Klarna’s big IPO has investors thinking ‘buy now – profit now’

The provider of ‘buy now, pay later’ loans is gearing up for its long-awaited stock debut. Theodora Lee Joseph’s taken a closer look at the company and its growing industry.

4th April 2025 08:37

by Theodora Lee Joseph from Finimize

Klarna is heading for the stock market – but this time, it’s for real. After a false start or two, the Swedish “buy now, pay later” start-up has formally filed for a US IPO and is aiming to raise $1 billion, at a valuation of between $15 billion and $20 billion.

Now, that’s a far cry from the $45.6 billion peak it was eying in 2021, but it’s also a massive step up from the $6.7 billion low it hit just a year later.

Still, with those kinds of ups and downs, you might have a few questions about this coming stock. For example, what are investors really buying into here? Is Klarna just a glorified checkout button, or is it quietly building a sticky, multiproduct platform for customers and retailers? And, more importantly, what’s this company actually worth?

Let’s take a look.

How does Klarna make money?

Klarna is best known for reshaping the way people shop with its “buy now, pay later” (BNPL) model – letting folks split payments into four interest-free installments or delay them for 30 days, with a loan approval process that’s automated and completed in mere seconds.

But Klarna isn’t just BNPL anymore: it has a whole shopping and payments ecosystem. That includes its Pay Now option, the virtual Klarna Card that can be used anywhere, and the Klarna App, a shopping hub with personalized deals, price drop alerts, and delivery tracking. In Europe, Klarna also has a banking license, which allows it to offer debit cards and interest-earning savings accounts.

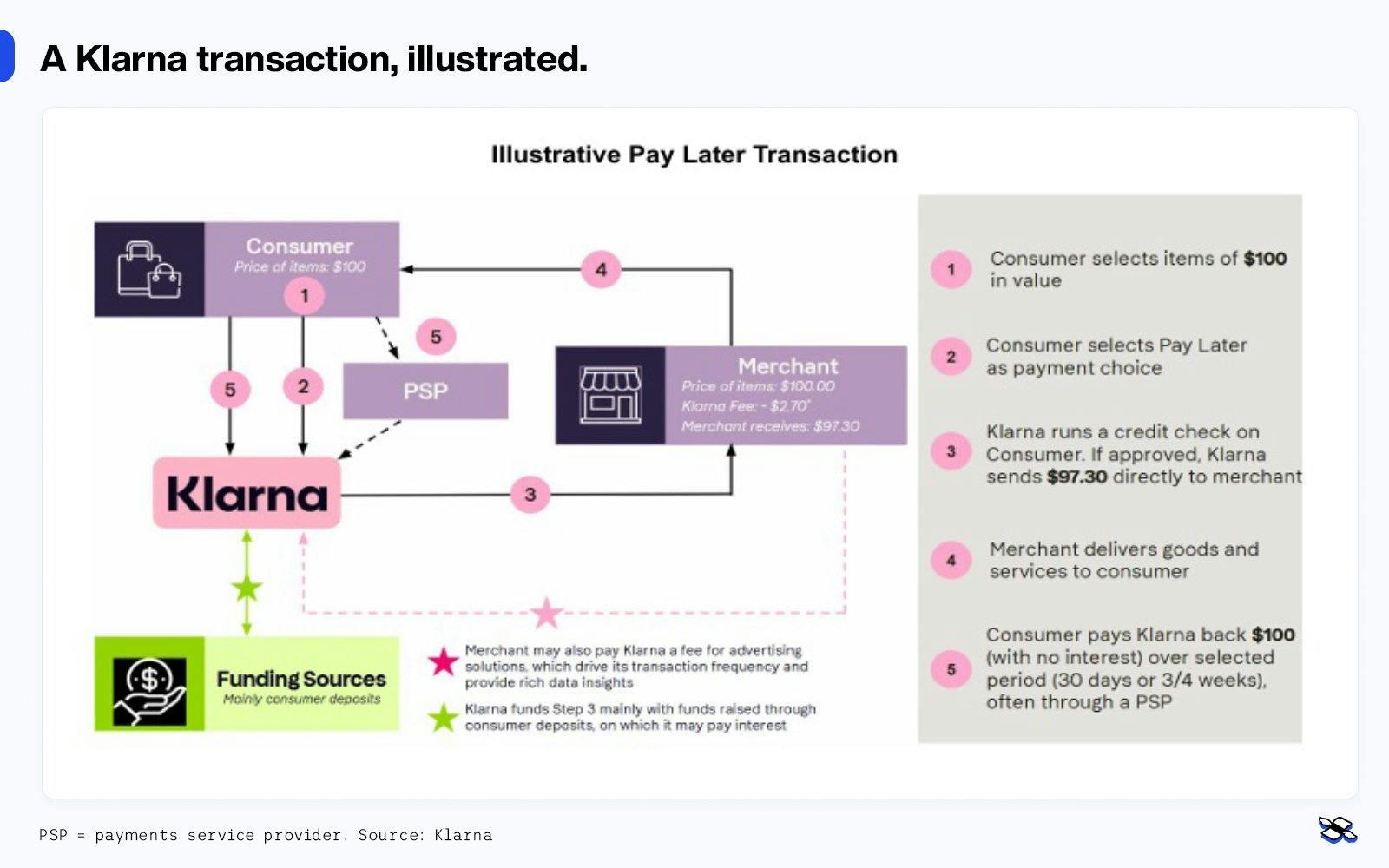

Here’s a simple example that shows one of Klarna's popular offerings:

Say you’re buying a $100 jacket. At checkout, you choose Klarna’s “Pay in 4” option:

You pay $25 upfront.

Two weeks later, Klarna will collect a second $25 installment, then a third $25 two weeks after that, and, finally, a fourth two weeks after that – at which point you will have paid the full $100.

Stick to the payment schedule and there’s no extra cost. Miss one, and Klarna could charge you a late fee.

The retailer gets your full $100 payment immediately (minus a small Klarna fee: usually a set amount, plus a small percentage of the sale), so the system works great for merchants – and their cash flow.

