‘Investor Essentials’ launched by interactive investor

30th January 2023 09:19

by Jemma Jackson from interactive investor

From 1 February, invest up to £30,000 for just £4.99 a month.

- Opens up ii’s award-winning, great value platform to more investors

- Invest up to £30,000 for just £4.99 a month

- Same full range of investment choice

- Free regular investing, and same low-cost trading fees as those found on ii’s core price plan

- interactive investor research among 1,000 UK investors found that over two-thirds (67%) would favour a subscription fee over percentage fee

interactive investor, the UK’s second-largest investment platform for private investors and leading flat-fee provider, is proud to launch Investor Essentials, available from 1 February 2023.

- Learn more about our Investor Essentials plan

Investor Essentials is a new entry-level addition to ii’s subscription service, broadening its award-winning, great value price plans to more people, without compromising on choice.

The new price plan is a game-changer because ii’s flat fee subscription model has traditionally been more cost effective for people with larger investment pots.

Customers can now invest up to £30,000 with ii for just £4.99 a month. They will benefit from free regular investingand competitive trading fees of £5.99 for funds, investment trusts and UK/ US shares – all with the same choice of investments.

Once customers reach the £30,000 threshold, they’ll automatically graduate to ii’s most popular Investor price plan, which is £9.99 per month. That’s regardless of whether they have over £30,000 or over £1 million – the fixed fee then stays the same.

Investor Essentials “changes everything”

Richard Wilson, Chief Executive, interactive investor, says: “Investor Essentials is a pivotal moment. No longer do you need to reach for the calculator to work out at which point in time fixed fees become an obvious cost-saving choice for your investments. ii now takes care of that with a simple, transparent service to meet a range of needs and budgets – and the added benefit of free regular investing.

“Historically, a percentage-based charging structure has generally been cheaper for people near the start of their investment journey. Providers then hope that their customers will stick with them without ever calculating the cost savings they could be making over the long term as their investment grows. Investor Essentials, with its low monthly cost, changes everything and provides greater value and choice to a much broader audience.

“Nor does paying less have to mean less choice. Investor Essentials comes with the same wide range of funds and investment trusts, whether active or passive. And the same huge range of UK and overseas shares, so you can invest in the world’s biggest brands, or seek out the hidden gems. All with great educational content, insights, and research tools to help you become a better investor.”

What you don’t get

In keeping with ii’s other ultra-low price plan, Pension Builder, Investor Essentials does not come with free monthly trades, and nor does it come with free Junior ISAs – features that are standard with ii’s Investor and Super Investor price plans.

Appetite for subscription services

Subscription services dominate many aspects of our lives, but are the exception rather than the rule when it comes to investment services.

Yet interactive investor research among 1,000 investors* found that over two-thirds (67%) would favour a subscription fee over percentage fee when it comes to investments.

Reasons given included simplicity (25%), fairness (24%), attractiveness (23%), and being more transparent (24%). The research was conducted by Opinium among a general population sample of UK investors.

