the 2020-21 tax year

Some of the big winners over the last year will not be a surprise.

Moves by betting customers online, given high street bookies remained shut, has helped the likes of Entain (LSE:ENT) and Flutter Entertainment (LSE:FLTR) rocket 363% and 144% since late March 2020. A takeover approach for Entain early year this year added to the excitement.

Central Bank money printing, aiding the value of finite resources extracted by miners such as Anglo American (LSE:AAL) and Glencore (LSE:GLEN) also played a part. Ultra-low interest rates and changed work and shopping practices also boosted tech stocks, aiding growth-focused investment trust Scottish Mortgage (LSE:SMT).

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.