IPO market: how the class of 2020 has fared

All the big flotations this year were done on Wall Street. Here are the highlights and lowlights of 2020.

17th December 2020 09:20

by Graeme Evans from interactive investor

All the big corporate flotations this year were done on Wall Street, mainly in the tech sector. Here are the highlights and lowlights of 2020.

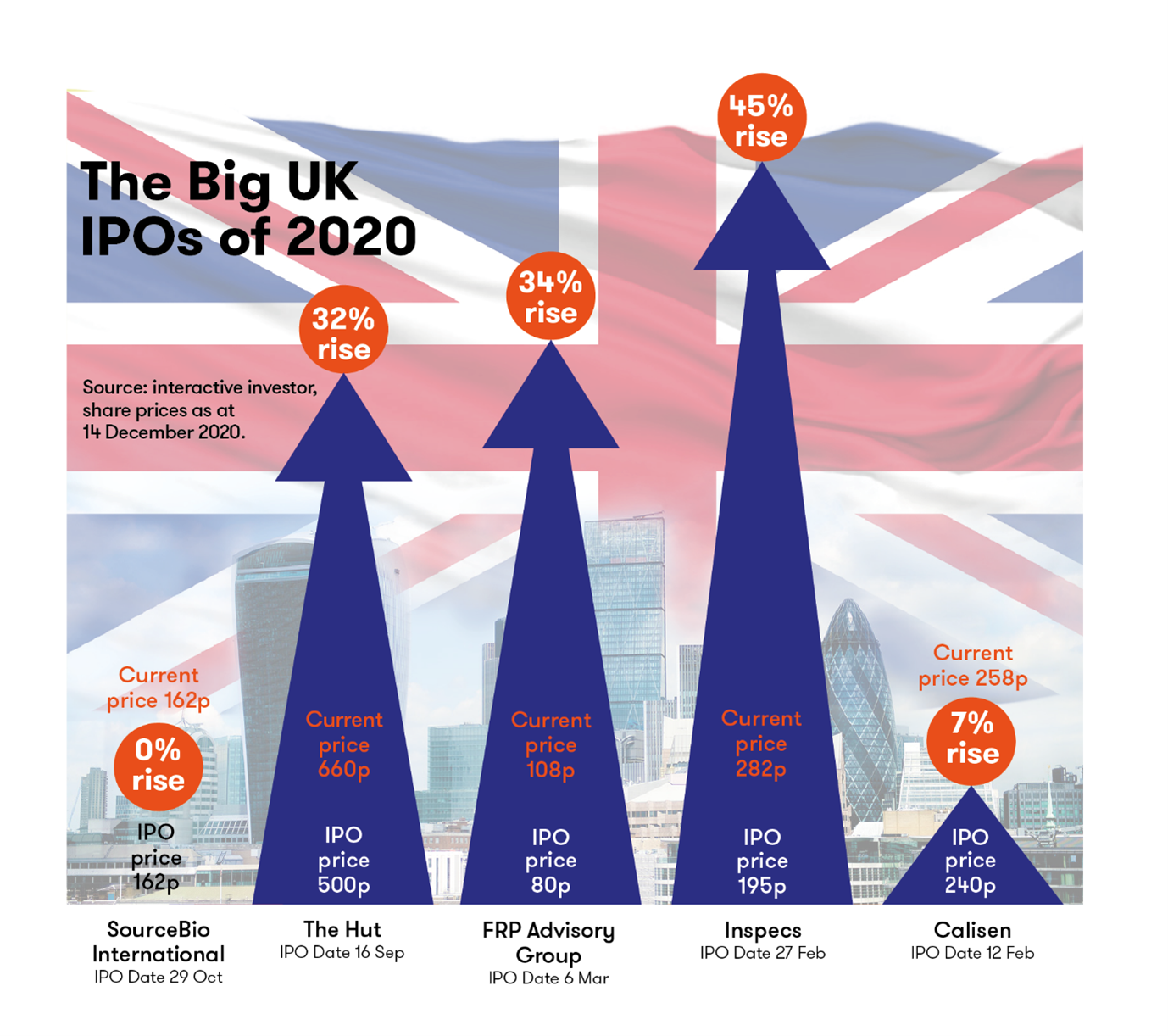

Vroom (NASDAQ:VRM), Snowflake (NYSE:SNOW) and Airbnb (NASDAQ:ABNB) kept up Wall Street's tech stampede in 2020 as another barren year for London IPOs was only partly rescued by Hut Group's blockbuster flotation.

