Is it time to buy China’s stocks again?

20th January 2023 12:01

by Stéphane Renevier from Finimize

Chinese stocks went from zero to hero in the space of a few months. And while they’ve already staged an impressive recovery from their lows, here are five reasons why you might still want to consider adding them to your portfolio.

Chinese stocks have rebounded sharply from their lows. Sources: Bloomberg, Finimize.

Households have their wallets ready.

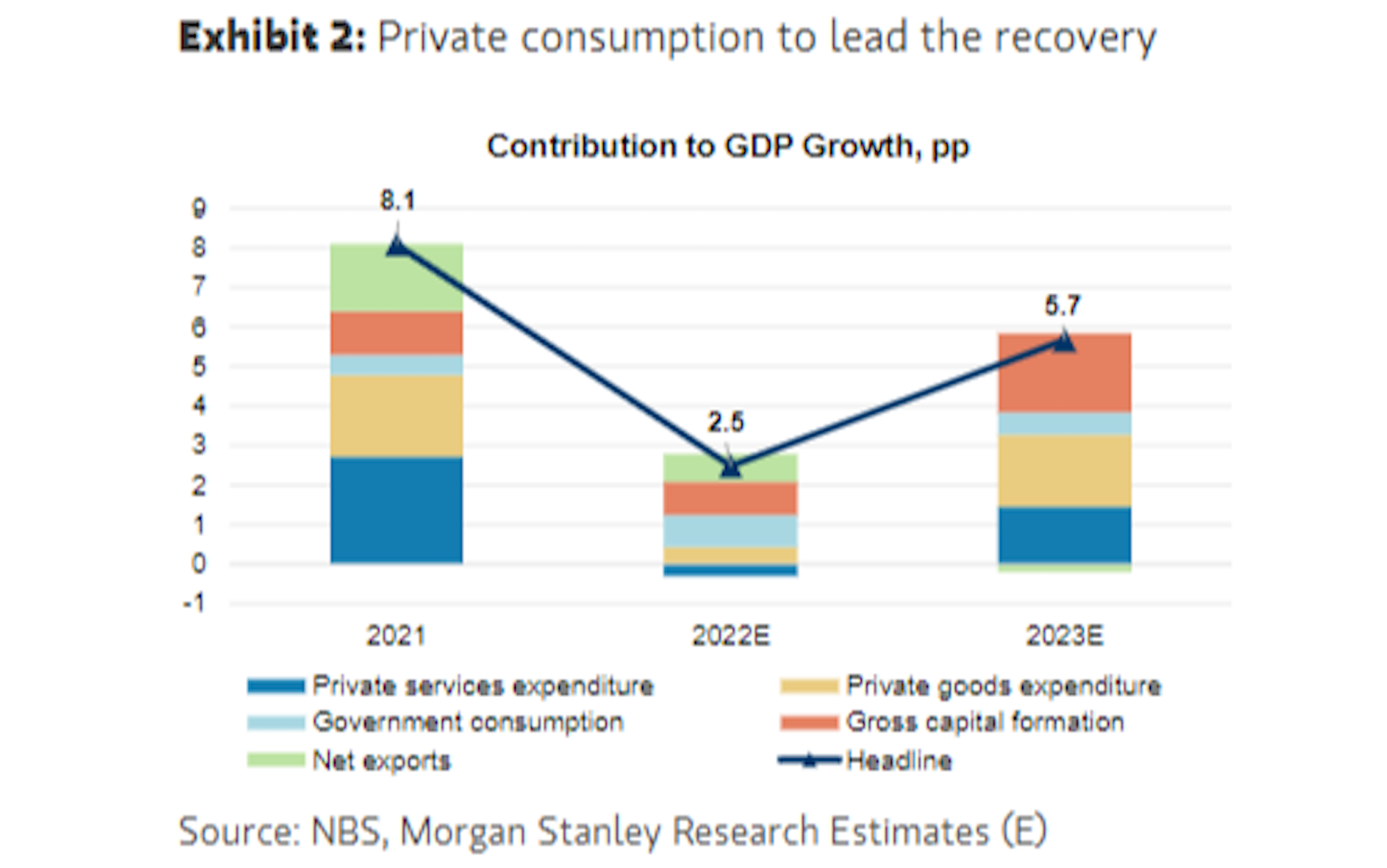

China kept strict Covid lockdowns in place for almost all of 2022 – long after the rest of the world had dropped them – and that disrupted its economy in a big way. But it’s now fully reopened. And the government’s hoping that a springy boost in household consumption (yellow and blue bars in the chart) might lead to a massive economic recovery – à la US post-lockdowns. With that spending, and a decent contribution from the government’s investments (orange bars), China wouldn’t even need to export more than imports this year to reach its target growth rate of about 5.5%.

