Is it a good time to buy this fund sector?

The best-performing fund in this sector is up nearly 50% over the past six months.

9th November 2020 14:27

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

The best-performing fund in this sector is up nearly 50% over the past six months, which has caught the eye of Saltydog.

Last month, the Shanghai Composite went up by 0.2%, the Hong Kong Hang Seng made 2.8% and the Indian Sensex gained 4.1%. This was in a month when most developed markets were struggling. The Dow Jones Industrial Average went down by 4.6%, the FTSE 100 lost 4.9% and the German DAX fell by 9.4%.

Developed markets have had their own issues to deal with. The presidential election in the US, fraught negotiations between the UK and Europe over a Brexit deal, and fears of a second wave of coronavirus forcing many countries back into lockdown.

However, that does not mean that we should dismiss what is happening in emerging markets.

We are possibly at a junction where overpriced tech funds might be losing their momentum, and this at a time when America struggles to maintain its position as the world economic leader in the face of competition from the East. Is this going to be the time when China and other Asian economies move to become a self-sustaining trading bloc, no longer relying on demand from the West?

Sooner or later this is likely to happen, but is this the time? Probably not, but it is unlikely that President Xi Jinping is not benefiting from the recent political spectacle and paucity of standards existing in America. Having an incumbent president threatening to contest the results of a legitimate election does not strengthen the democratic mandate of the US.

As a result, China must surely be preparing for the time when the yuan can replace the US dollar as the standard trading currency at least in the East, if not in the world.

Not so long ago, the whole world used to run on sterling and now it is the dollar, so things can change.

- The biggest tech mega-trends that funds and trusts are tapping into

- Have gold funds lost their sparkle?

- ii Super 60 investments: quality options for your portfolio, rigorously selected by our impartial experts

The economies of China and Asia’s trading bloc countries seem to be recovering after the worst of the coronavirus. Their population may be poor, but it is huge. Pay these people a little more and you generate a vast amount of money to spend on home-produced goods.

In fact, it could become a self-generating economy that will not be reliant on the purchasing power of Western economies.

I have also read that China’s government has been accumulating large quantities of gold bullion, and its own mines are working flat out. Presumably, this is for a rainy day in the future.

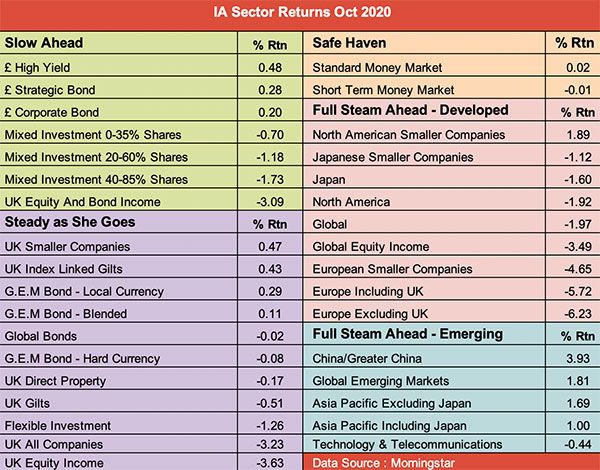

Our latest Investment Association analysis shows that China and Greater China was the best-performing sector in October, going up by 3.9% when most sectors were going down.

The global emerging market sector, along with Asia-Pacific including Japan and Asia-Pacific Excluding Japan, also went up.

Past performance is not a guide to future performance.

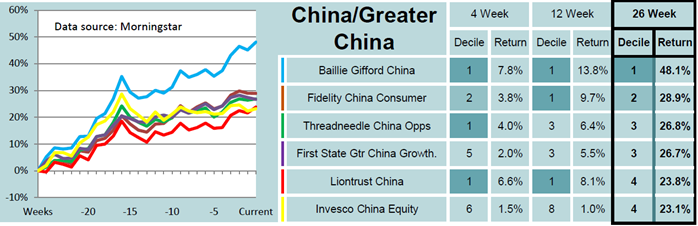

The leading funds in the China/Greater China sector have had a particularly lucrative six months, with Baillie Gifford China going up by just over 48%. In July, we briefly held this fund in one of our portfolios. We sold towards the end of August at a loss, as performance soon went off the boil. But, we have just gone back into the fund again.

We’ve been in and out of the Baillie Gifford China fund several times over the years.

Past performance is not a guide to future performance.

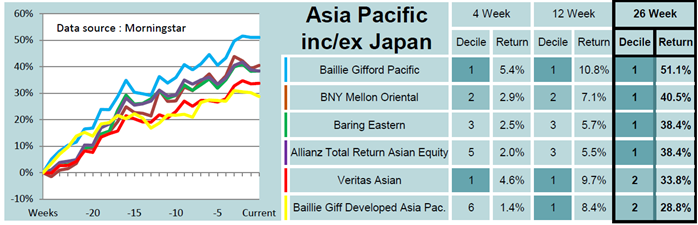

Although the funds in the more general Asia-Pacific sectors have not done quite as well in the last few weeks, they have done even better over the last 26 weeks, with another Baillie Gifford fund leading the way.

Past performance is not a guide to future performance.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.