The debut of the Hut Group e-commerce business THG Holdings (LSE:THG) was comfortably the highlight of the London Stock Exchange year, after the company founded by entrepreneur Matt Moulding was valued at £5.4 billion and quickly accelerated to £7 billion.

Covid-19 and no-deal Brexit uncertainty otherwise sapped appetite for stock market listings, meaning there were only 25 UK-based new issues in the first 11 months of the year. Capital markets were instead focused on share placings in order to prop up corporate balance sheets.

- Airbnb IPO generates massive excitement

- The Hut Group: ‘gem of a business’ rockets on debut

- Jack Ma’s Ant Group IPO will smash records

- Find out more about IPOs on interactive investor here

In contrast to London's pandemic woes, the strength of the American technology sector’s FAANG stocks provided a favourable backdrop for newcomers, including cloud data platform Snowflake and online car seller Vroom.

And there was time before Christmas for Airbnb to join the ranks, although the blockbuster float of Ant Group in Shanghai and Hong Kong won't be happening after the mammoth $200 billion listing was scuppered by regulators just days before it was due to take place. Ant is 33% owned by Alibaba (NYSE:BABA), which is China’s equivalent to US online retailing giant Amazon (NASDAQ:AMZN).

Changing tech priorities

The London market's limited pipeline of tech floats in comparison with Wall Street has long been the source of frustration for many UK investors.

Tech is currently the fourth largest sector on the London market with 11% of the total capitalisation, with the chief flagbearers in the top flight being Tesla (NASDAQ:TSLA)-backer Scottish Mortgage (LSE:SMT), accountancy software company Sage (LSE:SGE) and cyber security firm Avast (LSE:AVST).

THG Holdings won't be joining them anytime soon, despite being large enough.

That's because Moulding has a golden share that allows him to reject a hostile takeover, meaning the company is only able to use the standard segment of the market. In the United States, dual class shares are not a barrier to the higher echelons of the stock market.

Moulding believes changes to stock market rules are necessary to make it easier for companies to choose London over Wall Street or Asia. Entry to the FTSE 100 for his company would not only take the business to the next level in terms of profile, but enable it to attract more investment from tracker funds.

In November, Chancellor Rishi Sunak announced a review of the listing rules in order to find ways to attract “the most successful and innovative companies” to the UK stock market. One of the biggest topics for the UK Listings Review, which is being chaired by Lord Hill, will concern how much of a company’s shares must be available for the public to exchange.

For some issuers, the current 25% free float limit represents a high proportion of equity to have to sell and may deter some due to concerns around dilution of control.

Dual class share structures and other owner-control mechanisms are also up for review. There are concerns that allowing companies to issue shares without equal voting rights risks eroding corporate governance standards and unfairly impinges upon shareholders rights.

Unduly strict or inflexible track record requirements may also potentially deter some companies from listing. And Lord Hill will consider if the high standards for entry into the premium listing segment are putting off overseas companies from having secondary listings in the UK. This can reduce opportunities for smaller UK investors, who do not have ease of access to overseas markets.

The Hut Group IPO

The performance of Hut Group since its September flotation should serve as encouragement for 2021's potential tech IPO candidates, such as Deliveroo, Darktrace and Trustpilot.

The London Stock Exchange called THG a “case-study for tech in London” and said it showed that such companies no longer had to list outside Europe to achieve multi-billion valuations. In the past, many European tech companies would have first courted growth investors in California or New York before choosing to list on Nasdaq or NYSE.

THG is a global player but stayed true to its Mancunian roots and the 75% of its 7,000 strong workforce in the UK when it opted for a listing in London. The company raised £1.88 billion, the most since Worldpay in 2015, and was given an initial valuation of £5.4 billion after shares were priced at 500p.

The stock peaked at just above 700p in late October and had steadied at 619p by the end of November, keeping Moulding in line for at least £700 million of shares under an incentive scheme. His involvement is a key part of the THG attraction, although his superior voting powers and dual chairman and CEO role has raised corporate governance concerns.

Interest in the company continues to be driven by its exposure to the fast-growing beauty and nutrition markets through online brands Lookfantastic and Myprotein, as well as the prospects for the company's high-margin e-commerce platform Ingenuity.

It made a loss of £49.8 million in the first six months of 2020 but Liberum called THG a “gem of a business” and said it offered investors exposure to high structural growth as both a brand builder and a leading technology provider.