Private consumption is likely to lead the recovery. Source: Morgan Stanley.

Now, this isn’t a certainty. Last year’s sharp fall in property prices damaged household finances and confidence, so Chinese consumers might be more cautious than Americans were back in 2021. But Chinese consumers did manage to build significant excess savings during the pandemic, and there’s a great deal of pent-up demand ready to be unleashed. What’s more, China’s reopening is less likely to be met with a surge in inflation, since most of the global economy is slowing and supply chains are running smoothly.

This bodes well for Chinese companies’ earnings, which are likely to rise by double digits next year – much faster than in almost any other region. And according to investment banks like Goldman Sachs and Morgan Stanley, a better profit outlook hasn’t yet been reflected in share prices, meaning investors might get attractive returns even if companies simply deliver the earnings the market expects.

The government’s striking a friendlier pose.

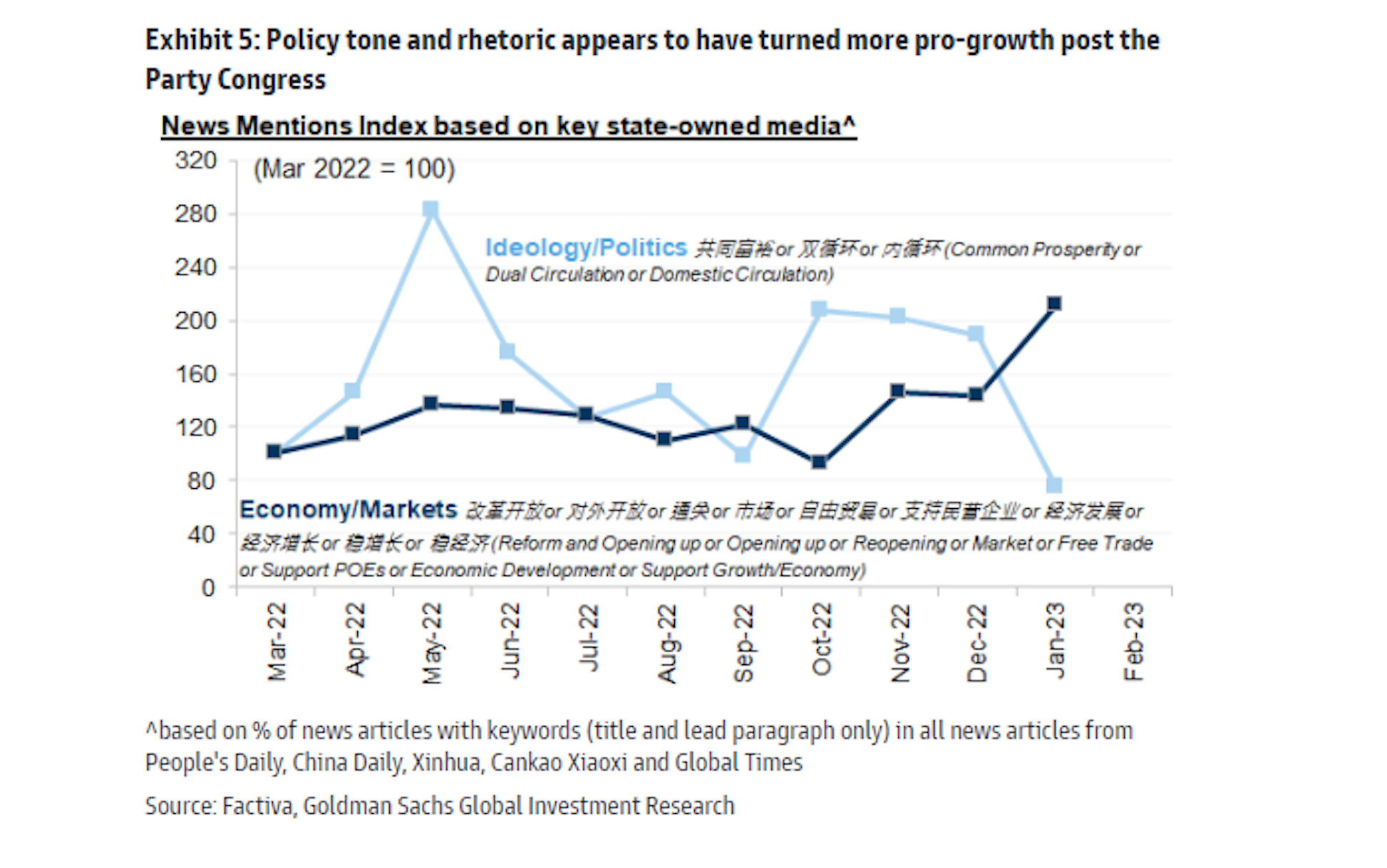

It wasn’t just those strict lockdowns that tanked Chinese shares over the past two years. Geopolitical tensions, and the government’s crackdown on the property and tech sectors also played a big part. The good news is that the government is finally shifting back to pro-growth policies, and on multiple fronts. It’s moved to support rather than strangle the property sector, it’s taken active stakes in some tech companies, and it’s done a bit to improve its tense relations with others, both at home and abroad.

Mind you, removing self-inflicted barriers isn’t the same as launching some big, aggressive stimulus package. But a market-friendlier stance does remove a key downside risk, and could gradually draw wary investors back.