It’s a win-win. For consumers, Klarna is a convenient, flexible way to budget purchases without a credit card. For retailers, it drives higher conversion rates and bigger order sizes – with Klarna taking on the risk of customer non-payment.

A Klarna transaction, illustrated. PSP = payments service provider. Source: Klarna

Klarna essentially has three main revenue streams:

1. Merchant fees (57% of revenue). Retailers pay Klarna a transaction fee – typically 3% to 5% of the purchase – for each sale made through the platform. Merchants accept this cost because Klarna helps them sell more stuff, to more people. Simply put, the more customers choose Klarna at checkout (and the more they spend), the more Klarna earns.

2. Interest income (24% of revenue). The company earns interest when consumers choose longer-term financing options (such as Fair Financing) or when they use payment flexibility features like “Snooze”. Klarna also rakes in interest from investing its excess cash, and from incremental merchant fees. Together, this stream reflects Klarna’s dual role as both a lender and a bank.

3. Consumer fees (9% of revenue). Roughly 99% of Klarna’s BNPL transactions are interest-free for the shopper, with the merchant actually covering their costs. So most folks who use Klarna won’t pay interest, but they would be charged late fees if they miss payments. They could also sign up for a premium membership – Klarna Plus – for around $8 a month, which gives them perks like exclusive discounts and waived penalties.

4. Advertising (6% of revenue). Merchants pay for visibility within Klarna’s ecosystem – by way of sponsored listings, affiliate campaigns, and targeted brand placements. This gives Klarna leverage over both merchant acquisition and shopper engagement, and it helps it diversify beyond pure payments.

What’s been fueling the BNPL boom?

Buy now, pay later is one of the biggest shifts in modern finance, but it didn’t just happen. The companies in this space aren’t exactly banks (though Klarna is licensed as one in Europe), and they aren’t exactly credit card issuers. But they are fast becoming the go-to way to shop and split payments.

In 2024, the global BNPL market was valued at around $235 billion. By 2034, it’s expected to hit $1.6 trillion. While estimates vary, everything points to the same trend: high sustained growth, with annual expansion expected in the low 20% range. Importantly, BNPL still accounts for only a single-digit share of global retail sales – suggesting tons of untapped potential as more consumers shift away from traditional credit cards and toward installment-based payment options.

And if you’re wondering where these services are growing fastest: it’s the United States. America’s annual BNPL usage grew 38% last year, making it the leading growth market. Understandably, Klarna and its rivals are pouring resources into grabbing market share there.

Here are some of the big factors that have made BNPL so popular.

Changing consumer preferences. Millennials and Gen Z love BNPL: they see it as a more transparent, more manageable alternative to credit cards. With no revolving debt and typically no interest, BNPL offers a cleaner way to finance short-term purchases.

Shopping habits are different now. Even after the pandemic e-commerce frenzy cooled off, online shopping continued to grow. And BNPL fits perfectly into that flow. It’s now a staple at checkout – from global giants like Amazon to little local boutiques.

Retailer adoption. BNPL helps stores sell more. It boosts conversion rates and basket sizes. And since BNPL players pay the merchant upfront and take on the credit risk, it’s a no-brainer for many retailers.

Regulatory whitespace. In many markets, BNPL has grown in a regulatory environment that's a lot lighter than what credit card companies get. This flexibility has set the stage for rapid innovation and adoption – though more regulation is likely coming.

Technological advances in risk and credit scoring. What used to take days now happens in seconds. BNPL companies use real-time data and AI to assess customers instantly, while managing their risk. This speed and efficiency fuels scale.

Who’s winning the BNPL race?

Any fast-growing, high-potential industry draws competition – and BNPL is no different. Klarna may be a heavyweight, but it's not alone in the ring. Heavy hitters like Affirm, Afterpay, and PayPal are scrambling for dominance, each bringing a particular strength to the contest.

Here are some of the things that could give these competitors an edge.

Retail reach. The more merchants a provider partners with, the more consumers it can acquire. Being everywhere is a massive advantage.

User experience. Shoppers want instant approvals, easy payments, and zero hassle. Whoever makes things the easiest, wins.

Risk management. Instant loans sound great – until borrowers fail to pay. The best BNPL players master credit underwriting to keep default rates low.

Product expansion. The industry isn’t just payments – it’s banking, shopping, ads, loyalty. Broad ecosystems attract stickier users.

Cost of capital. BNPL is essentially short-term lending. Providers with lower funding costs – like Klarna with its European banking license – can price more aggressively or hang on to its margin.

Next, here are some of Klarna’s more serious competitors.

US-based Affirm Holdings Inc Ordinary Shares - Class A (NASDAQ:AFRM) – which is valued at around $16 billion – is Klarna’s most direct competitor. It went public in 2021 and has gained major traction through big-name partnerships with Amazon and Shopify. Like Klarna, it runs a merchant-funded model where retailers pay to offer installment payments at checkout. Klarna and Affirm posted similar revenue figures last year, but Klarna wins in scale, processing nearly three times the BNPL volume. Klarna also has an edge when it comes to funding: its European banking license gives it access to low-cost deposits, while Affirm has to rely on third-party bank partnerships and loan securitizations. That difference gives Klarna more flexibility on pricing and margins.

The Australian-born Afterpay was acquired by Block Inc Class A (NYSE:XYZ) (formerly Square) in 2022 for a staggering $29 billion. Afterpay built its early success on the trusty “pay-in-4” model and gained strong traction in Australia, the UK, and the US. After the acquisition, Afterpay became integrated into Block’s Square merchant tools and its Cash App. That’s a major plus, giving it access to millions of small businesses and consumers. While Afterpay’s reach within Block’s network is powerful, Klarna has some key advantages. For a start, it’s far more global, with a bigger merchant base and greater consumer visibility across markets. It also offers a wider range of features beyond basic BNPL, while Afterpay has historically stuck with the single offering, leaning heavily on late fees for revenue. And, finally, Klarna’s lower cost of capital and broader scope allow it to adapt more easily: Afterpay’s strategic direction is firmly tied to Block’s priorities.

