Interest rates held again: prepare your portfolio for the next phase

As the base rate remains unchanged at 5.25% for a second successive time, it’s a good opportunity to make sure your portfolio is well placed to navigate the ‘higher for longer’ interest rate environment.

2nd November 2023 14:04

by Craig Rickman from interactive investor

The Bank of England (BoE) has kept interest rates on hold for the second successive time but has left the door open for renewed rate hikes should high inflation persist.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

The UK central bank’s rate setters voted by a majority of 6–3 to maintain the base rate at 5.25%, with the three outliers preferring a 0.25 percentage point hike to 5.5%. This followed the US Federal Reserve’s (Fed) decision yesterday to hold interest rates at a benchmark range of 5.25% to 5.5%, a 22-year high.

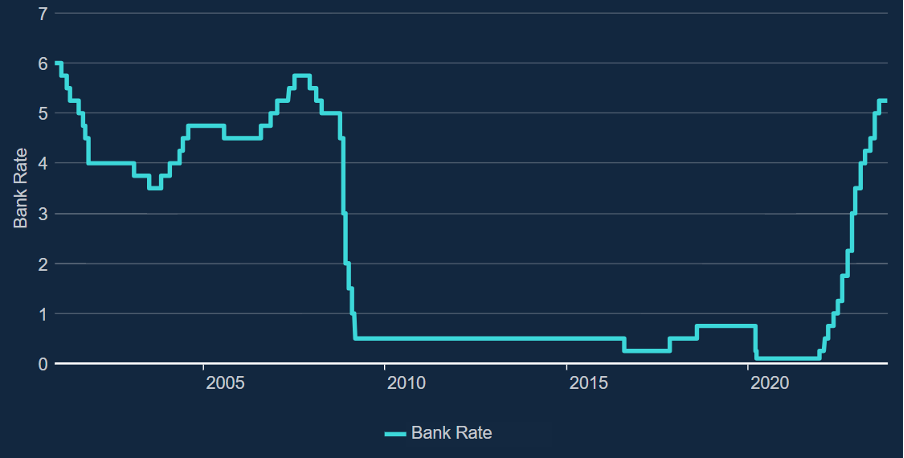

Source: Bank of England (November 2023)

Central banks on both sides of the Atlantic face a tricky balancing act right now. Despite easing throughout the year, inflation still poses a major headache in the UK and the US.

In September, the UK consumer prices index (CPI) remained at 6.7%, slightly higher than expected, while US inflation also came in hotter than forecast at 3.7%. However, core inflation – which excludes energy and food sectors – nudged down from 4.3% to 4.1%.

Hiking interest rates is seen as the most effective tool to tame price rises, but the BoE and the Fed are wary about how high borrowing costs could damage their respective economies.

While the prospect of further rate rises is still firmly on the table, the era of aggressive hiking now seems behind us. That said, BoE governor Andrew Bailey stressed it’s too early to get complacent about inflation, and “it’s much too early to be thinking about rate cuts”. The message is that interest rates will be ‘higher for longer’.

So, as we head deeper into the next phase of the interest rate cycle, now is a good time to examine whether your portfolio is suitably positioned for what’s in store. Here we explore what’s going on with shares, bonds, and cash.

Shares

Stock markets and interest rates typically have an inverse relationship. When rates increase, share prices struggle, helping to explain why markets have experienced a rough ride this year.

At the time of writing, the FTSE 100 was only marginally lower than where it started the year, sitting at 7,450 points. The path, however, has been choppy. After hitting an all-time high in February - breaching the 8,000-point mark for the first time in its history - the UK main market briefly tumbled close to 7,200 in July and again in August.

Since the rate hike cycle started, some parts of the UK market have fared better than others, as Kyle Caldwell, collectives editor at interactive investor, notes: “Over the past two years of interest rate rises, UK mid and smaller companies have come under pressure. A key reason is that smaller company shares are more domestically focused than the mega-caps in the FTSE 100 index, which generate most of their earnings overseas.