Policy rhetoric is turning more pro-growth. Source: Goldman Sachs

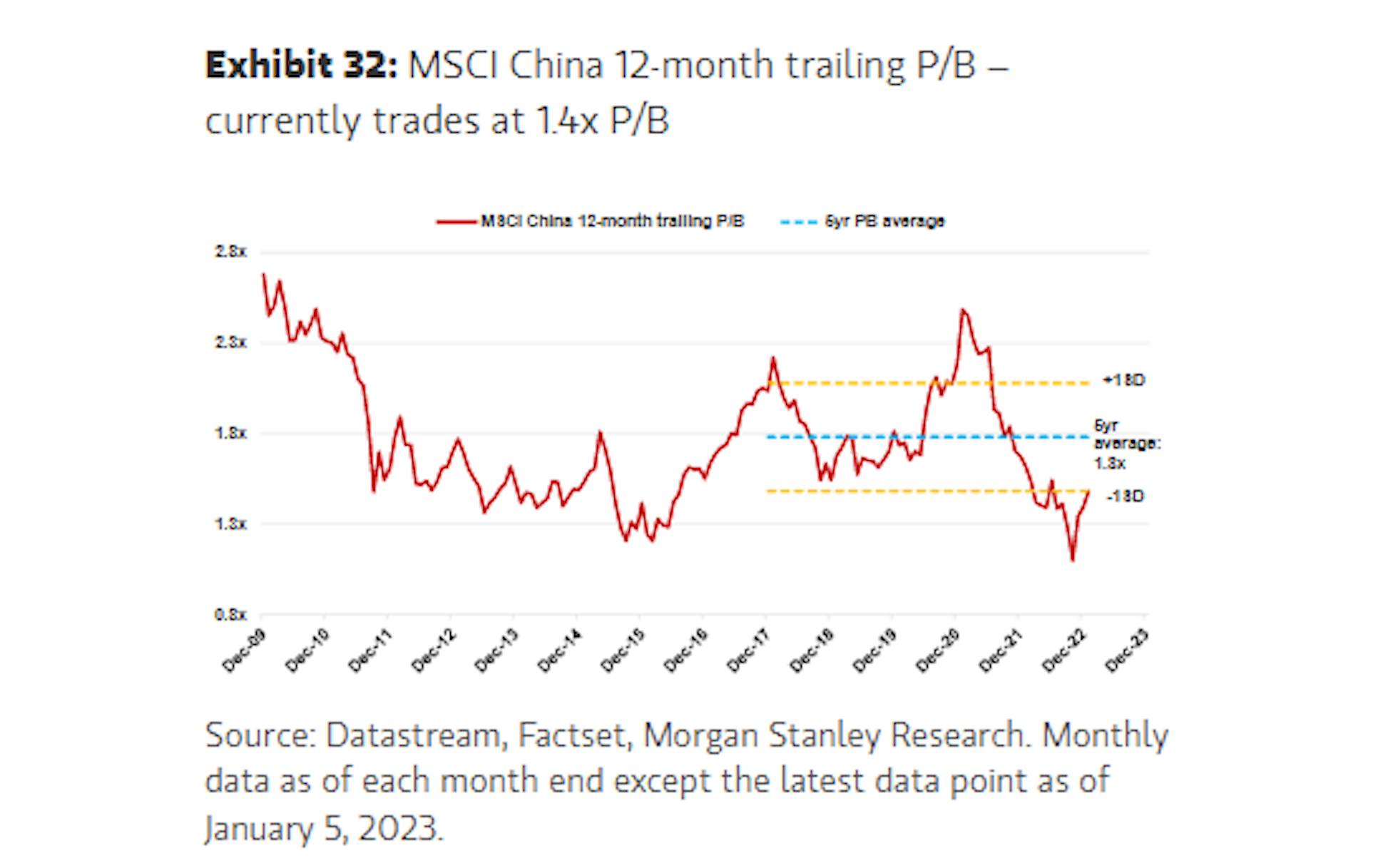

Their valuations can’t get a lot lower.

Although stock valuations have recovered from the dirt-cheap levels they saw in November, they’re still below their five- and ten-year averages – and well below their previous highs. They’re also at a discount compared to stocks from other emerging market economies. China’s policy shift back to growth, a lower potential political risk premium, and a scarcity of growth opportunities around the globe are likely to close that gap and bring Chinese stock valuations to at least average – suggesting over 10% upside from that move alone.

Valuations are attractive. Source: Morgan Stanley

Their demand might soon outmuscle supply.

Many investors “capitulated”, or threw in the towel, on Chinese stocks last year, including large institutional investors. And the rebound happened so quickly that most large, global, long-only investors – which represent a huge chunk of the market – didn’t have time to hop back on the train. They’re underinvested and are starting to feel FOMO again. When those investors look to bring their allocation back to at least neutral (from their current underweight levels), all that demand is likely to outweigh supply and send prices rising further.

They give your portfolio something different.

China is in a unique position: it’s not suffering from high inflation, its economy is rebounding, and its policymakers are working to ease conditions, rather than tighten them. China’s story is mostly a domestic one: it’s less exposed to what’s going on around the world. That’s not to say it’s immune to the effects of a global recession, but given the set of challenges faced by other regions, it does offer a differentiated source of return to your portfolio.

