Kepler’s investment trust XV: an all-star team

The Six Nations has ended but an analyst at Kepler takes it as his inspiration, unveiling a ‘field of dreams’ aiming to tackle volatility and yield returns.

21st March 2025 14:00

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

After the festive whirlwind of Christmas, many succumb to the January blues - cold, wet, dark days that seem to stretch endlessly. While I sympathise, I suffer from a far greater affliction - The Six Nations Slump. The symptoms? Empty weekends, irrational resentment toward non-rugby fans, and an uncontrollable urge to watch highlight reels on repeat.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Each year, the game evolves, drawing in new fans who, like me, marvel at its blend of athleticism and drama. Gone are the days when props were just human battering rams - barrel-chested brutes with no regard for elegance. Today’s props are a spectacle. They’re mulleted, mohawked, or gloriously bald, capable of flattening half a team before delivering an offload so silky it belongs in a Michelin-starred kitchen. And wingers? No longer just quick and agile, they’re lightning-fast powerhouses (google Jonah Lomu highlights, trust me). In my completely unbiased opinion, what’s not to love?

As this year’s tournament wrapped up, a thought struck me: rugby and investing have more in common than you might think. Success in both isn’t about picking the biggest, brawniest options and hoping they dominate forever. A winning rugby team, like a strong portfolio, thrives on balance - an interplay between steady accumulators and high-octane risk-takers, reliable workhorses and game-changing mavericks. You need defensive anchors to grind through market cycles, playmakers spotting opportunities before the pack, and outliers who go against the grain, changing the game entirely.

Ultimately, diversification is key - different strategies excelling at different times, providing ballast in uncertainty and growth in prosperity.

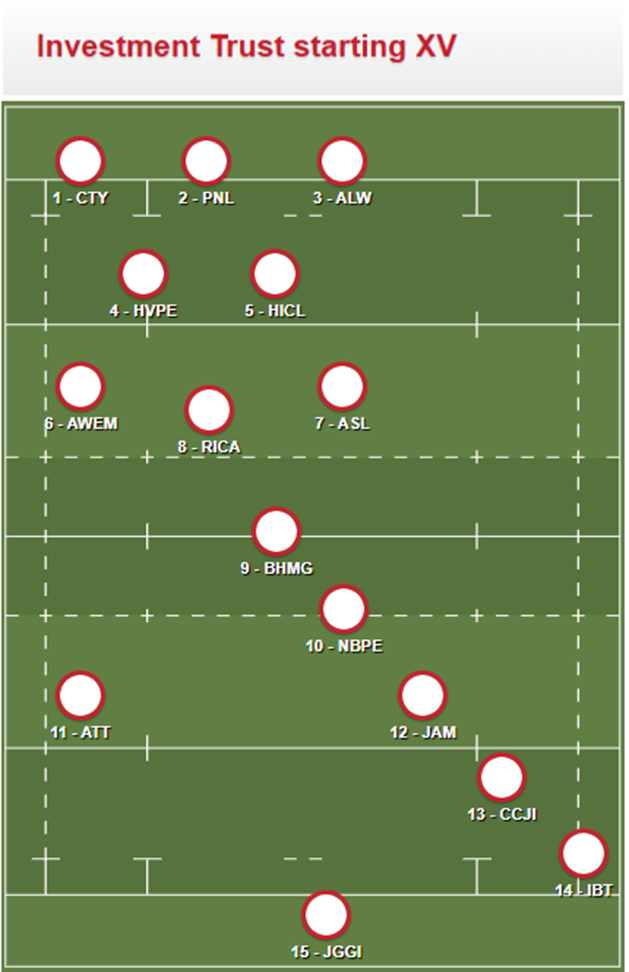

So, as the Six Nations fades into memory for another year, why not extend the excitement a little longer? Let’s assemble a 15-strong squad of investment trusts, each slotting into a position where their strengths shine. Just as a rugby team blends power, agility, and resilience, a well-constructed portfolio benefits from diversification across asset classes and strategies. I hope readers forgive me if I’ve left out any trust favourites - narrowing c. 365 to 15 is no easy feat.

With that, let’s kick off and introduce our investment trust starting XV.

