Jeremy Grantham: ‘Prepare for an epic finale of the superbubble’

5th September 2022 11:14

by Sam Benstead from interactive investor

Markets will hit new lows when the impact of inflation and interest rate rises feed through to the economy, argues the industry veteran.

Jeremy Grantham has warned that markets have much further to fall, as bonds, stocks and housing are still overvalued and the shocks from inflation and higher interest rates are just beginning to be felt.

Grantham, the Brit who founded American investment firm GMO 35 years ago, argues in a note to investors that there will be an “epic finale” to the ongoing “superbubble” that has emerged in financial markets, even after global shares have fallen nearly 20% already this year.

- Find out about: Investing in Bonds | Free regular investing | Opening a SIPP

He said: “Previous superbubbles saw a much worse subsequent economic outlook if they combined multiple asset classes: housing and stocks, as in Japan in 1989 or globally in 2006; or if they combined an inflation surge and rate shock with a stock bubble, as in 1973 in the US and elsewhere.

“The current superbubble features the most dangerous mix of these factors in modern times: all three major asset classes – housing, stocks, and bonds – were critically historically overvalued at the end of last year. Now we are seeing an inflation surge and rate shock as in the early 1970s as well. And to make matters worse, we have a commodity and energy surge (as painfully seen in 1972 and in 2007) and these commodity shocks have always cast a long growth-suppressing shadow.”

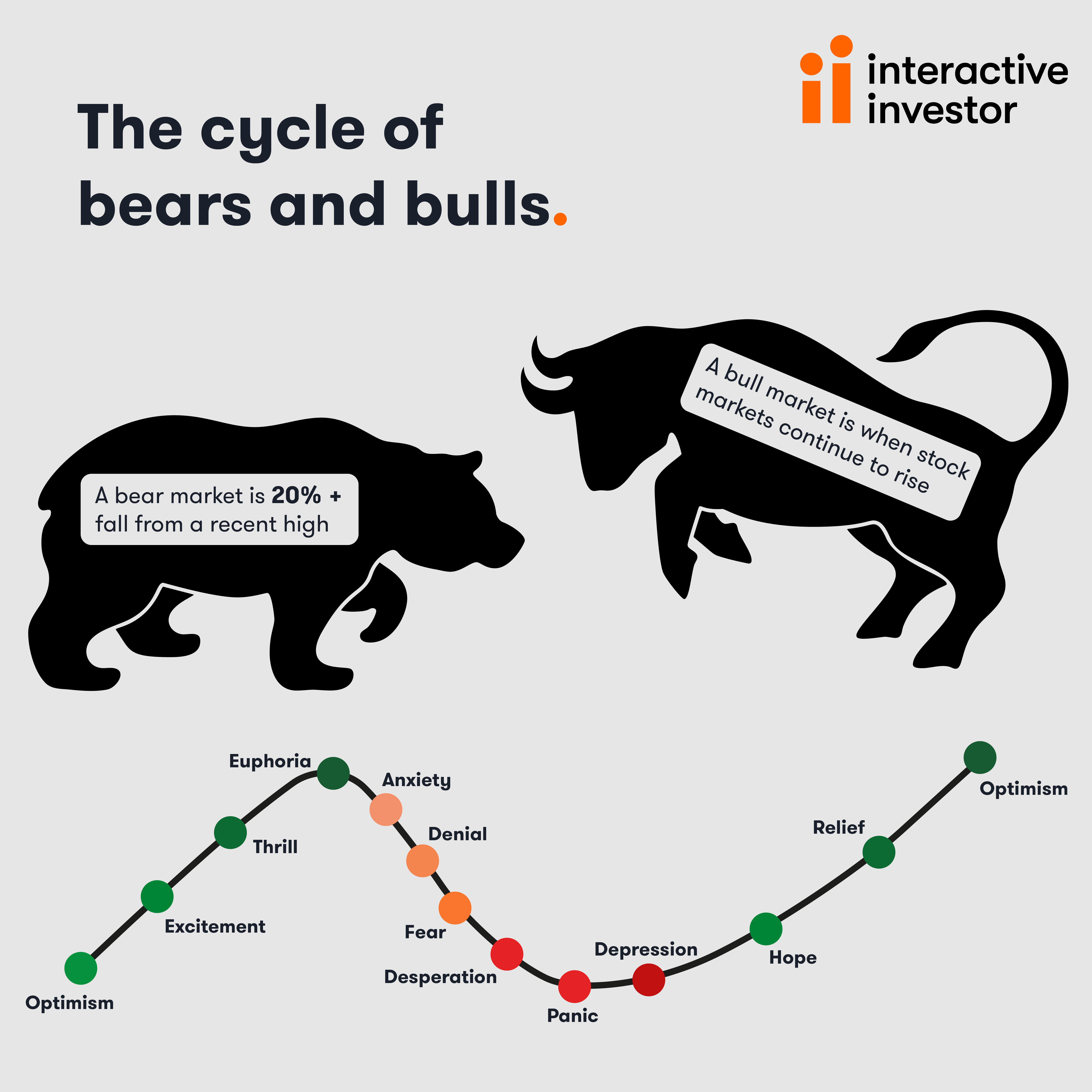

Therefore, Grantham reckons that the falls for markets have only just begun and the rally this summer, which saw global shares erase half their losses for the year, is nothing more than a “bear market rally”.

He says that a feature of a superbubble is a bear market rally after the initial de-rating stage of the decline, but before the economy has clearly begun to deteriorate. In 1929, 1972 and 1999 markets recovered half their losses, “luring unwary investors back just in time for the market to turn down again, only more viciously.”

- Commodities are falling – this is it what it means for the stock market

- Recessions are becoming more likely – here’s how to invest

- Why bonds are at a major turning point, according to veteran investors

Grantham adds that the US stock market is still very expensive given the economic backdrop. He says: “An increase in inflation like the one this year has always hurt valuation multiples, although more slowly than normal this time.

“But now the fundamentals have also started to deteriorate enormously and surprisingly: between Covid in China, war in Europe, food and energy crises, record fiscal tightening, and more, the outlook is far grimmer than could have been foreseen in January. Longer term, a broad and permanent food and resource shortage is threatening, all made worse by accelerating climate damage.”

Stages of a superbubble

Grantham says a superbubble has multiple stages. First, the bubble forms. Second, a setback occurs, as he says it did in the first half of this year, when “some wrinkle in the economic or political environment causes investors to realise that perfection will, after all, not last forever, and valuations take a half-step back.”

Then there is what we have just seen – the bear market rally. Fourth and finally, fundamentals deteriorate and the market declines to a low, he says.

He argues that because a stock has halved in value from its peak, then investors believe that it must be cheap. This fuels bear market rallies.

He said: “From the November low in 1929 to the April 1930 high, the market rallied 46% – a 55% recovery of the loss from the peak.

“In 1973, the summer rally after the initial decline recovered 59% of the S&P 500's total loss from the high.

“In 2000, the Nasdaq, which had been the main event of the tech bubble, recovered 60% of its initial losses in just 2 months.

“In 2022, at the intraday peak on August 16, the S&P had made back 58% of its losses since its June low. Thus we could say the current event, so far, is looking eerily similar to these other historic superbubbles.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.