An investor’s guide to buying motor stocks in a crisis

European car makers have been bashed up during the pandemic, but these ones might be worth owning.

3rd June 2020 10:42

by Rodney Hobson from interactive investor

European car makers have been bashed up during the pandemic, but these ones might be worth owning.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

It was a decision that stunned opinion on both sides of the Brexit debate and it has implications for car manufacturers across Europe: Nissan decided, against all expectations, to close its only factory within the European Union, in Barcelona, and keep faith with Britain’s biggest car plant in Sunderland.

This cannot have been an easy decision. The British government is sticking to its policy of taking the UK out of the European Union at year-end, irrespective of whether there is a deal, and discussions on trading arrangements have been disrupted by the hiatus caused by the coronavirus disruption to travel and face-to-face meetings.

Economists had assumed that any such problems would make the UK less attractive for manufacturers who would no longer see the country as a way to service their pan-European markets. Nissan’s decision, part of a plan to reduce costs by the equivalent of £2.3 billion worldwide, could be interpreted as a signal that EU countries will be seriously set back by the Covid-19 lockdowns.

That doesn’t seem to be the way that Nissan sees it. Sunderland is the larger plant, with 6,700 workers compared with 2,800 in Barcelona, and it will continue to produce Nissan’s core models. Clearly, there is considerable confidence in the European market. Otherwise it would have been possible to shut Sunderland as well and ship cars from Japan under the Japan-EU trade agreement signed last year.

- European equities: three key themes in a post-Covid landscape

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Funds Fan: fallen-star departs, trust dividend cuts, and top investor interview

The other side of the coin is that with Nissan shutting up shop in Barcelona, there will be greater opportunities for EU carmakers to enjoy a greater share of any bounceback in car sales on the Continent as lockdowns in various countries, most notably Spain, Italy, France and Germany, are eased.

While those European companies and individuals who have suffered serious financial loss in the lockdowns will postpone buying vehicles if possible, there will be some pent-up demand and motorists may well feel like seeing if they can drive a hard bargain on the forecourts.

Investors who fancy a punt on the sector should bear in mind that dividends are almost certain to be reduced or even abandoned this year, so yields based on 2019 dividends should be viewed with some suspicion.

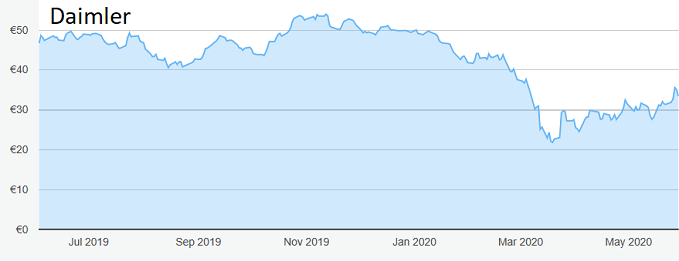

Daimler (XETRA:DAI) shares have recovered to around €36 after dipping to a low of €22 in mid-March. The shares had already begun to slide from a 12-month peak of €54.50, even before the extent of the coronavirus threat was fully appreciated, but at least the subsequent recovery has been consistent. The yield is 2.5%.

Source: interactive investor. Past performance is not a guide to future performance.

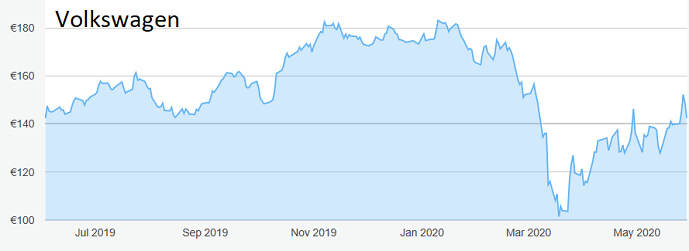

The share price in another German carmaker, Volkswagen (XETRA:VOW), shows a similar pattern, with a particularly sharp fall from €185 early in January to €87. They currently stand at €140.50, where they yield 4.67%.

Volkswagen owns Seat, the major Spanish car maker, and Skoda, the Czech manufacturer, so it has a spread of potential buyers loyal to their nation’s brand.

Source: interactive investor. Past performance is not a guide to future performance.

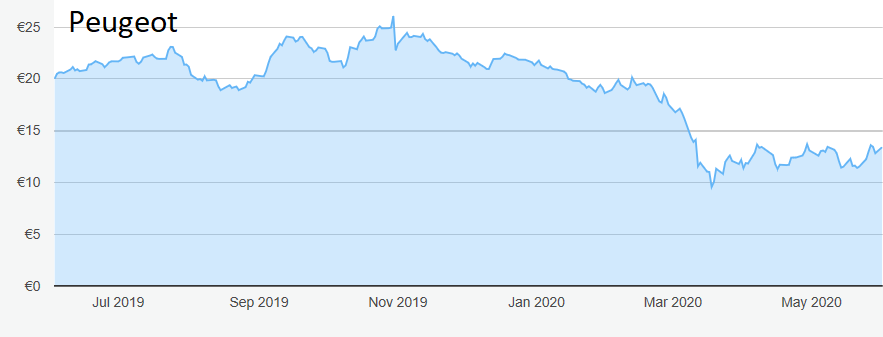

French-American manufacturer Peugeot (EURONEXT:UG), which also makes Citroen and Chrysler cars, has had a particularly rough time of it. At €13.60, the shares are still trading at little more than half of their 12-month high of €26 set at the end of October.

Shares lost nearly two-thirds of their value before hitting the bottom below €10, and the recovery has been much less convincing than at the German counterparts. The yield of 9% indicates that investors do not expect last year’s dividend to be repeated this year.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: Buy Daimler up to €40. The shares may hit a ceiling at €43-44 as they did in early February. Volkswagen is worth considering up to €148 at this stage. I would not be inclined to pay more than €15 for Peugeot until the future is clearer, not only in Europe but in the US.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.