PayPal Holdings Inc (NASDAQ:PYPL) jumped into BNPL in 2020 and grew quickly – processing over $33 billion in yearly BNPL volume by 2024. Its ubiquity worked in its favor – millions of merchants already were using PayPal, so adding BNPL required no new integration. And for casual users already comfortable with PayPal, switching to BNPL was seamless. But BNPL isn’t PayPal’s main focus. It’s just one feature of many in a sprawling, utilitarian payments platform. Klarna, by contrast, is built around BNPL shopping experience – with its price alerts, loyalty programs, and curated deals. For Klarna, the challenge is to stay differentiated in terms of experience and value-added tools, especially as PayPal’s scale and trust factor make it a formidable rival.

What do we know about Klarna’s balance sheet?

Klarna’s IPO paperwork gives us a detailed look at how the business has fared over the past three years. But before jumping into the numbers, it’s worth stepping back to understand what actually matters when evaluating a company like Klarna. BNPL isn’t your typical business – it sits somewhere between fintech, lending, and e-commerce – so a few key metrics will be more important than the rest.

Here are the standouts.

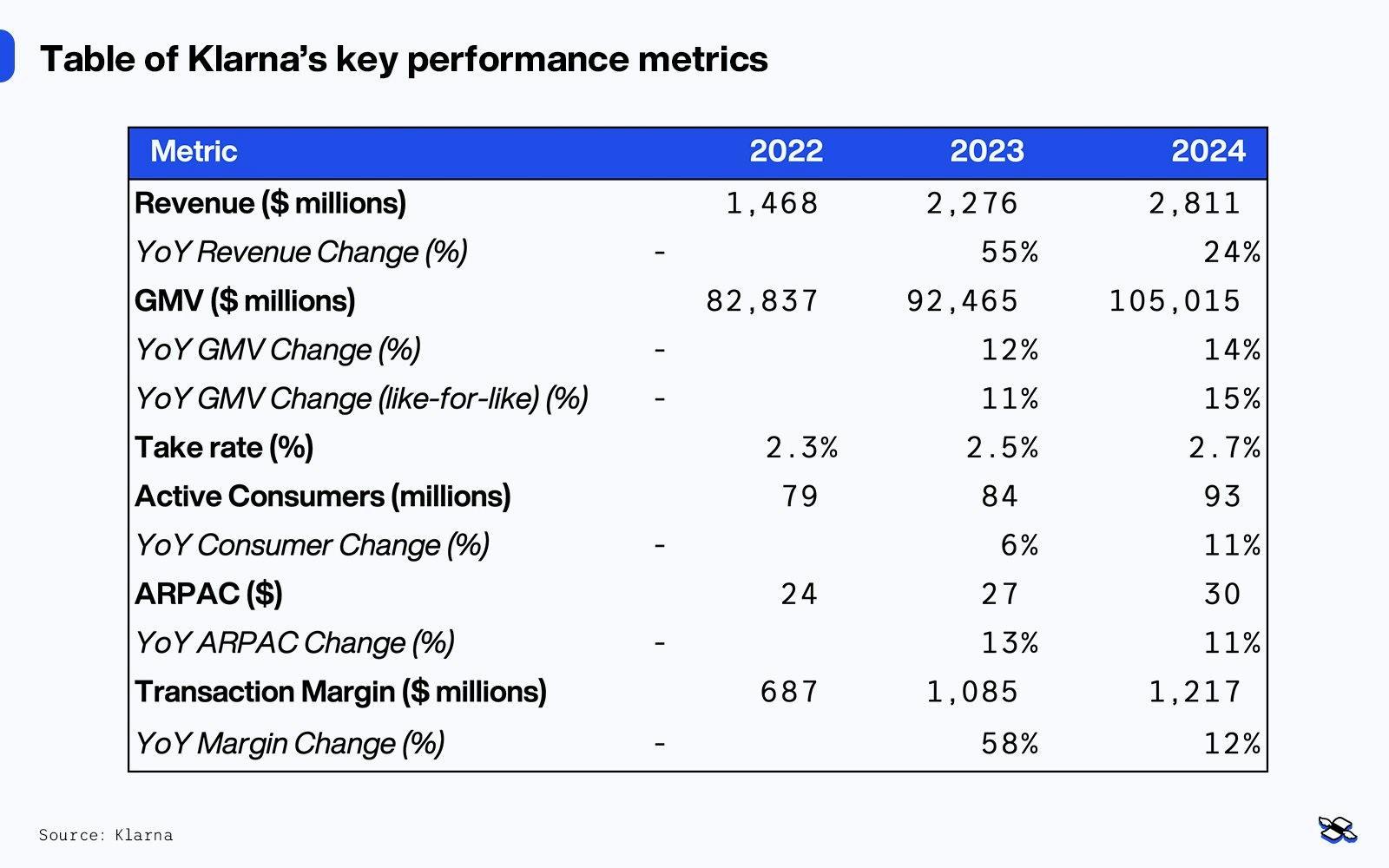

Gross merchandise volume (GMV). This is the total dollar value of all purchases made through Klarna. It’s a great way to gauge scale: if GMV is growing, it usually means more people are using Klarna and more merchants are coming on board.

Take rate. It tells us how much Klarna earns in revenue for every dollar of GMV processed. It’s a simple, but powerful measure of how efficiently the company makes money. A higher take rate means Klarna is extracting more value from each transaction – whether through merchant fees, consumer services, or ads.

Transaction margin. This is what Klarna earns after covering direct costs like payment processing and credit losses. It’s a way to see if each transaction is profitable before overhead – and a key measure of whether the model can work at scale.

Active consumers. Klarna tracks how many users made at least one transaction during the year. This helps gauge how broad the company’s reach is and how sticky the product might be over time.

Average revenue per active consumer (ARPAC). This tells us how much revenue Klarna makes from each user. If it’s rising, it means users are either spending more, using Klarna more often, or engaging with extra services like Klarna Card or Klarna Plus.

Credit loss rate. Because Klarna is effectively lending money every time someone uses BNPL, it’s important to know how much it loses to defaults. A lower rate shows better credit risk management – a make-or-break factor in lending.