So what’s the opportunity here?

Like all opportunities, Chinese stocks come with risks. An escalation in global tensions, a softening of the government’s pro-growth policies, turmoil in the property market, even a weaker-than-expected recovery could all send prices much lower. And after the size of the latest rally, a correction wouldn’t come as a big surprise.

But if you're looking to diversify some of your US stock exposure, China is still an interesting option. Over the near term, the recent changes in Covid, economic, and regulatory policies make the risk-reward quite attractive – even if the entry point isn’t perfect. And over the longer term, the currently low starting point for both valuations and earnings – which, as I explained here, are the two most important drivers of returns over a ten-year period – makes a solid case for investing in Chinese stocks.

American investors can invest in China through the iShares MSCI China ETF (ticker: MCHI; expense ratio: 0.58%), while Europeans may want to use the iShares MSCI China A ETF USD Acc GBP (LSE:IASH). For a higher-octane option, consider the KraneShares CSI China Internet ETF USD (LSE:KWEB), which tilts toward tech and consumer discretionary stocks. As for individual stocks, Morgan Stanley thinks Alibaba Group Holding Ltd ADR (NYSE:BABA) has the most to gain, as it’s undervalued and should profit from both the reopening of China and the return of inflows from foreign investors.

Stéphane Renevier is a global markets analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.