The key to picking US stocks revealed

25th July 2016 11:27

by Lindsay Vincent from interactive investor

Money, if you have enough of it, can take you out of one world and into another. US investors, probably the world's savviest, have long sought to hasten this passage by focusing on growth shares - those in companies that pay scant regard to dividends and instead reinvest retained earnings, aiming to multiply every last dollar.

For many years, income stocks were for wimps. But change is constant, and today US investors have stepped back from this macho, John Wayne approach and turned to the stockmarket's equivalent of granola. Income is now thought to be good for you.

Latest research shows that since 2009, US companies have increased dividend payments by a remarkable 98%. Dividends paid out by UK companies over the same period grew by only 44%, below the global average of 59%.

Chase income and growth

In part, the UK figures reflect dividend cuts by blue-chip miners such as and , and other maimed enterprises, including , and .

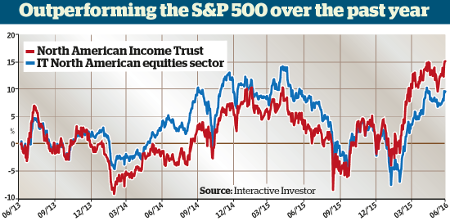

In contrast, North American returns have been influenced by "dividend-cutters reinstating their dividend payouts that were cut after 2009", says Fran Radano, US-based manager of , part of the group.

"Average US companies do raise dividends with earnings growth," he says, but many growth companies were reinvesting income to chase down every last growth opportunity.

"But there's no reason why you can't do both." That's a policy now appreciated by erstwhile cash hoarders such as and Cisco.

However, Radano also points out that US tax policies are "skewed in favour of capital gains rather than income", and that encourages the use of cash for share buybacks with the aim of boosting the share price, rather than for dividend payouts.

Radano prefers firms that reward executives based on cash not earningsBut buybacks also reward executives whose remuneration packages are "compensated with regard to earnings per share". He adds: "Sometimes the stock can be quite expensive [when it's bought back]. This is not such good use of capital."

Aberdeen, a textbook fund manager seeking out companies with strong balance sheets, a leading role in their field of endeavour and management with a long record of treating shareholders properly, devotes "a lot of time to corporate governance".

The focus is on remuneration packages that are linked to return on capital, not earnings per share. "This can't be manipulated," says Radano. "Earnings are an option. Cash is a fact and we look at cash."

So too do US investors. The dividend yield on the S&P 500 index is around 2.1%, or some 40% below its long-term average. This means investors are laying out around $47 of risk capital for every $1 of income.

Now that the latest US employment figures have dented hopes of an early rise in interest rates, investors cannot yet look forward to a more equitable return on their money.

Low dividend yield

North American Income Trust, a £270 million affair now in its fourth year, was hitherto a tracker fund. The maiden dividend was 27p, followed by 30p and 33p. These higher payments were after the trust increased its reserves each year.

This is rainy-day money which could be drawn on if, for instance, sterling's appreciation against the US dollar justified such a move. Roughly half a year's dividend payments are in the reserves 'till'.

The trust is currently at a discount of some 11% to asset value, and its share price is similarly 11% above what it was last summer. Its dividend yield, however, is some distance from what many would regard as right and proper for an income fund: it is just 0.7%.

As in the UK, sustained share buyback programmes have raised suspicions that US companies are under-investing and undermining future growth prospects.

"But we don't think they are," says Radano. Total expenditure figures, he points out, are influenced by spending restraint on the part of energy companies and other commodity producers.

"Those companies that are spending are allocating capital much more carefully, and marginal projects don't now get pushed through as they used to.

"And a lot of this spending is investment in technology and supply chain efficiencies," he says. That is expenditure aimed at enhancing profit margins.

Wage pressures build

Radano does have other concerns, however. "The underlying US economy is fairly strong and profit margins are high. But we are starting to see wage pressure for the first time in 10 years, with many headline companies raising wages - such as and (a healthcare company).

"Good companies will offset higher wage bills by raising their prices, but those without pricing power will see their margins contract," he says.

The other, pending, influence on corporate profitability is US interest rates, right now the fixation of global financial markets. "The US Federal Reserve clearly wants to raise rates even if the facts don't justify an increase," he says.

Targets are firms with above-average prospects and a good dividend growth recordBut his view is that to do so now would be classic central bank policy, even if this could lead to a strengthening of the dollar on currency markets at a time when global economic activity is flat. "What we need is a more positive global recovery."

Radano's target is companies with above-average prospects and a record of raising dividends each year. His portfolio is concentrated on around 40 stocks, the top 10 of which account for some one-third of the total value.

Turnover is in "the 25% range", he says; many stocks are held for much longer. "We aim to be the owners of our companies - not renters."

For an income fund manager, Radano has an usual take on bond holdings. "When we started we thought a 15% level (by value of the total fund) would be sensible.

"But as our equity values have risen, that has shrunk and we've taken it down to 5%," he says. That level has been maintained for more than a year.

Booze and baccy

Predictably, perhaps, booze and baccy feature among Radano's top 10 holdings, the largest being , a Canadian/US combine that ranks as the world's seventh-largest brewer. "We bought it on a 3% yield and now that has fallen to below 2%," he says.

This makes it a candidate for his 'sell'/'reduce' list. But, as he implies, there is not an endless list of high-yielding companies to choose from right now, and many are simply 'too expensive'.

The range of dividend yields on offer in the trust's infancy was between 3 and 4%. Nowadays, high-yield means 2.5 or 3%. The emphasis now is on firms with high rates of dividend growth.

Radano's tobacco counter is , arguably the most interesting of his main holdings. This is due to its oddly named new product under the Marlboro banner, iQOS, which is not a cigarette nor an E-cigarette.

Instead, the product heats tobacco but does not burn it, and the nicotine smoke is far less harmful than an ordinary cigarette.

Radano is clearly a tad uneasy at today's high valuations and rising wage inflationThe company has spent years developing the innovation; as Radano points out, "early opinions are favourable and this is not reflected in the company's share price".

Philip Morris has launched iQOS in Japan, but a supply shortage has meant a delay in its US launch. "The upside could be tremendous," Radano says. He points out that technology companies have historically been low-dividend payers.

But the landscape has changed, which explains why is also a top 10 holding. "The company has a lot of cash and it is returning this to shareholders."

Radano is especially keen on , a holding that could seem at variance with US defence spending cutbacks.

"Spending is up this year," he says, but Lockheed Martin was not affected by earlier spending curbs. The firm has valuable fighter jet contracts with long production lines and these will "make a lot of money for this well-managed company".

Like many, Radano is clearly a tad uneasy at today's high valuations and rising wage inflation. "If the Fed imposes an interest rate rise prematurely, it could impact [on values]."

As could exchange rates. "If the pound appreciated considerably against the dollar, that would sideswipe us. But I don't think that is likely."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.