Cost of capital and the funding mix. Klarna has to front the money for each BNPL purchase, and how it funds those loans really matters. With its European banking license, Klarna can use customer deposits to cover loans (as banks do), which is cheaper than borrowing from investors. And that gives it more room to compete on pricing.

OK, next, let’s look at how Klarna stacks up across each metric – and see what that tells us about the company’s momentum and potential.

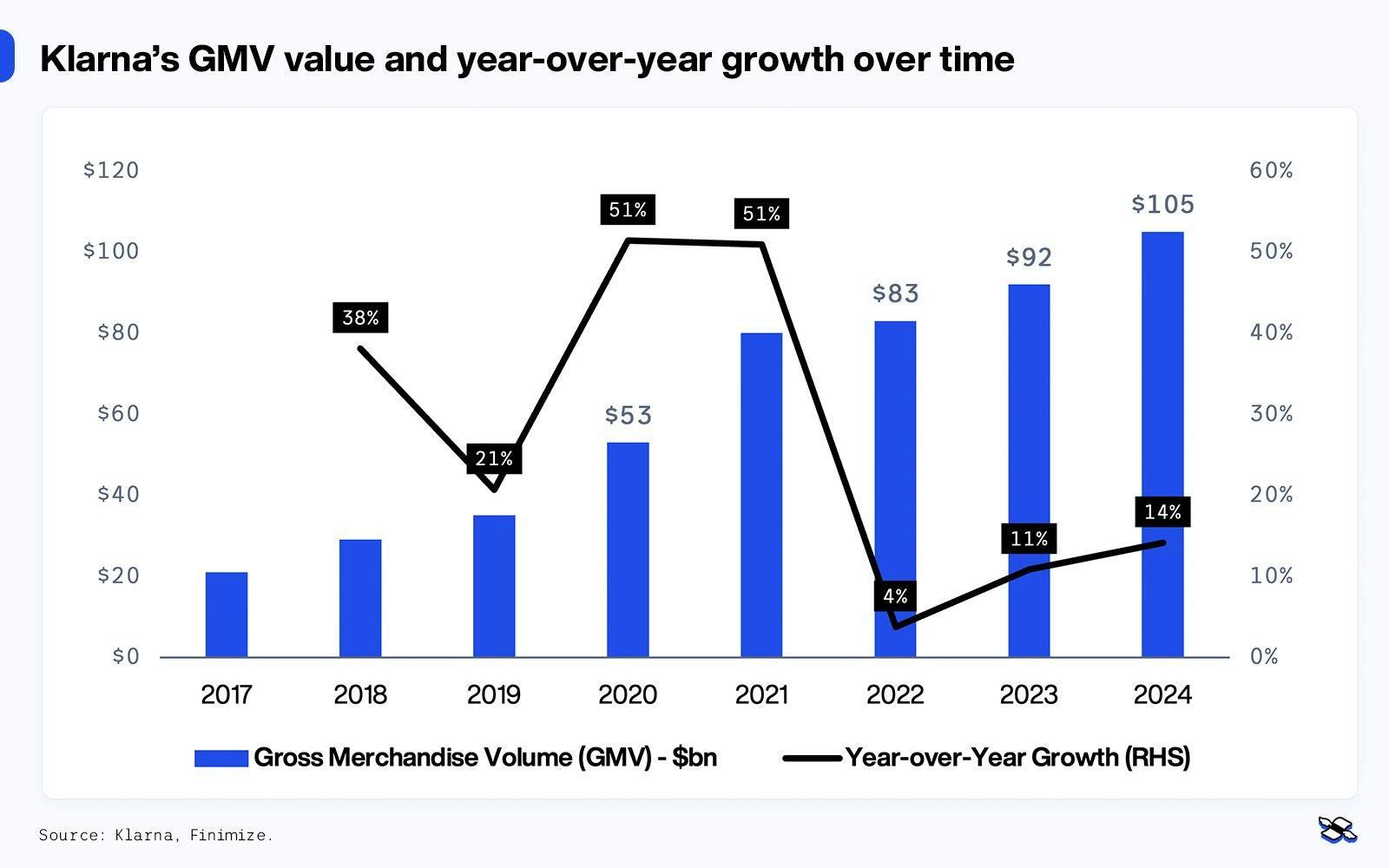

Klarna’s GMV value and year-over-year growth over time. Source: Klarna, Finimize.

Klarna has quintupled its GMV, from $21 billion in 2017 to $105 billion in 2024 – with that fivefold increase driven by a speedy global expansion and the rise of BNPL. Growth accelerated especially sharply in 2020 and 2021 as Klarna entered new markets and benefited from the pandemic-fueled e-commerce boom.

Growth slowed way down in 2022, rising just 4% as inflation and interest rates jumped higher and credit conditions tightened, causing consumers to pull back on their spending. But momentum picked up again in 2023 and 2024, with GMV growing 16% and 9%, respectively – more modest, sure, but from a much bigger base.