The initial IPO valuation represented 3.8 times 2020 sales, but Liberum believes a valuation range of between £7 billion and £7.5 billion is achievable.

The best of the rest in the UK

A “Boris Bounce” for markets after last December's general election raised hopes for a resurgence of IPOs in 2020 after a barren few months caused by Brexit uncertainty.

This optimism was given weight in February when smart meters business Calisen (LSE:CLSN) was valued at £1.3 billion in London's biggest IPO since the debut of Trainline (LSE:TRN) in June 2019. Remarkably, it was also the first British company to list on the main LSE since the train booking website.

Shares made their debut at 240p a share, with the £329 million proceeds helping towards smart meter expansion. But they fell to as low as 111p during the pandemic sell-off, and despite a strong recovery the following month, were still below the 200p barrier. That was until a consortium of funds agreed to pay £1.43 billion for the company in December.

The AIM flotations of spectacles maker Inspecs (LSE:SPEC) and corporate restructuring firm FRP Advisory (LSE:FRP) followed before Covid-19 shut off the flow of IPO action. Some of the names consistently touted as potential IPO candidates were also hobbled by a combination of the pandemic and Brexit, most notably Jaguar Land Rover.

Instead, the placing of new shares by existing UK-listed firms raised an estimated £7 billion in just a few weeks as companies looked to shore up balance sheets or finance rare acquisition opportunities in a distressed market.

After Hut Group signalled a re-opening of IPO markets in September, two familiar faces in David Beckham and fintech entrepreneur Jonathan Rowland were involved in bringing esports and bitcoin banking to the stock market.

Former England captain Beckham is a minority shareholder in Guild Esports (LSE:GILD), which is using the £20 million raised from investors to become one of the world's top 10 esports franchises.

It is in the process of recruiting players so it can field dedicated teams to compete in Fortnite, CS: Go, Rocket League and FIFA. Revenues are generated through tournament winnings, digital marketing opportunities and sponsorship.

Shares opened at 8p, valuing Guild at £41.2 million, but finished November at 6.2p.

Rowland's Mode Global Holdings (LSE:MODE) is also below water after falling from its starting point of 50p to 42p. The performance is a little different to when a 24-year-old Rowland floated his internet investment company Jellyworks during the dotcom boom in 2000. Shares on that occasion soared from 5p to 50p on the first day of trading, with the business bought six months later.

Rowland, who is Mode's founder and executive chairman, has used these latest proceeds to support the launch of an app allowing customers to manage traditional and digital assets in one place. The business also comprises the recently-launched Bitcoin Jar, alongside payment processing services for UK and European businesses to tap into the Chinese market.

