Investment trusts to protect against feared dollar reversal

14th October 2022 15:12

The US dollar has surged in 2022, but many are questioning whether this can be sustained. Analysts at Kepler Trust Intelligence examine the implications for investors, and which investments could do well.

As global stock markets have sold off, investors have flocked to the US as a safe haven, driving demand for US currency. However, the parabolic rise of the dollar against multiple currencies has led to fears of a reversal. If the dollar does weaken from these stretched levels, what are the implications for investors, and which investments could do well?

King dollar

2022 has been a year of economic turmoil. Rising inflation was a concern coming into the year as the ‘reopening trade’ increased demand, but then the Russian invasion of Ukraine accelerated the rise by critically disrupting energy and food markets. In response to this, many looked to one of the key economic tools for tempering inflation: raising interest rates.

However, the central banks of many developed economies have been unable or unwilling to raise interest rates as much as necessary, over concerns that will tip their economies into a recession as higher borrowing costs will cause demand to collapse. However, one country that has raised interest rates is the US. Whilst the country isn’t immune from the inflationary pressures affecting the global economy, it is relatively well insulated through its domestic energy and food security, with a robust labour market supporting demand (as last week’s strong jobs data re-emphasised).

The Federal Reserve has been able to implement a number of interest rate rises this year. As a result, the yield on US 10-year Treasuries has climbed to over 3.6%. For context, this is double the equivalent rate in Germany and nearly 20 times higher than Japan’s. US Treasuries are considered to be some of the lowest-risk assets around, and their return rate is as high as it has been for over a decade.

At the time of writing, the US two-year yield is over 4%, which means that any risky asset needs to offer a significantly higher return to justify investment. In our view this is the major reason behind the sell-off in US and global equities this year. The S&P 500 is down c. 23% so far this year as increasing interest rates have undermined the high valuations attached to many companies and the relative attraction of US Treasuries has increased.

Higher rates on US Treasuries have contributed to the demand for dollars. The dollar index (which measures the currency against a trade-weighted basket of currencies) already came into the year high versus its history, but has still rallied over 13% so far this year to hit a 20-year high against other leading currencies. In contrast, many other countries have seen their own currencies fall as they have struggled to balance the need to contain inflation and the need to support economic prosperity. In the UK, there have been many headlines about the demise of sterling, though much of this drop has been a result of the strengthening dollar on the other side of the trade, given the pound has been less weak against other currencies.

For UK investors, this has had a number of impacts. For one, holders of US assets have seen a translation benefit. A US stock priced at $50 would have been worth £36.97 at the end of last year, whereas it would be worth £44.78 at the last month end, all else being equal. That is a 21.1% gain for no fundamental change.

Below we show the five-year change in the dollar index. After such an extreme run-up, it is natural to wonder whether we are due a reversal, and what the implications would be.

Riding for a fall?

To answer this, it is key to understand what would cause the dollar to fall. In our view, the primary reason for the dollar’s ascent has been the Fed increasing interest rates as a result of the desire to curb inflation. A change in either element of this could result in a pullback in the dollar.

Firstly, there could be a change in policy from the Fed. So far in this cycle, they have been accused of being ‘asleep at the wheel’ when it came to policy action as inflation took hold. Since then they have been playing catch-up, looking to get inflation back under control with aggressive rate hikes. However, if they change course again, either by admitting defeat against inflation or over concerns that higher rates will negatively affect millions of mortgage holders in the US, then markets would likely react strongly and reprice many risk assets. How investors would take another change in policy in the long term, though, is difficult to predict.

Secondly, investors could look for signs of inflation starting to peak, or even come down. This would reduce the likelihood of the Fed needing to raise rates, and subsequently reduce the demand for Treasuries and dollars. The biggest cause of inflation at present is rising energy costs, an issue which has been exacerbated by the war in Ukraine. If energy prices were to reach a ceiling, the knock-on effects should see inflation coming down and also therefore a potential drop in the dollar. A change here would have a secondary impact of restoring the confidence of investors too. Another reason for the run-up in the dollar has been investors approaching it as a ‘flight to safety’ as concerns have grown about the impact of inflation on the real economy.