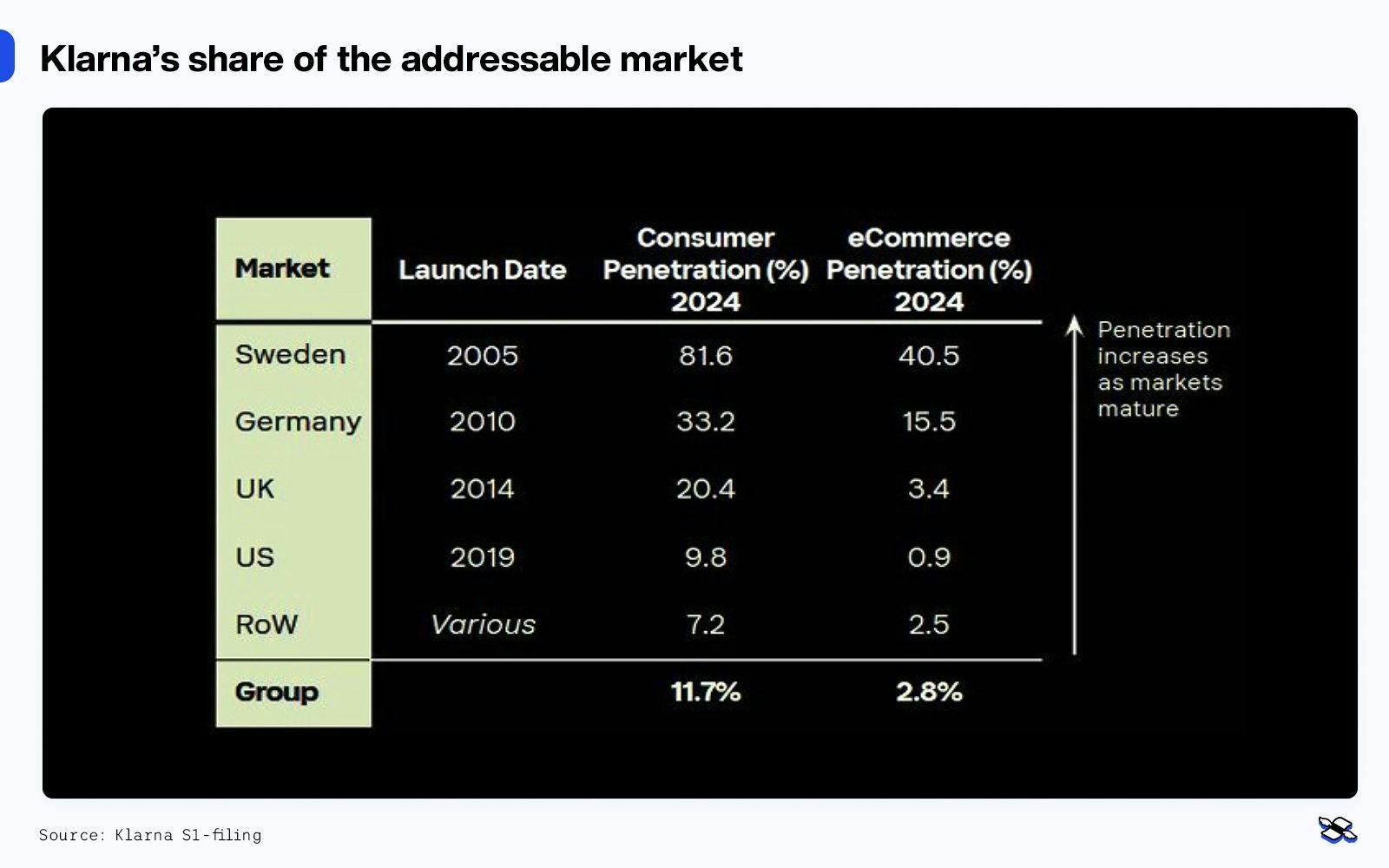

Klarna’s share of the addressable market and eCommerce penetration as a percentage of retail spending in 2024, in Sweden, Germany, the UK, the US, and the rest of the world. Source: Klarna S1-filing.

Importantly, Klarna is still the new kid on the block in key markets, and that means there’s loads of room for growth. The US is a great example: Klarna launched in the States in 2019 and consumer penetration there is just 9.8%, compared to 20% in the UK or 33% in Germany. That leaves lots of headroom – though competition in America is tougher, with Affirm and PayPal vying for share.

So Klarna’s grown up in the European market, but its future growth is all about expanding internationally – especially in the US. Now, America’s not the easiest market to break into. Unlike in Europe, where BNPL is a core payment method, in the US, firms typically offer it as a free add-on. So Klarna might have to sacrifice margin to stay competitive, particularly if it hopes to go all-in on volume or merchant partnerships.

If Klarna can replicate even part of its European success in the US, that would be huge. But let’s be realistic: the path might not be easy (or lucrative) for a good, long while.

Table of Klarna’s key performance metrics. Source: Klarna.

