It could be time to stop thinking of silver as second best

All that glitters isn’t gold. Sometimes, it’s silver. Here’s what sets the white metal apart – and why you might want to add it to your portfolio.

14th March 2025 08:44

by Theodora Lee Joseph from Finimize

- Unlike gold, which is mostly stored and recycled, silver is heavily consumed in industries like solar panels and electronics. With mining output stagnant and demand rising, silver prices could see sustained upward pressure

- The gold-to-silver ratio is near 90, far above its historical average of 15–20. If this ratio moves back toward normal levels, silver could significantly outperform gold in the coming years

- While gold is the ultimate safe-haven asset, silver’s dual role as both an investment and industrial metal makes it more cyclical. This means bigger price swings – but also greater potential gains when demand spikes.

Poor silver. It seems like it’s always stuck in second place behind gold. But, hey, that’s just Olympic Games thinking. In investing, silver could be your number one highest achiever. Just look at the past five years: gold has gained, sure, but silver has gained even more. And it’s likely not done sprinting yet: this so-called runner-up metal could be a winning hedge against today’s growing uncertainty, boosted by a wave of industrial demand.

Gold (green) and silver (blue) prices over time. Source: Trading Economics.

Let’s compare them side-by-side, silver vs gold

At first glance, these two seem like close cousins – both are precious metals, both have been used as money for centuries, and both serve as safe-haven assets when markets get shaky. But dig a little deeper, and the differences between silver and gold become abundantly clear.

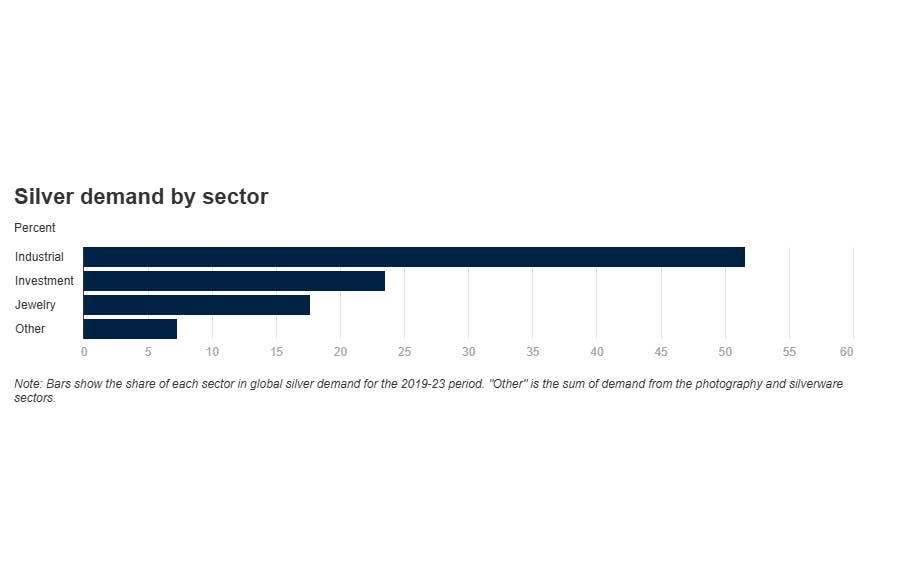

Gold is mostly worn or hoarded – it gets shaped into jewelry, or gets held by investors and central banks as a long-term “store of value”. Silver, meanwhile, does double duty. Like gold, it’s a vehicle for jewelry-making or investing, but then it has a whole separate life as an industrial metal. It’s a key ingredient in electronics, solar panels, and medical technology, which means its price is far more tied to the ups and downs of the global economy. When manufacturing picks up, silver prices tend to follow suit.

Silver demand by sector. Sources: The Silver Institute, World Bank.

Silver is also a lot more affordable than gold, and that lower price point makes it an easier buy for retail investors. A one-ounce bar of gold might cost $2,900, while a one-ounce bar of silver goes for around $30.

But you might want to think of the price difference as a silver lining: the fact is, silver is actually a riskier asset. It’s far more volatile than gold, so its price can swing wildly in short periods, offering bigger potential gains, but bigger potential losses, too.

That said, here’s why silver could outperform gold

1) Silver supply has been tightening while demand has been surging

One of the biggest advantages for silver investors is the metal’s growing supply-demand imbalance. Unlike gold, which is mostly recycled and stored, silver is consumed in industrial uses – and the supply mined hasn’t kept up with rising demand.

For example, silver is a key material in solar panels, and as the world shifts toward renewable energy, silver demand is expected to boom. China, a global leader in solar panel production, has been importing record-breaking amounts of silver, further tightening supply. Silver mining production, meanwhile, has been stagnant for over a decade. And since new mines take years to bring online, this imbalance could keep upward pressure on silver prices for years to come.