Yet how likely are either of these scenarios? Well, it is hard to say. Given the rise in core inflation in the US, it looks like the Fed will be slow to slam on the brakes even when headline inflation is definitively falling. Additionally, the rhetoric from the Fed leads us to believe they are far from a change in direction. Our base case would therefore be a persistence in dollar strength, and if such an environment continues, investors may want to remain invested in defensive assets.

Ruffer Investment Company Ord (LSE:RICA) is set up to protect against inflation persisting over the coming years. This positioning should therefore enable the trust to continue to perform in conditions that would support a strong dollar. RICA is designed to be an all-weather solution for investors, aiming to grow capital over the long term without suffering significant drawdowns. The trust has the flexibility to invest in a range of asset classes which will allow manager Duncan MacInnes to navigate markets in order to try to deliver steady returns. We published an updated note on the trust recently.

However, there are a number of outcomes that could lead to a weakened dollar, and we think it would be unwise for investors not to seek protection. In these scenarios a variety of asset classes could outperform, and one of the most pertinent of these is equities, particularly in the developed markets that have struggled the most.

Overseas opportunities

Japan could do well from a reversal in the dollar, due to its very depressed currency and a potential valuation opportunity in the stock market. The Japanese yen has collapsed this year in dollar terms and the Bank of Japan has had to step in to support the currency for the first time in over 20 years, in spite of the yen’s supposed status as a safe haven asset. Much of this can be attributed to the bank’s interest rate policy, which has remained low despite concerns over inflation.

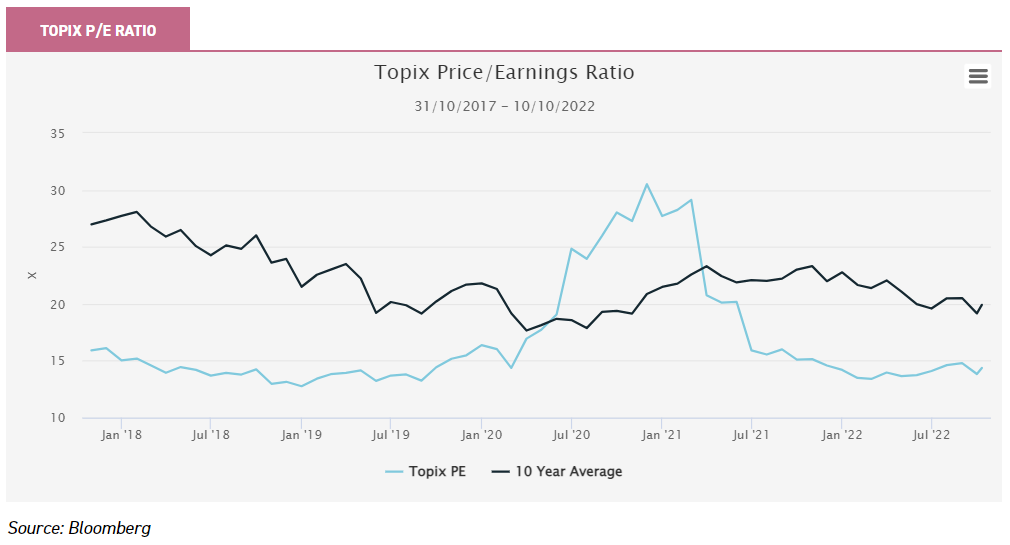

The weakness in the currency has been beneficial to many Japanese firms, though. The country is home to some of the world’s most recognisable international companies, which have a large portion of overseas earnings. A recovery in risk aversion would see higher economic activity and international trade, which would benefit Japan plc due to its high sensitivity to the global economy. The Japanese stock exchange is also trading on reasonable valuations at present, which could provide a boost to returns. The aggregate P/E of the market is 14.4x, versus a ten-year average of 19.9x (Source: Bloomberg, as at 10/10/2022)

