Investment Pathways: fund choices from interactive investor

We unveil our fund choices for the four new investment options open to pension savers entering drawdown.

13th January 2021 10:01

by Rebecca O'Connor from interactive investor

We unveil our fund choices for the four new investment options open to pension savers entering drawdown.

From February 1, hundreds of thousands of people turning 55 this year and entering the “drawdown” phase of their pension saving will be met with four new investment options for their pension pot.

The new initiative – ‘Investment Pathways’ (see notes to editors) from the Financial Conduct Authority, is designed in part to address concerns that people entering or in retirement are placing their funds into cash and missing out on years of investment growth in the process, leaving themselves at greater risk of running out of money in retirement.

It is also designed to increase engagement with pensions and to reduce the risk of non-advised people being enticed into making potentially risky investments with their defined contribution pension.

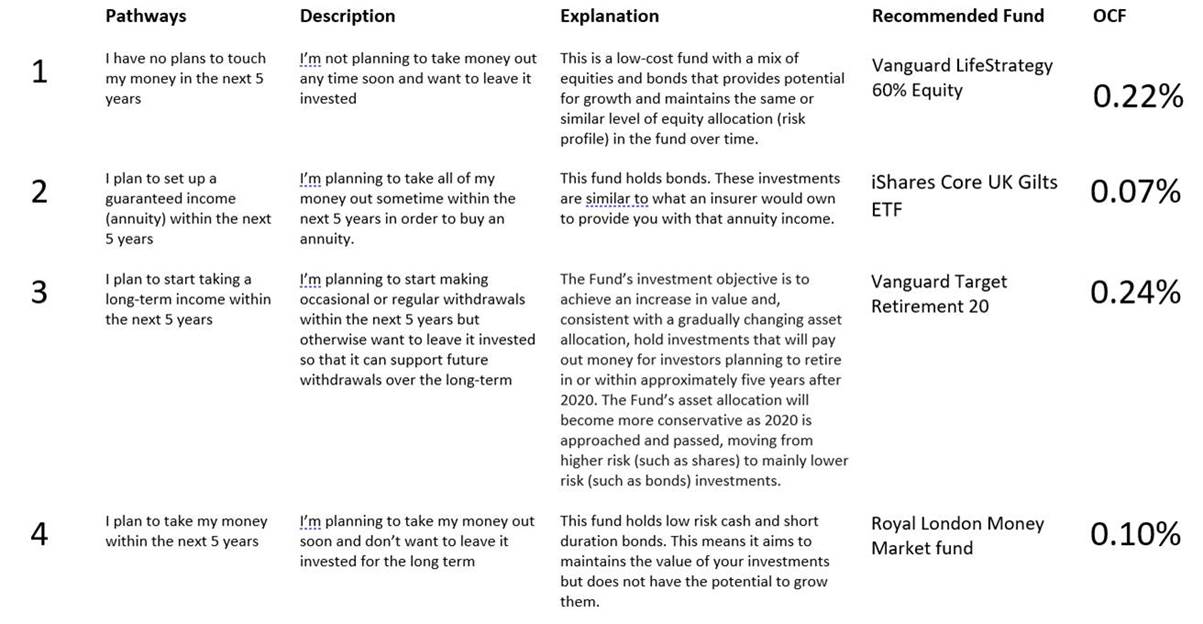

Interactive investor today (Wednesday 13 January) unveils its fund choices for the pathways, available on the platform from February 1:

Pathway 1:Vanguard LifeStrategy 60% Equity

Pathway 2:iShares Core UK Gilts ETF

Pathway 3: Vanguard Target Retirement 20

Pathway 4: Royal London Money Market fund

Commenting on the launch, Becky O’Connor, Head of Pensions and Savings at interactive investor, said: “A reluctance to leave the comfort of cash is ironically one of the biggest risks to pension pots for those approaching retirement, as it can result in the loss of thousands of pounds of potential investment growth.

“The Investment Pathways initiative could help coax people out of cash, but at minimal risk. Over time, it may encourage people to take more interest in where their pension is invested. With people working for longer, it’s more important than ever that people don’t de-risk their portfolios too early – retirement pots must be built to last. At the moment, with interest rates so low, far too many are being eroded by inflation.

“We see Investment Pathways as an important middle ground for people approaching drawdown who are daunted by risk and investment choice. There may be some difficulty in choosing between the four options, as people in their mid-fifties might not yet be clear on what their retirement plans are. They are still some years away from full retirement, after all, and won’t want to make the wrong choice. So even with these supposedly simpler options, there is likely to be some confusion and hesitation.

“We don’t expect to see huge uptake from interactive investor’s existing customer base. They are largely self-directed investors who enjoy the choice, freedom and control over their own investment portfolios. Investment Pathways is likely to be ignored by these, more experienced investors. But for new pension investors coming to the platform, Pathways could act as a valuable bridge.”

ii already provides great value, flat-fee pricing for customers of £19.99 a month. This pricing lends itself to customers who are more actively engaged with their investments. The average amount of SIPP holdings going into drawdown on the platform is £300,000+.