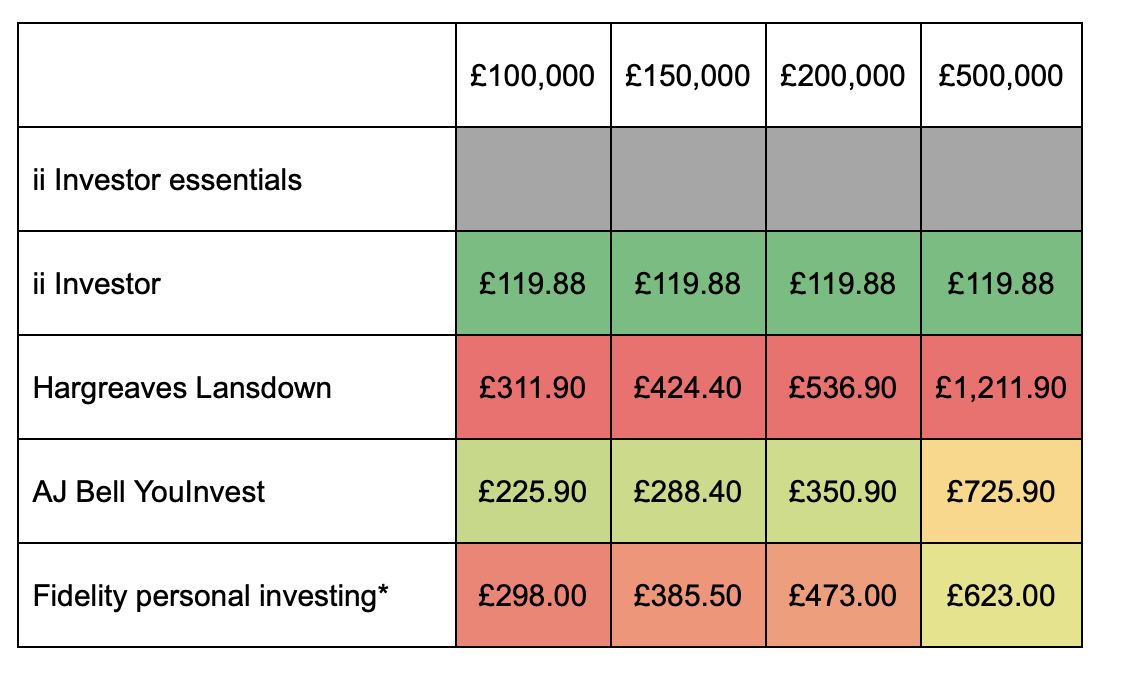

Investor Essentials versus the competition – annual cost comparison

interactive investor asked platform consultancy The Lang Cat to compare Investor Essentials annual charges with its largest competitors (and with its own Investor price plan).

The illustration below is based on an ISA portfolio that is 50% shares and 50% funds.

It assumes two ad hoc fund trades in a year and two equity trades. It also assumes regular investing into one fund per month, and one share (or investment trust) per month.

*Based on charges applying from 1st February 2023

See notes to editors to view how ii’s flat fee stacks up even more against the competition for larger pot sizes.

Investor essentials key facts: what you get

- Low, flat subscription of £4.99 a month

- Free regular investing for funds, investment trusts, and popular UK shares

- Just £5.99 per UK and US trade for individual equities

- Both a Stocks and Shares ISA and a Trading Account within a single subscription

- Hold up to £30,000, above which you move onto our standard Investor Plan

- Access to the widest range of investments on the market – both UK and overseas

- Invest in the world’s best-known brands

- Educational content and independent editorial to help you develop your investing skills

- Easy to use select lists, model portfolios, and independent research to help you choose

- Research tools on sustainable investments

- Quick Start range for beginner investors

- Option to vote your UK shares at the push of a button through our notification service

Investor Essentials key facts: what you don’t get

- No free monthly trade

- Can’t open JISAs or a SIPP

- Must be set up to pay fees by Direct Debit and be set up for electronic communications.

Notes to editors

- *The research was conducted by Opinium Research between 15 to 20 December 2022 amongst 1,000 UK adults with money invested outside a pension – ii customers were not specifically targeted. The Opinium sample reflects the gender investing gap: 67% of respondents were male and 33% female, and while respondents come from the length and breadth of the UK, there was a South East bias: 16% of respondents were from South East England, and 11% from London. Some 52% of respondents manage their own investments entirely, while 35% said they had a mix of investments they manage on their own and some through an adviser. Some 14% said they use a professional adviser.

- How ii compares for largest portfolios – annual charges based on the following pot sizes.

Interactive investor asked platform consultancy The Lang Cat to compare interactive investor’s new Investor Essentials with its largest competitors pricing.

The illustration below is based on an ISA portfolio that is 50% shares, 50% investment trusts

It assumes two fund trades in a year and two equity trades. It also assumes regular investing into one fund per month, and one direct equity (UK share or investment trust) per month.

*Based on charges applying from 1st February 2023

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.