One other factor to support the Japanese story is the high level of cash on corporate balance sheets. This means many companies have fiscal reserves to help with market challenges ahead, support dividends and offer protection from the refinancing risk of rising interest rates.

abrdn Japan Investment Trust Ord (LSE:AJIT) is a trust which offers exposure to the valuation opportunity. The Tokyo-based managers look for companies with quality characteristics such as greater margins of safety, fewer tail risks, less volatility and more resilient earnings while also having management teams who can navigate uncertain futures and capitalise on presented opportunities. All of this is sought at attractive prices. The managers will not look to overpay for companies and have used the recent market pullback to buy fundamentally sound businesses at depressed valuations.

Whilst over half the fund is in large companies, the trust does have an overweight to small- and mid-cap names versus its benchmark. This gives the trust a balance of domestic companies that can benefit from an economic rebound and larger multinationals that can capitalise on the currency differential. AJIT currently trades on a discount of 17.4%.

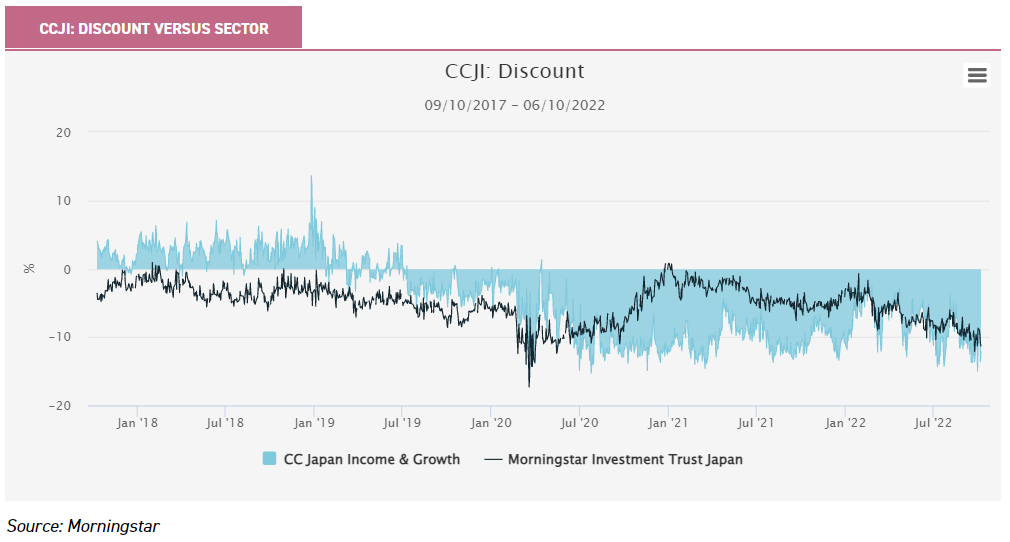

Another Japanese name to consider could be CC Japan Income & Growth Ord (LSE:CCJI). The trust focusses on Japan’s corporate leaders, many of which will be the largest and longest-standing companies in the market. The trust has one of the best track records in the sector, offers a compelling yield and is currently trading on a discount of 12.1%, not far off the widest point of its long-term history.

Whilst the managers have a focus on individual stock-picking, the trust does hold a number of names that are beneficiaries of a weaker yen – such as Toyota, the world’s largest producer of automobiles. Beyond just this simple translation effect, though, the team believe the company to have strong fundamental drivers, dominating the hybrid-vehicle market after reaping the rewards of a year of investment in advanced technologies.

Europe should also benefit from a weakened dollar. One of the root causes of the dollar’s strength stems from the impact of the war in Ukraine. Should this move towards a resolution, not only would the drivers of US$ demand possibly fall back, but there would be increased confidence in the region. There is very obviously a difference between causation and correlation, but this would create an unquestionably favourable outcome for the continent. Additionally, the eurozone is a net energy importer, so any bounce in its currency would benefit its current account and the fiscal situation of many governments.