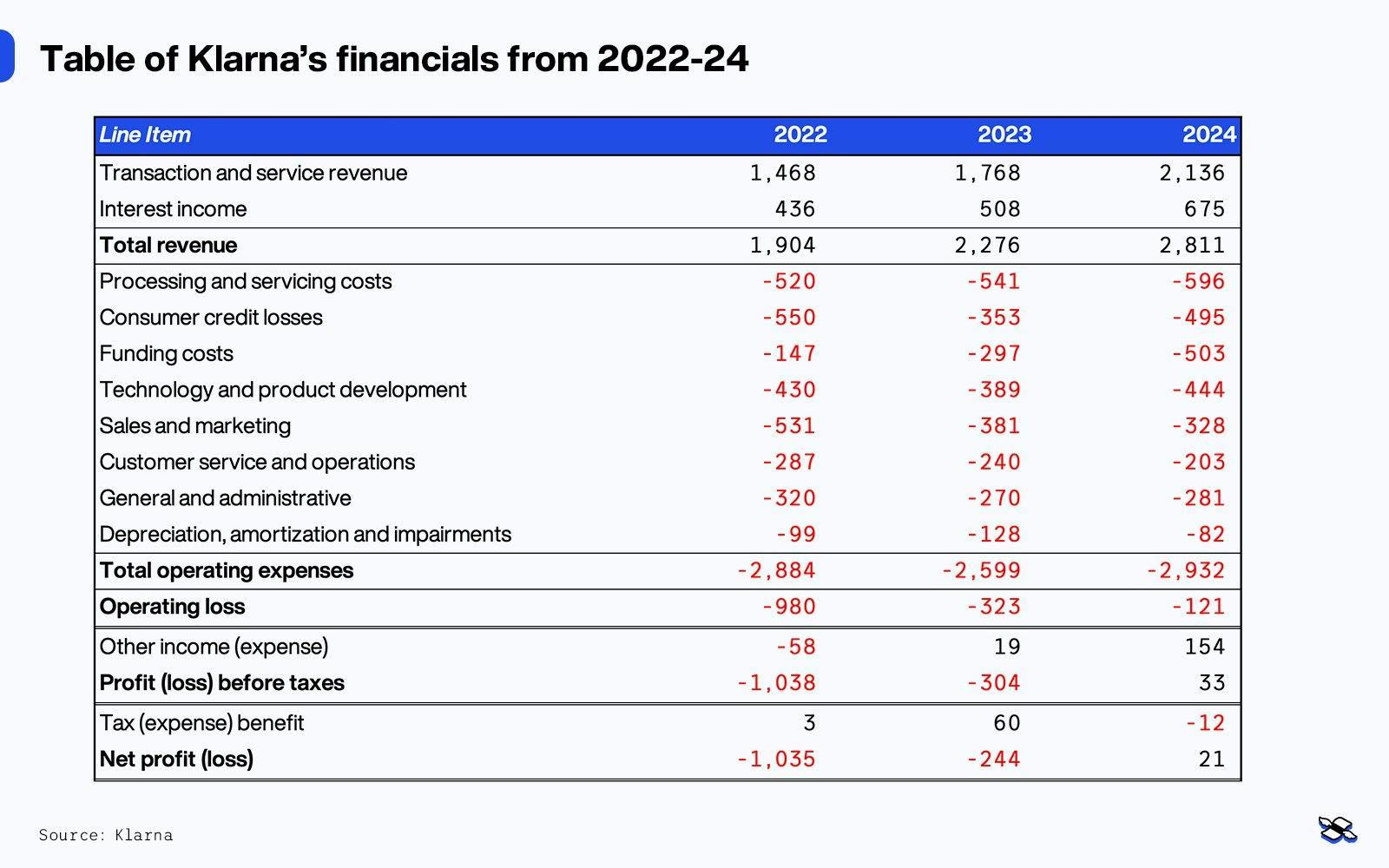

Table of Klarna’s financials from 2022-24. Source: Klarna.

The company’s financials have improved by leaps and bounds over the past few years. Back in 2022, the firm was bleeding money, posting a hefty $980 million operating loss. Two years later, its shortfall had narrowed to $121 million. Even more impressively, Klarna turned a net profit of $21 million – though, to be fair, that was driven mostly by a one-time gain of $171 million from selling Klarna Checkout. Sure, profitability might not be in the bag yet (so to speak), but Klarna is at least moving things in the right direction. You can see the financials in the link here. And if you make a copy of the template, you can make changes to reflect your own forward estimates.

What gives me confidence is the company’s operational leverage – in that, it suggests an ability to scale. Unlike costs for product development and customer service (where expenses don’t necessarily rise in lockstep with growth) revenues can expand much more quickly. If Klarna keeps a tight grip on spending, while growing its top line, its margins should naturally improve over time.

And there are some clear signs that Klarna has become better at making money. Klarna’s take rate increased to 2.7% in 2024, from 2.3% in 2022, so it’s earning more per dollar of transaction volume. Its transaction margin, meanwhile, after accounting for credit and processing costs, has also improved: rising to 43.3%, from 36.1% over the same period. That reflects better pricing, smarter risk management, and the growing contribution of higher-margin services.

What’s more, Klarna is also building its revenue faster than its transaction volume (GMV) – up 24% in 2024, compared to 14% GMV growth. To me, that says Klarna is finding new ways to generate income – for example, through advertising, late fees, and merchant tools. And in the short term, that’s great for the firm, but over the long haul, it might not be. If it leans too heavily on add-on fees, the company could face regulatory scrutiny or risk alienating cost-sensitive merchants and consumers – especially in super competitive markets like the US.

Klarna’s business model is working-capital-intensive: it pays retailers upfront, then waits six to eight weeks to collect from consumers. In its early days, this created some cash flow headaches, especially during the busy holiday shopping season.

But, look at it this way: the short-term nature of BNPL actually gives Klarna an advantage over traditional credit providers, because higher capital velocity means higher asset turnover – and therefore, higher return on capital. Look, the average loan cycle is just 40 days (give or take). That means the company can recycle its money nine times a year (365 days / 40 days = 9.125).

Now, let’s do some quick math: if Klarna earns a 2.7% take rate and maintains a 45% transaction margin, each $100 it lends would generate $100 x 2.7% x 45% margin x 9 loans per year = $11. Not bad.

What is Klarna actually worth though?

Valuing Klarna isn’t easy at this stage. The company is just starting to turn a profit, and while its financials have improved a lot, trying to predict future cash flows with any confidence is, well, tricky. After all, Klarna’s operating margins are still inconsistent and its net profit last year was mostly thanks to a one-time boost from the sale of Klarna Checkout. Without more visibility into its long-term cash margins, its own spending demands (or “capital intensity”), and its credit loss behavior over a full business cycle, a discounted cash flow (DCF) model could turn out some seriously speculative figures.

