interactive investor widens reach as best value provider

31st July 2023 07:24

by Jemma Jackson from interactive investor

interactive investor is cutting trading fees by a third.

- Market leading: trading fees cut by a third to £3.99 on funds, trusts, UK and US trades

- Non-US overseas trades slashed by 50% to £9.99

- ii’s £4.99 starter price plan, Investor Essentials, expanded for customers with assets up to £50,000 (currently £30,000)

- ii’s core Investor price rises to £11.99 per month (from £9.99)

- Subscription fees on all other price plans unchanged

- Friends and Family referral scheme, previously an extra £5 per month for Investor price plan customers, now free for up to 2 members

interactive investor, the UK’s second-largest investment platform for private investors and number one flat fee provider, is cutting trading fees by a third.

- Invest with ii: Open a Low Cost SIPP | What is a SIPP | Interactive investor Offers

ii will introduce amarket leading ultra-low trading fee of £3.99for funds, ETFs, investment trusts and UK/US trades.

Simplicity and impartiality continue to be front and centre of ii’s proposition. With a flat monthly platform cost and the same trading fees for UK/ US shares, funds, investment trusts and ETFs, customers can choose the right investment for them.

The changes will apply across all ii’s service plans, with a raft of wider changes, all coming into effect from 1 September 2023.

At the same time, after keeping the flat monthly fee unchanged for four years, ii has increased the Investor (£9.99) subscription plan by £2 per month, (£11.99).

The subscription fees on all ii’s other price plans, including its £12.99 per month Pension Builder plan and £4.99 Investor Essentials price plan, are unchanged.

Broadening access to lowest-cost plan

ii has also broadened its fantastic value, entry-level Investor Essentials price plan (£4.99 per month) to more customers, extending the assets cap to £50,000 from the current £30,000.

ii will move tens of thousands of qualifying customers that it calculates will be better off in Investor Essentials on to this lower cost price plan, which comes with the same full fat range of choice.

Unambiguously the best value

Even with the adjustment on ii’sInvestorprice plan, all these changes combined mean that interactive investor is now unambiguously the best value provider among the major platforms for people with assets of £15,000 upwards.

That’s according to calculations by financial services consultancythe Lang Cat, assuming a 50/50 equities/fund split and an even number of fund/equity trades (see assumptions below).

The changes come at a time when ii has rapidly cut trading costs. Only five years ago ii charged £10 per trade, reducing to £7.99 in 2019 and £5.99 in 2020, and down to £3.99 from 1 September 2023. That’s a 65% decrease in five years.

Richard Wilson, CEO, interactive investor, says: “These adjustments reflect our relentless drive to innovate and bring unrivalled value, choice and the best customer experience to the UK. It means our great value platform is now accessible to even more investors.

“When we last repriced four years ago, we were the best value major platform for people with more than £50,000. From September, we are best value from £15,000 upwards, and the more you invest, the bigger the savings because of our flat fee.

“As part of the changes we have increased our monthly subscription fee in our Investor price plan, introduced free friends and family accounts and reduced trading commission again to make investing as friction-free as possible.

“At the same time we are moving tens of thousands of qualifying customers in our Investor price plan on to our lower cost £4.99 per month Investor Essentials plan, having extended this package out for more customers.

“Taken together, these changes will make ii the go-to platform for more investors than ever.”

Trading fees in detail

From 1 September 2023 customers will see trading fees slashed to just £3.99 for funds, ETFs, investment trusts and UK/ US trades. That’s a 33% trading fee reduction across ii’s Investor, Investor Essentials, and Pension Builder range. This £3.99 trading fee will apply to all price plans.

Customers on Investor/Super Investor will continue to receive free monthly trade(s).

International (ex US) trades have been slashed by 50% to just £9.99 across lower cost and core price plans, while Super Investor customers will continue to pay a lower rate of £5.99.

Supporting a new generation of investors

ii’sFriends and Familyreferral scheme, previously an extra £5 per month for Investor price plan customers, is now free for up to two members. The scheme allows ii customers to gift a free ii subscription to family members.

This referral scheme means more people can get started on their investment journey with a trusted and familiar platform, with the same full range of investment options that is available to all ii customers.

The offer comes with free regular investing, the full range of investments, and has to date been particularly popular with younger customers, with a majority female take up.

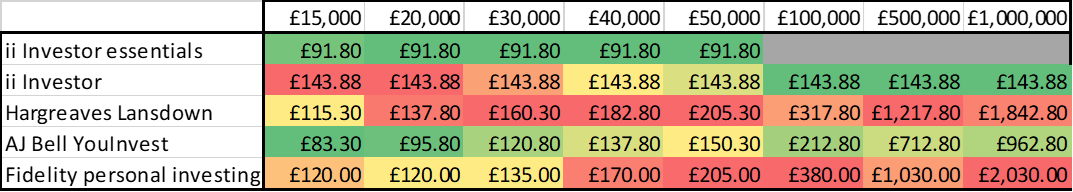

The Lang Cat pricing comparisons (moderate trading) – costs over a year in an ISA

Based on a portfolio with 50% funds and 50% direct equities (or investment trusts), with 4 fund trades and 4 equity trades. No regular investing.

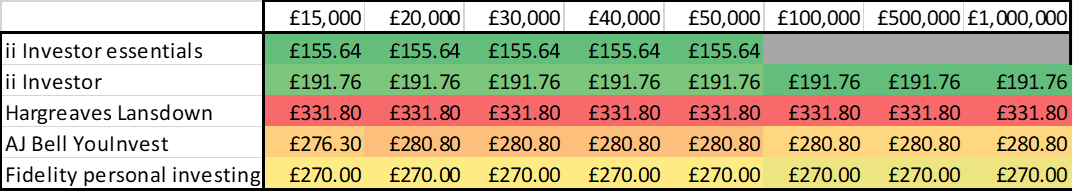

The Lang Cat pricing comparisons (for more active equity traders) – costs over a year in an ISA

Based on a portfolio that is 100% direct equities (or investment trusts), with 24 equity trades. No regular investing.

Steve Nelson, insight director, The Lang Cat, says: “Clearly, investors need to take their own circumstances into account, however, with this reprice, interactive investor looks like it is going to be much more attractive to a lot more investors. This is a significant move by interactive investor that suddenly makes them more attractive on price to a much wider audience.”

Jeremy Fawcett, head of Platforum, says: “These changes from interactive investor firm up the extra rung on the bottom of the ladder, opening up ii’s flat fee model to more investors.

“This is essentially about behavioural economics. Flat fees clearly benefit people with larger pots but that may be a future consideration for people starting their investment journey.

“Customers are sticky, so you need to get them to make a decision early on. This reprice builds a competitive offering early on in the investment journey.

“It has been a price inelastic market, but the likes of interactive investor and Vanguard are opening up awareness of choice around cost, and it’s disruptive.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.