Labour’s WASPI pledge: I’d get £12,833 extra state pension, but this cash should go to the NHS

28th November 2019 14:18

by Hannah Nemeth from interactive investor

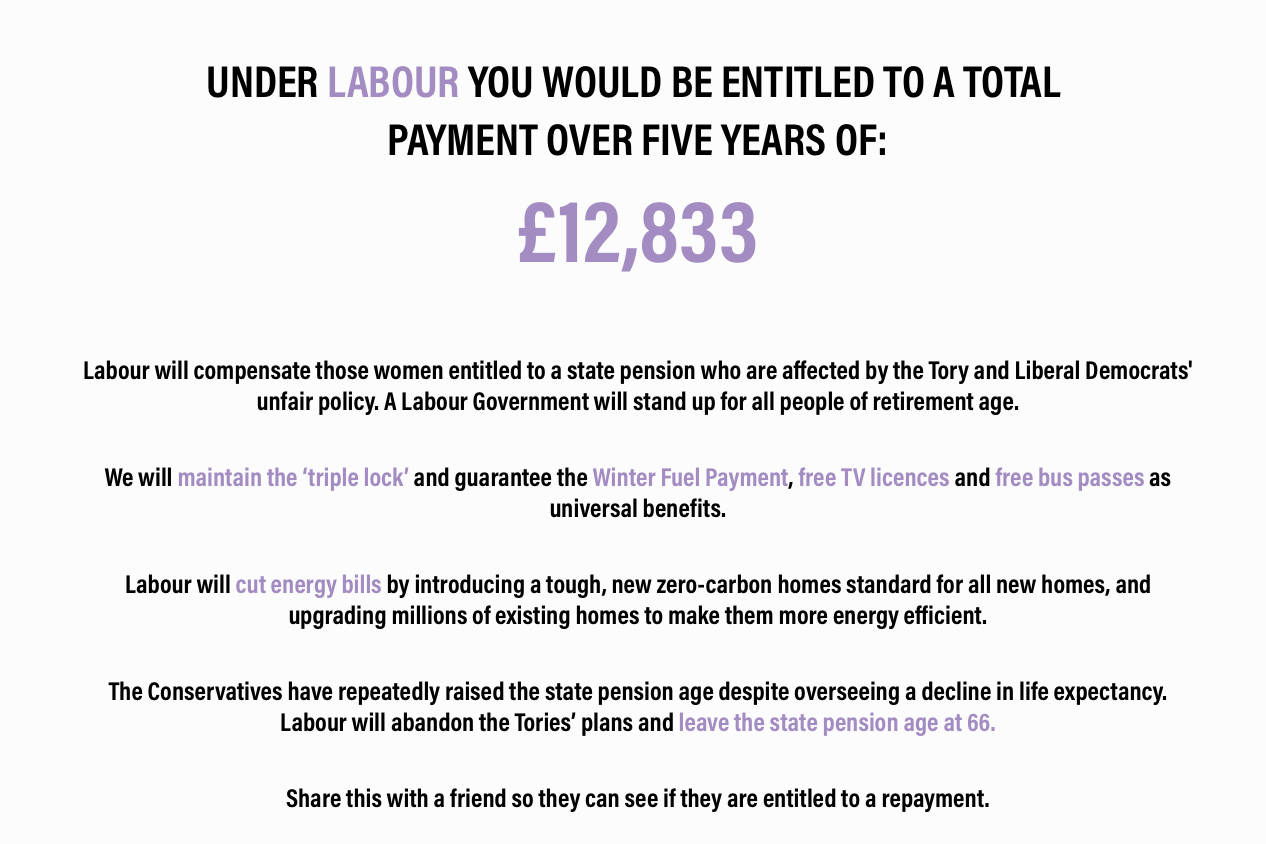

If Labour confounds the latest poll from YouGov and is able to form a government, then I will be due for a windfall of £12,833 over five years – that’s £2,566 a year.

I’m already thinking about how I would spend this pension payout – paying off credit card bills, helping my two kids with deposits for their first homes or just helping to clear their debts, going on a few holidays or splurging on a trip to Ikea or John Lewis.

But, deep down, I believe my potential windfall would be better spent elsewhere – on improving the ailing NHS.

Born at the tail-end of the 50s, for the first 15 years of my working life I expected to receive my state pension at 60. And this did affect my retirement planning – I took out a personal pension plan in my mid-20s and I factored into my pension forecast that I would receive my state pension at 60.

- Invest with ii: What is a SIPP? | Is a SIPP right for me? | SIPP Cashback Offers

I do recall receiving a letter explaining that my state pension age would go up from 60 to 65 – and I remember feeling dejected and angry.

When the 1995 Pensions Act was introduced, I was self-employed with two young children and wasn’t earning enough to plough extra cash into my pension pot and make up for a shortfall in 25 years’ time.

In 2011, I accepted the change to my state pension age from 65 to 66 with greater equanimity because it didn’t seem such a big leap.

While I have lost out on six years of state pension, to some extent I have had time to play catch-up – however, not all women have been so lucky.

I am a ‘Waspi’ – one of the Women Against State Pension Inequality – but only out of support for those who are most adversely affected, such as women born from 6 April 1953 to 5 April 1955, who had their retirement plans snatched away from them.

Labour posted a 'calculator' online to show how much so-called Waspi women could get back in state pension payments

I have friends in this age group who have found it hard to see other women who celebrated their birthday just a few months before them accessing their state pension months or years earlier.

The other groups that I believe should be compensated are workers on low incomes, struggling to make ends meet and unable to make up the shortfall, along with self-employed women who couldn’t fall back on a company pension plan or afford to pay more into a private pension.

I am puzzled why Labour would propose a compensation scheme that will be universal. While I am not in favour of means-testing, I do feel there should be a cap on compensation to the wealthiest women in our society.

Much has been made of the fact that Theresa May would receive £22,000 under Labour’s compensation scheme – she earns £79,468 a year as an MP.

But what about ITV breakfast host Lorraine Kelly, born on 30 November 1959, who would be entitled to £2,191, and is said to be worth more than £4 million? Or actor Emma Thompson, born 15 April 1959 and said to be worth $45 million, who would be entitled to a payout of £5,966?

Let’s keep the compensation for those who really need it or those who were most adversely affected by being at the cusp of when these changes started to take place.

And if money can be found in the government’s coffers for this – and that’s a big if – let it go to our beleaguered NHS.

That way, both men and women can benefit, getting the best treatment possible as quickly as possible – something more of us will need as we head towards retirement.

This article was originally published in our sister magazine Moneywise, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.