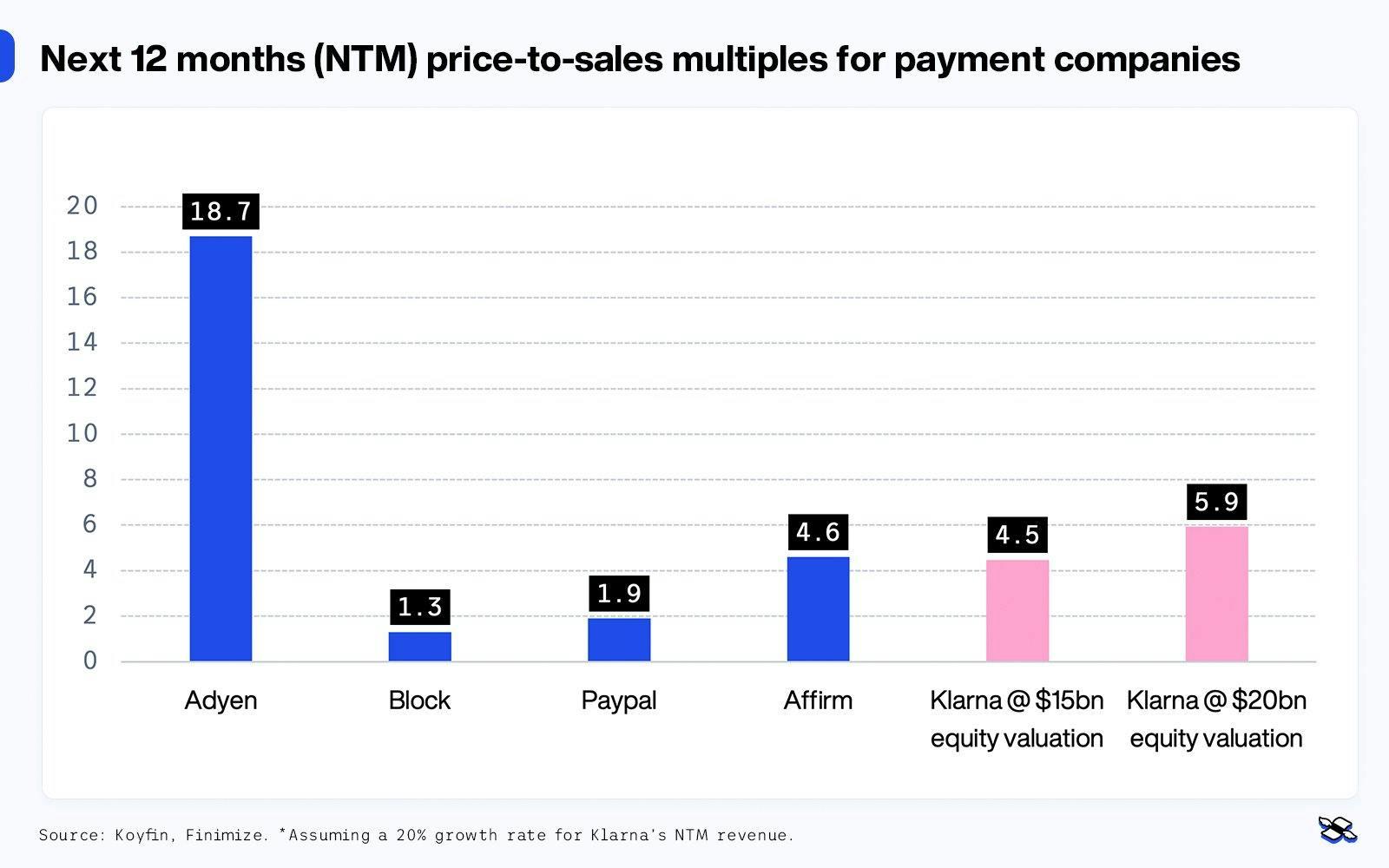

For now, then, a price-to-sales (P/S) framework is likely the best way to gauge Klarna’s value. It’s a metric that’s commonly used for high-growth fintech and software startups that haven’t yet generated stable free cash flow. And it should tell us a bit about Klarna’s scale and monetization potential. What’s more, it will let us compare this firm against its peers – including Affirm, PayPal (BNPL segment), and Block (Afterpay). Here’s how these companies stack up

Next 12 months (NTM) price-to-sales multiples for payment companies. Source: Koyfin, Finimize. *Assuming a 20% growth rate for Klarna’s NTM) revenue.

I’ve included Adyen NV (EURONEXT:ADYEN) in this comparison because it represents the high end of the fintech payments spectrum – a premium, profitable company with global reach and strong margins. While its business model differs from Klarna’s, both operate at the intersection of payments and technology, and Adyen’s valuation multiple provides a useful benchmark for what the market is willing to pay for a scalable, tech-driven payments platform with strong merchant relationships. You can think of the firm as Klarna’s aspirational peer.

