Investors are so bearish it is time to be bullish

20th July 2022 10:16

by Sam Benstead from interactive investor

Bank of America’s latest survey of professional investors paints a bleak picture – but that may be a good thing, reports Sam Benstead.

Professional money managers are capitulating, with global growth and profits expectations at all-time lows, cash levels their highest since 9/11, and equity allocation at the lowest level since Lehman Brothers collapsed in 2008.

This is according to Bank of America’s latest survey of fund managers in charge of more than $700 billion (£580 billion), which now delivers a “max bearish” score of 0 on its much-followed “bull & bear” indicator.

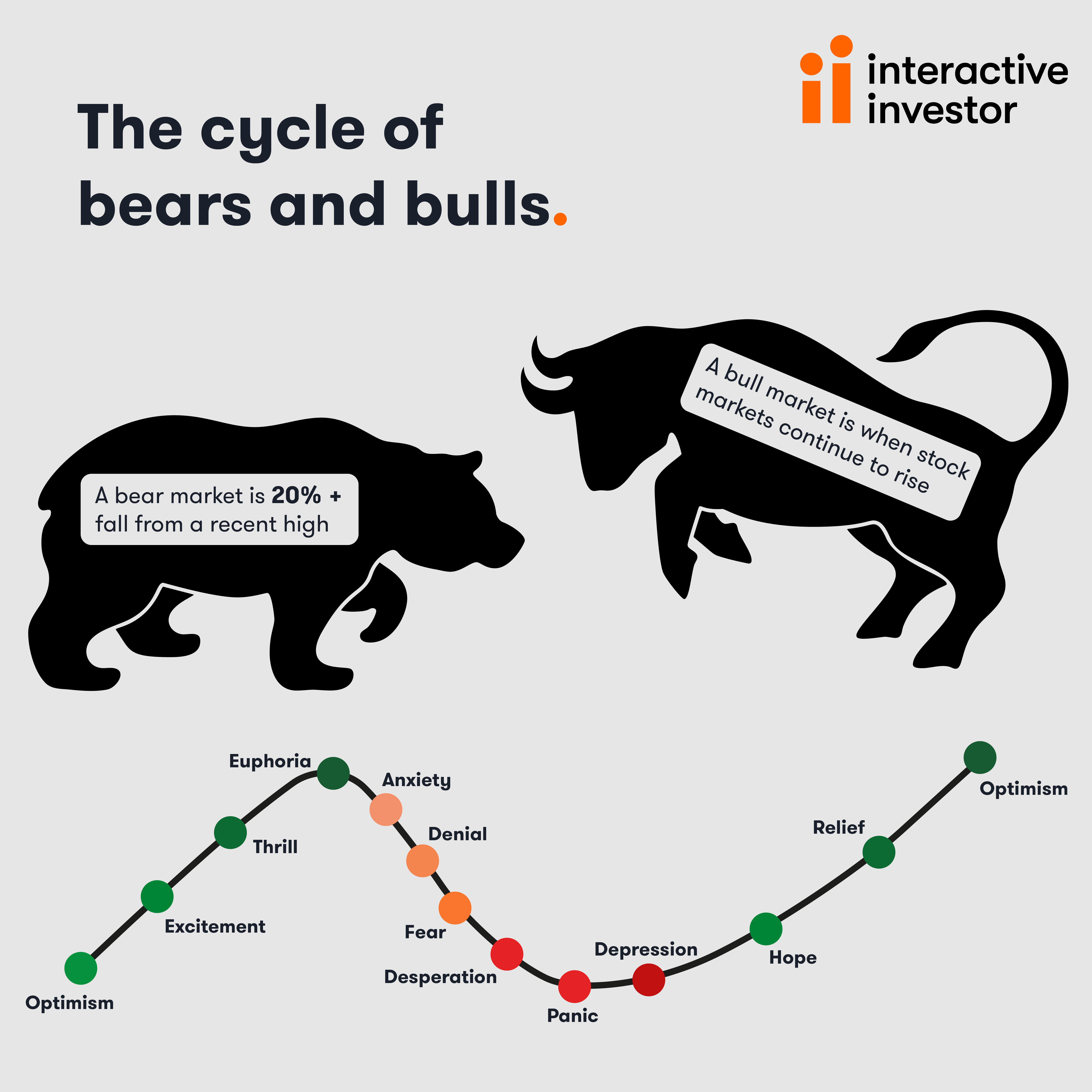

Stock markets have tumbled this year, with US and global shares briefly slipping into bear market territory after 20% drops from their highs, in dollar terms.

However, with inflation showing no signs of subsiding, incomes failing to keep up with prices and hiring slowdowns announced by the likes of Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT), the outlook for company profits is dire.

Bank of America called the findings “full capitulation” and found that investors were rushing to safe-haven assets in times of inflation, including the US dollar, oil and commodities.

In the stock market, the pros were most overweight healthcare, consumer staples and energy, and most underweight consumer discretionary stocks, utilities and banks.

- Funds and trusts four professionals are buying and selling: Q3 2022

- Reasons why the bear market is far from over

- Why these defensive investments will continue to deliver

Investors said that high and persistent inflation was the biggest risk, followed by global recessions and too many interest rate rises from central banks. Recession anticipation is at its highest level since May 2020.

However, Bank of America reckons that this dreadful outlook among the pros for the economy and profits may be a good time to buy shares.

It titled its report “I’m so bearish, I’m bullish”, referencing its off-the-chart bearish “bull & bear” indicator as a good time to invest because all the bad news ahead may be priced into shares already.

It said that while businesses performance for companies will likely be poor in the second half of the year, sentiment could swing and there may be a stock and bond market rally.

The contrarian trade is to buy shares, particularly bank and consumer discretionary stocks, and bet against the US dollar, according to Bank of America.

These trades may work if inflation falls and the US central bank pauses its rate rise schedule by Christmas, it noted.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.