“Due to being more domestic, a slowdown in consumer spending is a headwind. This is reflected by, in share price terms, the FTSE 100 index gaining 4.4% over the past two years versus declines of 21.8% and 19.4% for the FTSE 250 index and FTSE All-Share index.”

- The four stocks with yields above 8% about to pay dividends

- The Income Investor: don’t underestimate the value of dividend growth

But now that it appears rates have peaked, the outlook for UK shares looks more encouraging. Kyle wrote an article on this subject in September in response to the BoE’s previous rate pause. Here’s an extract:

“The peaking of the interest rate cycle could spark a turnaround in fortunes. Data from Martin Currie shows that when interest rates peak, it has historically led to notable outperformance for mid-cap shares.

“Its research found that between 1985 and 2022, the average FTSE 250 index return after rates peaked was 12.3% over one year (2.1 percentage points ahead of the FTSE All-Share Index); 20.3% over three years (5.5 percentage points); and 31% over five years (10.9 percentage points).”

Bonds

Just like shares, bonds also have an inverse relationship with interest rates. Rising interest rates make the fixed rates offered by bonds less attractive. And bonds have indeed struggled in the past couple of years in response to rate hikes. In fact, 2022 was the worst on record for the US bond market, though a rebound has ensued so far in 2023.

Sam Benstead, ii’s deputy collectives editor and bonds expert, explains how the lead up to today’s decision has impacted the UK bond market.

“Bond prices are extremely sensitive to interest rate changes, and importantly, expectations about where interest rates will be in the future. Gilt yields fell, which is a result of bond prices rising, in the run-up to the rate decision, as investors bet that the BoE would follow the Fed and pause interest rate rises.

“The yield on the 10-year gilt has dropped from 4.6% to 4.4% this week, while the two-year gilt yield has fallen from around 4.8% to 4.7%.”

- Bond Watch: Bill Ackman thinks bonds are finally ready to rise

- Benstead on Bonds: the bond crash has broken records – is it finally time to buy?

Sam says the bond market reaction was subdued following today’s news, as the BoE delivered what investors had expected. The question investors are grappling with now, according to Sam, is whether the BoE will raise rates again, how long rates will stay high for, and whether they will fall next year to stimulate economic growth.

“Much depends on the inflation rate and how healthy the economy is, with a scenario of low growth or recession, coupled with falling inflation, the most likely to lead to a cut in interest rates. If inflation stays high, then that would put pressure on the BoE to keep interest rates elevated, even if the economy is struggling.”

Cash

Improved returns on cash savings has been a bright spot of the rate hike cycle. For more than a decade, banks offered paltry interest rates to savers, with the UK base rate languishing at all-time lows.

But with interest rates rocketing from 0.1% to 5.25% between December 2021 and August 2023, you can now earn north of 6% on your savings if you’re prepared to tie the money up for at least a year.

Even some current accounts now pay you more than 4%, a promising development in the fight against the ongoing cost-of-living crisis. But you may have to shop around to find the best deals.

- The highest-yielding money market funds to park your cash in

- Funds and trusts with yields above 5% that are also top performers

However, there are signs that savings rates may have peaked, underscored by NS&I’s decision to pull its one-year bonds after demand went through the roof.

Myron Jobson, interactive investor’s senior personal finance analyst, says: “Those who have been waiting to nab a top savings deal might want to get a move on as the very best deals may not be around for much longer.”

How much cash to hold is a key decision for investors right now, and it’s one that requires some thought. On one hand, as noted above, cash rates have improved dramatically. But on the other, even the best rates still lag inflation. That said, if inflation falls sharply between now and 31 December, which the BoE expects it to, the top rate savings accounts could begin to outstrip inflation.

However, when saving and investing for the long term, more volatile assets, most notably shares but also bonds, tend to outperform cash. So, if your investing goal is still many years away, the stock and bond markets should prove better horses to back.

As always, diversification is your friend. When constructing your portfolio with a mixture of long-and-short-term positions it’s vital to make sure you spread your risk across varying asset classes, sectors, and geographies. This means that should some parts of your portfolio struggle, others will be there to prop them up.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.