Starting forwards

The front eight are the engine room - powerful, resilient and built for endurance. They absorb pressure in the scrum and lay the groundwork for success when momentum shifts. In investing, I believe they represent a portfolio’s core holdings - resilient, steady performers capable of navigating various market cycles, generating consistent income and building long-term wealth.

Loosehead and tighthead props (1 & 3)

Props do the grunt work - stabilising the scrum, absorbing hits and carrying hard when needed. They’re the foundation of any strong team, and in a portfolio they represent rock-solid, dependable trusts.

At loosehead prop (1) we have City of London Ord (LSE:CTY)- a trust as dependable as they come. The largest and lowest-cost trust in its sector, CTY boasts an unmatched 58-year record of consecutive dividend increases, a testament to its conservative, income-focussed approach. Managed by Job Curtis for over three decades, CTY’s portfolio blends higher-yielding stocks with lower-yielders that have higher growth potential, providing steady, growing income over time. Like a seasoned prop, it doesn’t grab headlines but forms the core of any well-structured team.

At tighthead prop (3) we need a strong, defensive anchor that can still make an impact across the field. Enter Alliance Witan Ord (LSE:ALW) - the result of the Alliance Trust (ATST) and Witan (WTAN) merger, creating one of the largest investment trusts on the market. With a globally diversified portfolio and multi-manager approach, ALW balances risk and reward, offering investors broad market exposure with steady long-term growth potential. Like a great tighthead, it anchors the pack while providing flexibility across different market environments.

Hooker (2)

If props anchor the scrum, the hooker is the linchpin - powerful, precise and essential in both set pieces and open play. While the art of hooking a ball in the scrum may be a relic of the past, today’s hooker needs Luke Littler-like accuracy in the lineout and the agility to shift the ball across the field.

Enter Personal Assets Ord (LSE:PNL). Lead manager Sebastian Lyon is renowned for his disciplined stock picking and conservative asset allocation. He doesn’t chase risky plays, instead favouring capital preservation above all - achieved through flexible exposure to equities, bonds, cash, and gold. But when markets turn, he’s ready to flex his multi-asset approach, reallocating into emerging opportunities: exactly the kind of steady hand and strategic reliability you want from your hooker.

Second rows (4 & 5)

Second rows, or locks, bring power, dependability, and dominance in the scrum and lineout. They may not always steal the headlines, but their impact can be game-changing. In a portfolio, these are trusts offering diversification, resilience, and uncorrelated returns from pure-equity strategies.

At 4 we have HarbourVest Global Priv Equity Ord (LSE:HVPE) - a towering presence offering exposure to a diverse range of private equity opportunities across geographies and sectors. With a portfolio of more than 1,000 underlying businesses, from high-growth start-ups to cash-generating mature companies, HVPE has outperformed global equity markets since its inception. Crucially, by avoiding overconcentration in any single area, HVPE mitigates risk and provides a robust, diversified play on private equity.

Partnering in the second row at 5 is HICL Infrastructure PLC Ord (LSE:HICL) a core exposure to equity investments in institutional-quality infrastructure assets worldwide. Its portfolio can be viewed through two key elements:

- Yielders: Predominantly through PPPs, they are lower-risk, high-cash-yielding assets with predictable cash flows that have a high degree of correlation to inflation.

- Growth: Defensive, critical infrastructure with higher return and cash flow potential but greater sensitivity to economic variables.

HICL’s ability to deliver stable, uncorrelated returns makes it an ideal diversifier—providing defensive ballast when markets get rough.

Back rows (6, 7 & 8)

This is where dynamism meets grit. World-renowned flankers are relentless, scouring the field for opportunities, disrupting the opposition and turning over possession with seemingly endless energy reserves. Meanwhile, the number 8 serves as a sort of captain of the pack - an adaptable all-rounder balancing power and versatility. In a portfolio, these roles suit active, opportunistic strategies that excel in stock selection, risk management and tactical positioning.

At blindside flanker (6) we have Ashoka WhiteOak Emerging Markets Ord (LSE:AWEM). Though small and relatively new, launching in May 2023, it has hit the ground running, bringing a fresh and differentiated option to the sector. The team thrives on adding alpha through stock selection in the under-researched world of emerging market small- and mid-caps, where inefficiencies offer fertile ground for sharp-eyed stock pickers. Like a flanker thriving in the chaos of a breakdown, AWEM hunts for alpha-rich opportunities, leveraging its on-the-ground expertise.