Interactive investor Investment Pathway fund choices

The pathways wereselected as best-in-class options, on a whole of market basis. This resulted in us having selecting funds from three different fund houses.

Pathway 1: Vanguard LifeStrategy 60% Equity Acc

A low-cost fund with a mix of equities and bonds that provides potential for growth and maintains the same level of equity allocation (and the same risk profile) in the fund over time.

Reasons for our choice:

• No plans to touch money in next five years, investor remains invested.

• The manager of the investment fund will keep the level of fund “relative risk” constant at 60% of the risk of global equities.

• Neither Pathway Objectives nor fund objectives explicitly reference future withdrawals so this approach is a valid option for this pathway

• Simplicity of offering single fund per pathway is an advantage for customers

• Lower cost owing to 1) fixed asset allocation; 2) use of index funds including in-house fund; 3) higher economies of scale: provides excellent value for money.

• Vanguard are already a very popular option with our customers and many are already invested in the LifeStrategy range, making it an obvious follow on fund for customers who are not looking to touch their money for the next five years.

• From a suitability point of view, the fund meets all the requirements of the pathway objective and its long-term performance is exceptional. It is also likely to be owned by customers who are looking for a one-stop shop and therefore there is huge consistency and awareness of the fund that is likely to be of benefit to customers.

Pathway 2:iShares Core UK Gilts ETF GBP

Reasons:

• For investors planning to take all of their money out sometime within the next 5 years in order to buy an annuity.

• Recommend a bond fund to match the type of assets that insurers use to fund the annuity payments they make to their customers.

• Duration similar to that of all gilts index which in turn is similar to that of the 15 year reference gilt yield that is used for GAD rates and annuity prices.

• Corporates were a possibility, but bearing in mind a recessionary environment, gilts are a more risk-averse option.

• An index-tracking GBP currency-based bond fund is appropriate

• Excellent value for money

• Advantages of an index-based approach are: diversified, transparent, liquid, low-cost and targeted exposure

Pathway 3: Vanguard Target Retirement 2020

Reasons:

• Investor remains invested. This is critical to being able to derive a long-term sustainable income from your investments

• Simplicity of offering single fund per pathway is an advantage for customers (requires lower level of engagement which is assumed to be the target for this cohort)

• The mandate of the fund is specifically to reduce risk over time, which is suitable for this self-selecting cohort of investors who are looking to start taking an income from their portfolio over the next five years

• Lower cost owing to use of index funds including in-house fund and higher economies of scale: provides excellent value for money.

• Vanguard are already a very popular option with our customers, and while this TRF may be a new concept for investors, the trusted name will make it easier for an investor to consider.

• The long-term performance of the fund is good, though a comparison is difficult bearing in mind the lack of competitors. It is comparable with the Vanguard LifeStrategy 40%, which has a percentile ranking of 2 over three and five years.

• The risk of set-and-forget investors is minimised with a glide path strategy.

• Accumulation is about growing a pot, and uses an asset-optimised approach, while decumulation is about making it last, and uses a liability-relative approach. These investors have actively chosen a pathway that states they are looking to take an income from their SIPP in the next five years, so we believe this is the best solution available for this pathway.

Pathway 4: Royal London Money Market

Reasons:

• More than 75% of our investors who have taken all the money from their SIPP have done so within the first year, meaning that cash is an appropriate option

• Simplicity of offering single fund per pathway is an advantage for customers (requires lower level of engagement which is assumed to be the target for this cohort)

• The mandate of the fund is to deliver capital preservation net of fees, which is the only appropriate mandate for a group of customers who may take all their money within 12 months.

• It has low fees and is a first quartile performer over the short and long term.

• A money market fund is likely to be easily understood and relevant for this cohort of customers.

• If the time horizon of our investors had been longer, then we would have chosen a gilt fund.

• There is a risk of set-and-forget investors being in ‘cash’ if they remain in this pathway for 5 years, let alone 10-15 years. However, customers will receive updates from ii during the period.

• Investors choosing this pathway are making a conscious choice and it will be clearly communicated that this is not a good long-term solution

• We are aware that the FCA do not want cash as an option for the pathways, but our data is supportive of this choice given our primary objective is capital preservation and the risks that being invested can pose if you do not have a sufficient time frame to recover.

• In the current low-rate environment, ii is mindful of the fact that money market funds may not be able to deliver positive returns. We have chosen the money market fund with the lowest charges and best performance but will be keeping a close eye on the return of the fund to ensure it retains a positive net return.

Dzmitry Lipski, Head of Fund Research at interactive investor, said: “We are mindful that there may be investors who are less engaged with their investments and therefore, as part of the investment pathways strategy, our objective is to choose appropriate funds for each pathway from the whole of market and to provide excellent value for money with appropriate risk levels.

“We want to make sure these choices are clear, fair and not misleading for customers, so the rationales are jargon-free and explain clearly why we have chosen these funds, their suitability and risks.

“While the funds themselves are designed to be a ‘buy-and-forget’ range for less engaged customers, it is still the intention of the business to actively support customers and communicate with them so that they achieve the best outcome for their circumstances and needs. These selections will be kept under review.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.