Investors pile into these four safe-haven gold stocks

23rd October 2018 14:15

by Graeme Evans from interactive investor

Historically treated as a bolt-hole when risky equity markets turn sour, gold and the companies that mine it are popular again. Graeme Evans reports.

The safe haven appeal of gold is less under scrutiny from investors after a swift turnaround in fortunes for stocks including Randgold Resources and Fresnillo.

October's flight to safety, which has also benefited Hochschild Mining and Petropavlovsk, follows some surprise in previous months that gold had not performed better as a place of sanctuary for investors.

This was largely attributed to US dollar strength and emerging market weakness. But gold price movements in the past couple of weeks reveal that precious metals are reasserting their safe haven status in periods of market volatility.

"Rates and the US dollar are still the most important drivers of gold price changes, coupled with oil and the VIX," explains Bank of America Merrill Lynch.

Analysts at UBS have reiterated their three-month price target at US$1,280 an ounce, compared with the current $1,234, and think that any pullback in the dollar, weakness in equities or the potential for a soft patch in US data could act as potential upside catalysts for gold.

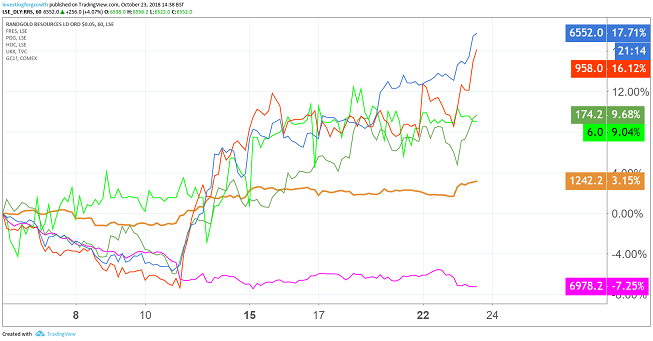

Source: TradingView (FTSE 100, pink; Gold price, gold; Hochschild Mining, green; Petropavlovsk, bright green; Fresnillo, red; Randgold, blue) Past performance is not a guide to future performance

Contributing factors in recent days have also included developments in Italy, where the spread on 10 year bonds has widened substantially to Germany. Seasonal physical demand and stronger-than-expected official sector buying are also providing support in the background.

UBS said:

"We have maintained the view that gold should remain a relevant asset for portfolio diversification and for hedging tail risks, and this should ultimately support a gradual drift higher in prices as strategic positions are slowly built."

And Bank of America is bullish looking ahead to 2019.

"Volatility signals change. So market focus could soon shift from robust US growth to its rising current account and government budget twin deficits. Also, while China's credit bubble could negatively impact gold in the near-term, a possible shift to aggressively ease monetary policy to deal with debt deflation (QE, anyone?) could be very bullish for gold.

"After all, as rates go down in China, the opportunity cost of holding gold is expected to drop. These golden triplets could turbocharge gold in 2019 to a $1,400/oz high."

Whilst the vast majority of mining stocks are down in the year to date, the picture is much different in the past three weeks as companies with gold operations benefit from rising precious metal prices.

As our table shows, Mali-focused gold miner Randgold Resources is up 14% since the current stockmarket downturn started on October 3. Fresnillo, which is the world's biggest silver miner and Mexico's largest gold producer, is 12% stronger.

| Company | Ticker | Price (p) | Day change (%) | Change since 3 October (%) | Change in 2018 (%) |

|---|---|---|---|---|---|

| Fresnillo | FRES | 927.7 | 3.6 | 12.4 | -35.1 |

| Hochschild Mining | HOC | 171.6 | 2.1 | 8.3 | -35 |

| Petropavlovsk | POG | 6.42 | 0.6 | 9.6 | -17.2 |

| Randgold Resources | RRS | 6,364 | 1.1 | 14.3 | -14.1 |

| FTSE 100 | UKX | 6,972 | -1.0 | -7.1 | -9.3 |

Source: SharePad

The pair were identified a few days ago as among Macquarie's preferred mining picks, given that the end-of-year outlook is looking more favourable.

They had a 6,200p price target on Randgold, although that's already up with events after strong gains in recent days. Fresnillo was priced at 1,020p based on expectations that its recent operational performance has been sound and that the company's Q2 downgrade to silver guidance is now fully priced in.

Today, JP Morgan raised its target price on Randgold to 6,256p from 5,200p but cut Fresnillo from 1,250p to 1,200p.

Other stocks benefiting from the flight to safety include Hochschild Mining, whose shares rose more than 3% today. The company has four gold and silver mines, with three located in southern Peru and the other in Argentina.

Petropavlovsk, which was named Peter Hambro Mining until 2009, is one of Russia's biggest gold mining companies with operations in the far east of the country. Its shares are up 10% since early October, although they are still 17% lower in the year to date.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.