The openside flanker (7) relishes more freedom in open play, disrupting the opposition and quickly turning defence into attack—a perfect match for Aberforth Smaller Companies Ord (LSE:ASL). Focussed on unloved UK small-caps, ASL searches for valuation discrepancies, identifying otherwise solid firms trading at temporarily depressed valuations and holding them through to recovery. Its deep-valued, contrarian approach provides differentiated access to the UK market, mirroring a flanker’s ability to spot and seize overlooked opportunities.

At number 8, we need resilience through market cycles, with tactical awareness and the ability to adapt to shifting conditions. Ruffer Investment Company (LSE:RICA)fits this bill, offering investors portfolio protection in uncertain times. Its mandate is simple: deliver consistent positive returns regardless of market conditions, while protecting against market falls, using a flexible approach across asset classes that can perform well in multiple environments. This ranges from Japanese currency and credit derivatives to Chinese equities and gold miners - assets that thrive when traditional equity or bond markets falter. With an asymmetric return profile, RICA shifts between attack and defence as needed.

Backs

A great rugby team needs balance - raw power up front and precision in the backline. Similarly, a well-constructed portfolio blends stability with growth, combining resilient core holdings with trusts that can capitalise on emerging opportunities. As backs provide flair, quick thinking and attacking edge, using speed and vision to break through defences, we want investment trusts that thrive on adaptability, tactical positioning, and uncovering value.

Scrum-half (9)

The scrum-half dictates the tempo of play, acting as the crucial link between forwards and backs. Agile and quick-witted, they can distribute the ball at the right moments for an attack or decide it’s better kept safe in the arms of a rolling maul. The ideal 9 - think Antoine Dupont or Conor Murray - brings something unique to the table, balancing game management with the ability to seize opportunities.

Rather than opting for a nimble small-cap trust (perhaps the obvious choice), I’ve selected BH Macro GBP Ord (LSE:BHMG). As a feeder fund into Brevan Howard’s Master Fund, it represents a highly liquid access point to one of the top hedge fund managers of all time. BHMG focusses on generating asymmetric returns regardless of market conditions - not predicting future market moves, but capitalising on mispricings with a strategy built on convexity: targeting high upside while limiting downside risk. Much like a scrum-half making quick, decisive passes to the right player at the right time, BHMG stabilises play in volatile conditions, providing balance when equity markets experience turbulence.

Fly-half (10)

If the scrum-half sets the tempo, the fly-half orchestrates the attack. The best number 10s aren’t just flashy playmakers - they’re tactical leaders who can adapt to shifting conditions. While some favour the flair of Finn Russell or Marcus Smith, I prefer a general built for all conditions - strong off the boot, defensively solid, and good in attack—like Owen Farrell or Johnny Sexton, or all-time greats like Dan Carter and Jonny Wilkinson.

For this role, NB Private Equity Partners Class A Ord (LSE:NBPE)embodies the number 10 shirt. Like a fly-half, its strategy can adapt to shifting market conditions. While its NAV performance relative to quoted markets has been disappointing in recent years, I think its pure co-investment focus sets it apart. This gives the managers full control over capital deployment, making it highly selective—defensive in downturns but aggressive when opportunities arise.

- In bearish conditions, NBPE hunkers down, with future NAV growth driven by underlying portfolio company growth.

- In bullish conditions, realisation activity ramps up, driving valuation uplifts, and bringing cash back to the balance sheet.

Unlike some peers, NBPE isn’t pressured into forced sales or additional gearing, offering stability in downturns and capitalising on realisation opportunities in upturns. This tactical flexibility makes it a standout in private equity.

Wingers (11 & 14)

Wingers are the game-breakers - electric and always ready to finish off a try opportunity. In the investment world, I think this aligns with the high-growth sectors like technology and biotech, where rapid innovation and dynamic shifts create huge upside potential but also heightened risk. Like wingers hunting for space, these trusts are actively managed, opportunistic and always searching for an edge.