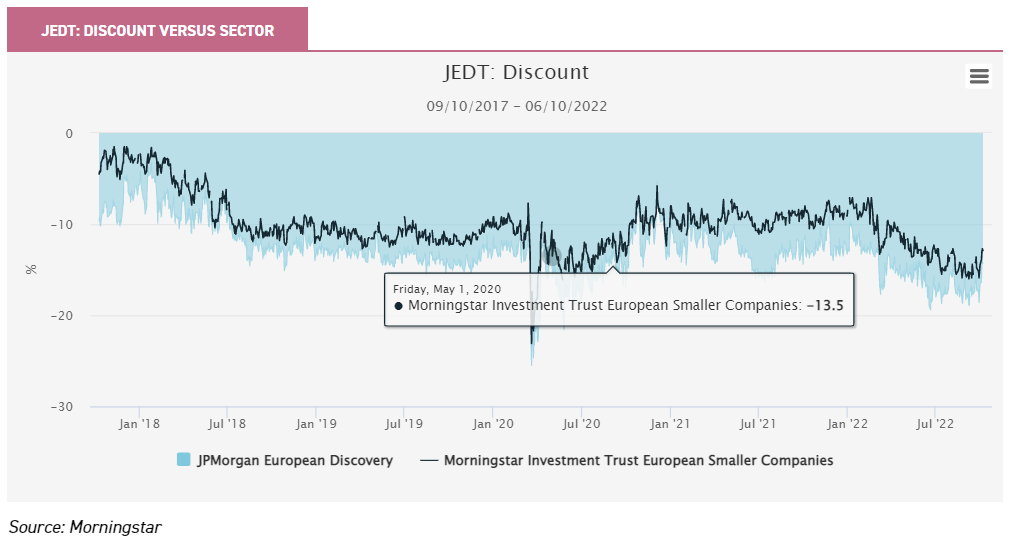

JPMorgan European Discovery Ord (LSE:JEDT) invests in small and mid-sized companies from across Europe. Due to their size, these companies are likely to have a focus on domestic demand and would therefore benefit from the easing of pressure on the European consumer, as well as from an improvement in sentiment across the continent. The managers invest in high-quality companies trading at attraction valuations, which they believe are best positioned to absorb the impacts of high inflation.

The trust has been heavily impacted by the headwinds of high energy prices in 2022, meaning a potential relief there could lead to a recovery in the trust’s NAV. The investment case is further supported by the trust’s wide discount relative to its history of 14.3% (as at 06/10/2022).

Closer to home

One final area that investors could look towards is the UK. UK large caps have outperformed this year as the FTSE 100 has a high proportion of overseas earnings. While the FTSE 100 has fallen 4.1% this year (to 30 September), the FTSE 250, which is an index more reflective of domestic UK stocks, has fallen 24.5%. Should the dollar retrench in our scenarios outlined above, that would imply a rebound in economic activity and corporate earnings and could see risk appetite return to markets. As a result, it could be the higher-risk, more domestic FTSE 250 which outperforms.

Schroder UK Mid Cap Ord (LSE:SCP) has a strong focus on domestic revenue sources from its investment universe of the FTSE 250 (ex ITs), meaning it could be well placed to capitalise. Managers Jean Roche and Andy Brough focus on bottom-up stock selection to build a high-conviction portfolio of companies with stable growth prospects run by excellent management teams.

Presently they have a large exposure to the industrial and consumer discretionary sectors that would be set to benefit from a recovery in UK industry and sentiment which a turnaround in the macro picture would provide. As a result of the negative sentiment at the moment, the trust has fallen to a wide discount of 11.9% (as at 06/10/2022), which may add to its appeal for some at this entry point.

Conclusions

Over the long term, we believe markets should follow fundamentals rather than currencies. However, so extreme has been the move in the dollar this year that we think it is prudent to be protected against a reversal. In our view dollar weakness is most likely to be accompanied by an improvement in the economic outlook and a lower discount rate on earnings, and therefore equity trusts could be a good way to achieve this protection. We think the discounts available on investment trusts provide an extra margin of safety, which makes them a good way to achieve this.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.