Kraft Heinz vs Walmart: results analysis as inflation bites

23rd February 2022 08:38

by Rodney Hobson from interactive investor

Both companies are able to raise prices to combat rising costs, but our overseas investing expert would only buy one of them.

Inflation really is hitting a wide range of companies, and the big worry for investors is that the situation is likely to get worse. As fast as companies pass on higher costs by raising their prices, those input costs will be rising further, leaving companies such as Kraft Heinz (NASDAQ:KHC) running just to stand still.

Fourth-quarter figures from Kraft were frankly disappointing as the food manufacturer saw net sales decline 3.3% to $6.71 billion and there was a swing from a net profit of just over $1 billion in the final three months of 2020 to a net loss of $255 million this time.

Funnily enough, the loss is not as bad as it seems. Had there not been a $1.3 billion writedown of the value of the Kraft brand following the sale of its cheese products in November, net profit would have been hardly changed year-on-year.

- Top 10 things you need to know about investing in the US

- Could the S&P 500 really fall 20%?

- ii view: Nvidia flags exceptional demand

- Want to buy and sell international shares? It’s easy to do. Here’s how

More worrying is the sales performance. Kraft claims that it has managed to make some cost savings and raise prices across the board by an average 3.8% to offset inflationary pressures. However, volumes were pretty flat as a recovery in sales to restaurants was offset by a corresponding fall in retail sales that were riding high in 2020 when lockdowns kept consumers at home.

The poor final quarter meant that sales for the full year were 0.5% lower at $26 billion, although net income almost trebled to over $1 billion.

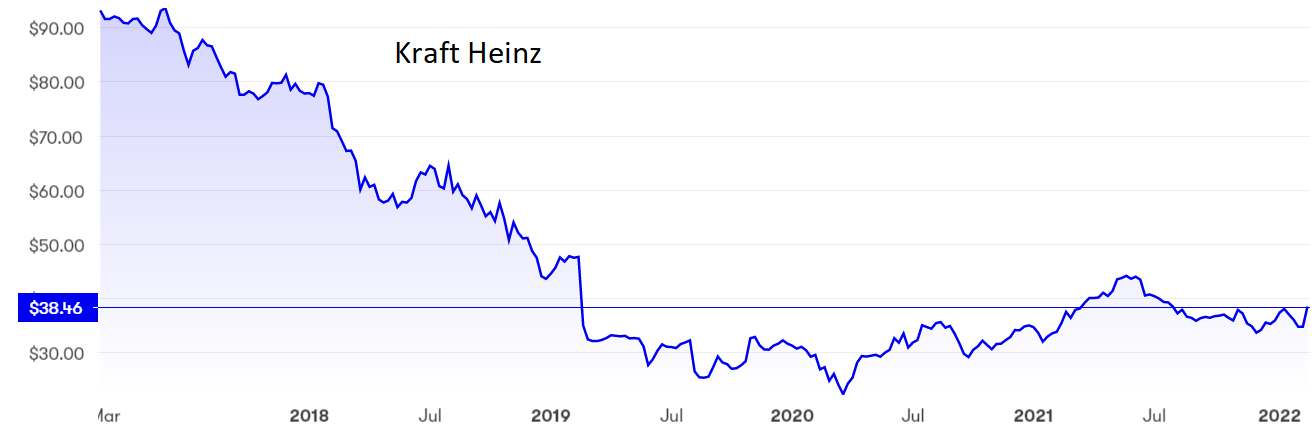

Source: interactive investor. Past performance is not a guide to future performance.

The big question is whether the October-December quarter was the start of a tougher period or a temporary dip. Kraft believes net sales, stripping out the impact of disposals, will grow this year, though not by more than 5%. At least the range of strong brands will help Kraft to make price rises stick.

Two years ago, a precipitous slide in the share price evened out, with $20 proving to be the bottom. The shares are nearly double that now, but $40 is proving to be a difficult ceiling to crack and the latest quarter will not help Kraft to break higher.

The quarterly dividend of 40 cents makes the yield an attractive 4.16%, which at least compensates for the cloudy outlook.

- US stock market outlook 2022: more record highs for Wall Street?

- Want to know more about US stocks?

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

How to pass price rises on to consumers and how to cope with supply chain issues are also exercising the brightest minds at retail chain Walmart (NYSE:WMT).

Revenue for the three months to the end of January edged up only 0.5%, but the $152.9 billion total was admittedly depressed by a series of disposals, which also distorted profit figures. Stripping out one-off hits left net profit also flat.

The encouraging news was that margins actually improved slightly despite rising supply chain costs and the impact of the pandemic.

Source: interactive investor. Past performance is not a guide to future performance.

Walmart claims to have momentum, although the fourth quarter actually marks a slowdown in an otherwise successful year in which revenue rose 2.4% to $572.75 billion. It forecasts net sales running 3% ahead this year with earnings per share up around 5%. And management are sufficiently confident to launch a $10 billion share buyback programme over the next 12 months.

- Read more of Rodney's articles here

- Our outlook for 2022: key topics and investment ideas for the year ahead

- Subscribe to the ii YouTube channel for our latest New Year share tips and fund manager interviews

However, management put on a brave face three months ago when serious concerns about inflationary pressures and supply chain issues were already squeezing margins. At that stage the company pinned its hopes on the Christmas quarter, which has now proved to be less than overwhelming.

The shares have doubled over the past five years but have baulked several times at $150 over the past 15 months. At $137 the yield is 1.6%.

Hobson’s choice: I have previously suggested buying Kraft below $40 and that stance still stands. If you are already in Walmart it is probably right to hold on, but at the moment there is no obvious reason to buy in.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.