On the left wing (11), Allianz Technology Trust Ord (LSE:ATT)brings explosive potential through its focus on high-growth tech stocks. ATT capitalises on transformational technological shifts, from AI breakthroughs to cloud computing and cyber security, as they move from adoption to mass integration. The trust has benefitted significantly from AI trends, with holdings in NVIDIA and Microsoft, but it doesn’t just follow the crowd. Like a winger searching for gaps in the defence, manager Mike Seidenberg seeks differentiated opportunities further down the market-cap scale, identifying under-the-radar disruptors that broaden its return profile. Whether backing the latest disruptive technology or sidestepping crowded trades, ATT mirrors a winger’s instinct to pounce on an opportunity.

International Biotechnology Ord (LSE:IBT) takes the right wing (14). Specialising in biotechnology and life sciences - a sector known for its high growth potential but also regulatory and trial-related volatility - IBT invests in a diversified portfolio of drug discovery, medical innovation, and cutting-edge treatment companies. Since the co-managers took over in March 2021, IBT has outperformed its index, crucially delivering in both rising and falling markets. Its recent small-cap and early-stage focus has positioned it to capitalise on a change in sentiment. The proactive approach keeps it focussed on identifying emerging winners.

Centres (12 & 13)

Centres provide a blend of power and agility, disrupting opposition attacks while maintaining defensive solidity and absorbing pressure on the back foot. The ideal centre pairing balances contrasting but complementary styles, making them a dynamic partnership that adapts to different phases of play.

JPMorgan American Ord (LSE:JAM)takes the 12 shirt, with its blend of value and growth approaches to investing, providing balance, consistency, and the ability to shift gears when necessary. JAM takes a dual-manager approach, with one manager focussing on value and the other on growth, each contributing a concentrated set of stock ideas to the overall portfolio. The team maintain a high-quality bias, avoiding both deep-value stocks and blue-sky growth names, ensuring a measured, diversified approach. While predominantly large-cap focussed, JAM also allocates a percentage to small-caps, adding a dynamic edge to its portfolio. Its consistent outperformance over the past five years reflects its strategic agility - a key playmaker in an investment portfolio.

The outside centre (13) is tasked with shutting down opposition attacks while having the vision to spark counterattacks. CC Japan Income & Growth Ord (LSE:CCJI) fits this position well, pairing strongly with JAM. CCJI takes a balanced approach, considering both capital and income growth as key components to returns, making it less susceptible to sharp style shifts. Unlike many income-focussed strategies that sacrifice growth for yield, CCJI delivers an attractive income stream without compromising the growth potential of its underlying holdings. This discipline has underpinned its outperformance of the benchmark since inception. By balancing quality, income, and growth within Japanese equities, CCJI embodies the outside centre’s ability to dictate play both defensively and in attack.

Fullback (15)

The fullback is often the last line of defence - fielding high balls, making crucial last-ditch tackles, and launching counterattacks with a daring line break or a well-placed kick.

I think JPMorgan Global Growth & Income Ord (LSE:JGGI)embodies these traits, offering a balanced global equity income approach that blends growth opportunities with capital preservation. Like a fullback turning defence into attack, JGGI provides resilience in volatile markets while capitalising on long-term global opportunities. Its ability to deliver a reliable income stream, through its vast capital reserves, afford it greater flexibility to invest in wherever quality and value align. A steadying force in a portfolio, JGGI defends against downturns but has also driven index-beating returns over the past five years.

Conclusion

While this article is clearly a bit of fun, its underlying purpose is to remind us of the fundamentals of investing - balance, diversification, and patience. Just as a successful rugby team thrives on a mix of power, skill, and adaptability, a well-constructed portfolio benefits from diversification through a blend of defensive holdings, steady income generators, uncorrelated return drivers, and high-growth opportunities.

And, much like building a winning team, success isn’t achieved overnight. Constructing a resilient portfolio takes time, and there will inevitably be ups and downs along the way. But with the right blend of strategies, investors can position themselves for long-term success. Looking at the starting XV below, I can rest easy knowing it is well-diversified and built to weather varying market cycles over time - offering growth potential, income resilience, and capital preservation through a carefully curated mix of strategies.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.