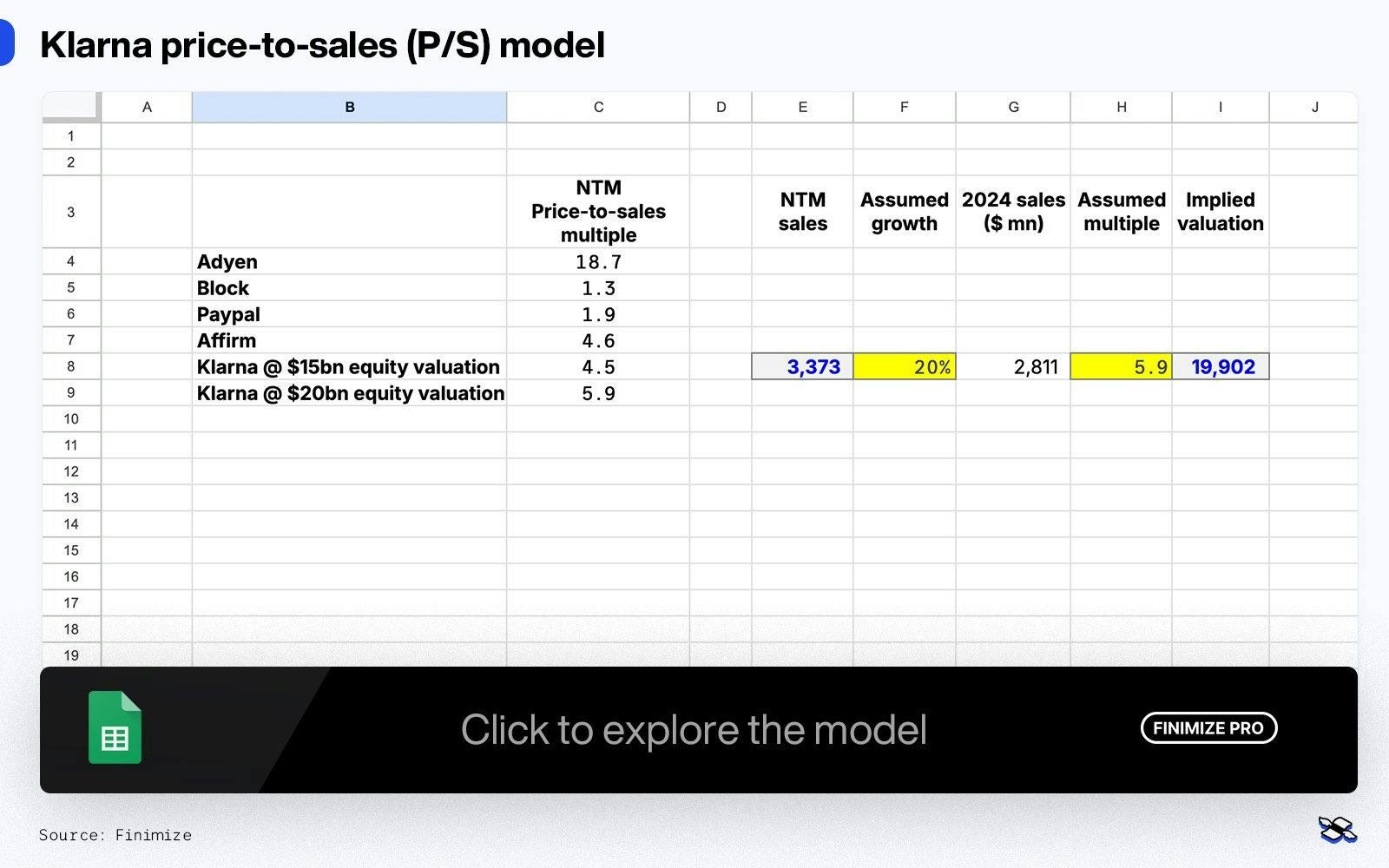

Whenever you consider a stock, keep in mind things could go really well, precisely as expected, or really badly. So, that being said, let’s check out the bull, base, and bear case valuation ranges based on Klarna’s 2024 revenue of $2.8 billion, assuming 20% growth over the next 12 months. Each scenario applies a different P/S multiple, reflecting varying levels of optimism around Klarna’s future growth, profitability, and competitive position. You can download the model in the link here. You can also make a copy of the template and see how things play out when you put in your own assumptions.

The price-to-sales model. Note that you can adjust the figures to reflect your own forecasts, but you’ll need to make a copy of the template before you can actually fiddle around with the cells.

Bull case: Valuation between $24 billion and $27 billion (P/S multiple of 7x to 8x)

In the bull case (or best-case scenario), Klarna would successfully leap from being just a BNPL provider to a full-fledged consumer commerce platform. The core payments business would continue to scale, especially in America, while transaction margins expand through tighter underwriting, lower credit losses, and cheaper funding via Klarna’s banking license. But what would really drive the upside here is Klarna’s ability to monetize the massive amount of transaction-level data it collects.

Think about it: every year, Klarna processes billions of SKUs across hundreds of thousands of retailers. Over time, this data could help it refine its risk models, sure, but it could also help it build personalized marketing, loyalty programs, and conversion tools for merchants. Klarna could essentially shift from being a cost center at checkout to a full shopping ecosystem, driving repeat engagement, and boosting B2B services like advertising, sponsored listings, and analytics that become meaningful revenue streams. And, essentially, that is the plan.

If Klarna pulls it off, it will start to look like a category leader with a defensible brand and a multiproduct platform – like other top fintech names. And it could then justify a higher P/S multiple (of say 7x or 8x) based on its growth, margins, and platform optionality.

Base case: Valuation between $15 billion and $20 billion valuation (P/S multiple of 5x to 6x)

In the base case, Klarna would stay on its current trajectory. It would continue to grow steadily, both in GMV and revenue, and edge closer to consistent profitability. Transaction margins would improve, ARPAC would tick up, and the business would become more efficient with scale. Klarna would make further market share gains in the US, but its growth would (understandably) be tempered by stiff competition from embedded providers like Apple and PayPal. These players would make it harder for Klarna to raise fees or differentiate purely on payments.

Merchant-side monetization – through ads, sponsored listings, or loyalty tools – would grow, but not at the pace or scale seen in the bull case. Klarna would remain a well-regarded player in BNPL and adjacent services, but it wouldn’t fully break out into a category-defining platform. There’d still be some strong upside, particularly if Klarna can maintain its margin improvements and deepen consumer relationships, but it’d face enough challenges to warrant a more modest valuation.

At 5x to 6x sales, this scenario would support a valuation in the range of $15 billion to $20 billion – not bad for a well-run, maturing fintech with good fundamentals but limited optionality.

Bear Case: valuation between $10 billion and $13 billion valuation (P/S multiple of 3x to 4x)

In the gloomier, bear-case scenario, Klarna would face a combination of external pressure and internal challenges that would limit its ability to scale profitably. Growth would slow – particularly in newer markets like the US, where competition is fierce and incumbents are offering BNPL as a free, bundled feature within wider ecosystems. Klarna would struggle to defend its take rate and could be forced to lower fees to retain merchants.

At the same time, regulatory pressure would increase – especially around consumer fees, transparency, and lending practices. Klarna might have to pull back on some monetization tools like late fees or marketing charges, which would hit its short-term revenue growth. Meanwhile, efforts to grow its shopping app and advertising products would stall, leaving Klarna increasingly dependent on a commoditized core product.

With margins under pressure and optionality looking shaky, investors would assign Klarna a more conservative multiple – in the range of 3x to 4x sales – leading to a valuation of $10 billion to $13 billion. The company would remain relevant, but no longer would command a growth premium.

What could change Klarna’s story?

As excited as I am about Klarna’s potential, there are a few real risks you and I need to keep in mind before getting too carried away.

First, interest rates matter (a lot). Klarna might not be a traditional bank, but it's still affected by the broader macro environment. When central banks started raising rates in 2022, Klarna’s valuation collapsed – from $46 billion to less than $7 billion almost overnight. Even though most of its revenue now comes from merchant fees (which gives it some insulation against interest rate changes), investor appetite for fintech stocks tends to dry up fast in tougher markets. If rates stay higher for longer, Klarna’s funding costs could increase, or growth could slow.

Second, credit risk is always in the background. At the end of the day, Klarna isn’t just a payments company – it’s a lender. And lending means taking on credit risk. Don’t get me wrong: Klarna has done a great job of reducing loan losses (down to 0.38% in 2023). But the very next year, those losses started ticking up again, especially in the US, where consumers tend to carry more debt and behave differently with repayments. As Klarna expands into riskier markets, it’ll need to balance growth with financial discipline.

Finally, the valuation swings have been wild. Klarna’s valuation has been all over the place over the past few years, and I wouldn’t be surprised if that volatility continues after the IPO. If you’re thinking about investing, just know that this stock may not be for the faint of heart.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.