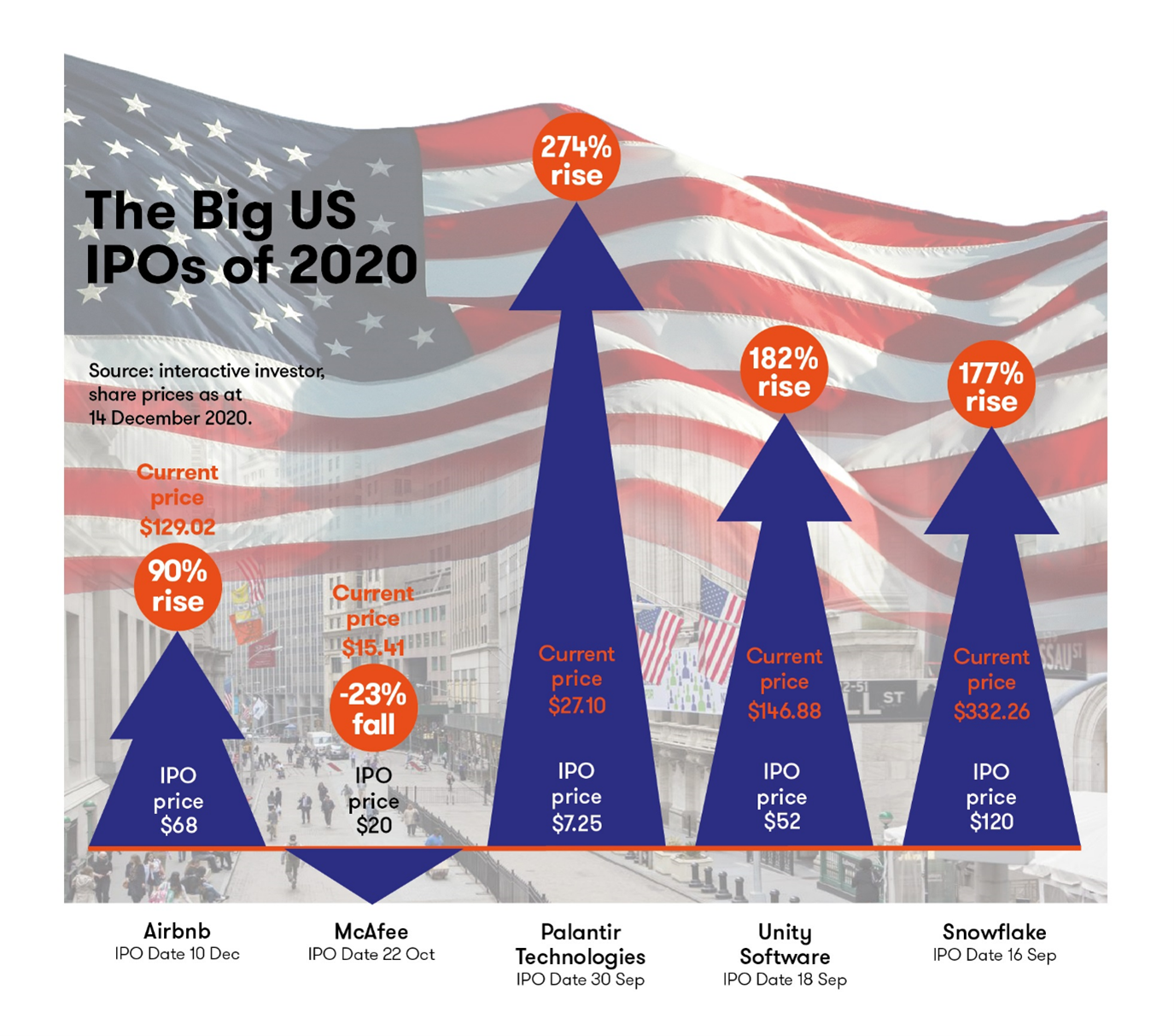

The US tech boom continues

Wall Street welcomed several more high-profile Silicon Valley start-ups during another turbocharged performance by the wider tech sector in 2020.

With the likes of Apple (NASDAQ:AAPL), Netflix (NASDAQ:NFLX) and Amazon helped by favourable consumer trends during Covid-19, the Nasdaq index had no trouble recovering from the wider March market meltdown.

The speed of the turnaround was shown in June when online car seller Vroom and business intelligence platform ZoomInfo Technologies (NASDAQ:ZI) made their debuts with a combined valuation of more than US$10 billion (£7.5 billion). The pair are up by 68% and 111% respectively in the period since.

The new issues market really gathered pace in September, with a run of listings that included the biggest US IPO of the year so far. The Warren Buffett-backed data warehouse company Snowflake more than doubled in value from $120 on its first day of trading, and is currently at $325 a share for a market cap of more than $90 billion.

Trading under the ticker SNOW, investors have chosen to focus on rapid revenue growth and the company's potential rather than the losses of $384 million generated last year.

This trend for loss-making tech companies to pursue stock market listings reached its peak during the IPO euphoria of 2019 when Uber Technologies (NYSE:UBER) and Lyft (NASDAQ:LYFT) were able to tap investors, despite the pair's far-from-certain route to profitability.

September also saw the debuts of data analytics company Palantir Technologies (NYSE:PLTR) and workplace app Asana (NYSE:ASAN), but these were through a direct listing enabling existing investors to monetise their shares, rather than the more usual IPO route. One of the weakest performing new entrants so far this year has been McAfee (NASDAQ:MCFE), which was valued at $8.6 billion in its October IPO but is now trading at US15.96 compared with an opening price of $20.

- Bill Ackman: how I invested billions in 2020

- What Bill Ackman thinks will happen to stocks in 2021

- McAfee IPO to take advantage of tech boom

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

But the year ended on a positive note, as home rental business Airbnb snuck its mega-IPO in just before Christmas. Airbnb was valued at up to $47 billion and raised $3.5 billion in the IPO, buoyed by the San Francisco-based company posting a third-quarter net profit of $219 million.

Having already raised its IPO price from $44-$50 to $56-$60, then to $68, the shares traded as high as $165 on its stock market debut. That valued the business at over $100 billion, a remarkable feat given the pandemic had wiped out a massive chunk of its business earlier in the year. Well done Airbnb.

The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this data may not be suitable for all investors and, if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website.