JPMorgan Russia trust seeks mandate change as it fights for survival

29th July 2022 11:32

by Sam Benstead from interactive investor

A 95% hit to net asset value typically ends in a wind-up, but this trust has other ideas.

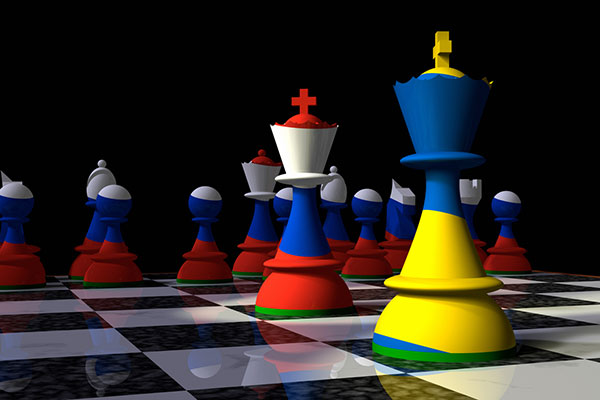

Crisis-hit investment trust JPMorgan Russian Securities is attempting to change its investment mandate to avoid being wound up.

The board of the £18 million trust has requested authorisation from the City watchdog, the Financial Conduct Authority (FCA), to amend the company’s remit and allow it to invest in emerging Europe (including Russia), the Middle East and Africa.

If it gets FCA approval, the board will propose a resolution at a general meeting of shareholders, expected in the Autumn this year.

If shareholders support the change, the new mandate will take effect as soon after the meeting as possible.

According to JPMorgan Russian Securities’ half-year results, the trust’s net asset value (NAV) fell 95.2% in the six months to 30 April 2022, to 47.1p per share. As of 26 July 2022 the NAV has fallen further, to 45.4p per share. The share price is now around 80p, almost 90% lower than a year ago.

Numis, the investment trust analyst, said: “A NAV fall of 95% would typically lead to a fund being wound-up, but we can understand why the board is seeking to keep the fund alive and amend the mandate.

- The funds and investment trusts to profit from the energy revolution

- Ian Cowie: battery trust play for shift away from Russian energy

“The fund has written down the value of the Russian positions but still technically has holdings. A change in the sanctions may at some point mean these holdings have some value again, but it is impossible to know when or if this may happen.”

The impacts of the war in Ukraine include the closure of the Moscow Exchange to overseas investors and the prohibition of dividend payments by Russian companies to western shareholders.

The trust paid its first interim dividend of 15p per share for the current financial year, which had been declared before Russia's invasion of Ukraine. No further dividends will be paid in the current circumstances.

- Russia and risk: what you need to know before trading Russia-focused stocks

- The best and worst funds since Russia invaded Ukraine

Chair Eric Sanderson said: “These restrictions have had a severe negative impact on the value of the company's portfolio because as required under the terms of the company's investment objective, almost all of the trust’s portfolio consisted of Russian equities.”

Despite the crisis, retail investors remain interested in a potential turnaround. Sanderson says: “As some institutions reduced their holdings following the invasion there was significant demand from individuals to buy shares, and consequently institutional holdings have fallen from approximately 70% to 36% as at 30 April 2022.”

Numis, the investment trust analyst, points out: “Interest from retail investors has left the shares trading at around 80p, a 75% premium to the last published NAV, which we presume reflects investors hoping for some recovery in this value in future.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.