2) Central banks and investors have been warming up to silver

Gold has been the go-to metal for central banks for ages, while silver was mostly ignored. But that has started to change. Russia, for one, has begun stockpiling silver alongside its stash of gold, and other governments might well do the same.

Investors certainly see the appeal. Silver ETFs – funds that let folks gain exposure to the metal’s price without physically holding it – saw strong inflows last year for the first time in years. And that suggests that deep-pocketed fund managers have finally started to take silver seriously as part of a diversified portfolio.

3) Silver is historically cheap relative to gold

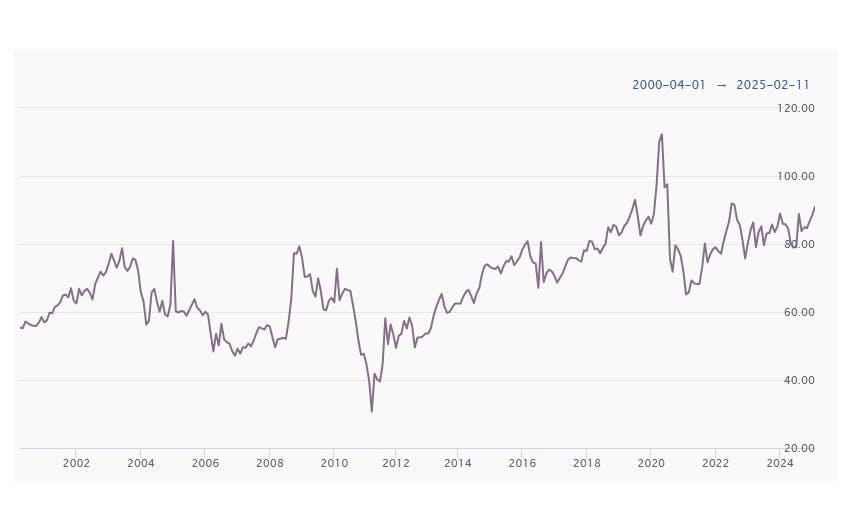

A key metric watched by the market is the gold-to-silver ratio, which measures how many ounces of silver it takes to buy one ounce of gold.

Historically, this ratio has hovered around 15 to 20, meaning silver was roughly 15 to 20 times cheaper than gold. But today, it’s closer to 90 – which suggests that silver is deeply undervalued compared to gold. If history is anything to go by, silver could see strong gains as the ratio moves back toward historical norms.

The gold-to-silver ratio over the past 25 years. Source: GoldSilver.com.

Now, let’s talk about the downsides

Yep, silver’s potential is exciting, but it’s not without risks. And here are the three biggest ones.

Higher volatility. Silver is much more volatile than gold, and its price can move two to three times more in a single day. This can be great for traders looking to capitalize on price swings, but for long-term investors, it requires a strong stomach. Unlike gold, silver can fall sharply if industrial demand weakens.

Market manipulation concerns. Some investors believe silver prices are artificially suppressed by big banks and futures traders. Now, that’s hard to prove, but there have been past cases of price manipulation, and that adds an extra layer of unpredictability to silver’s price movements. For long-term holders, this can be frustrating, because silver doesn’t always move as expected, even when fundamentals look strong.

Silver’s role as a safe haven is weaker than gold’s. Gold has been the market’s longtime favorite hedge against inflation, financial crises, and geopolitical turmoil. It’s hoarded by central banks and sought after in times of uncertainty. Silver, while still a safe-haven asset, has an even stronger link to industrial demand. So when the global economy slows down and industries cool their production, silver prices often take a hit – even while gold remains steady.

What’s the opportunity here?

The answer depends on your investment goals.

If you want stability: stick with gold. It’s been a trusted store of value for literally thousands of years. It’s less volatile, more liquid, and widely accepted as a hedge against economic uncertainty. If your main goal is to protect wealth, gold is the odds-on safer choice.

If you want growth potential: consider silver. It’s got higher upside potential because of its hefty industrial demand and supply constraints. If the silver-to-gold ratio starts narrowing, silver could significantly outperform gold in the coming years. But this pretty metal also comes with higher risk and volatility.

If you want balance, own both. Many investors hold a mix of gold for stability and silver for growth potential. A 75% gold and 25% silver split is a popular strategy – it keeps a strong foundation in gold while providing exposure to silver’s potential upside.

At the end of the day, both metals serve different roles, and owning a mix can help you navigate different market conditions while still benefiting from the strengths of each.

If you want exposure to silver without holding physical metal, ETFs are a convenient option.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.