interactive investor launches new Managed ISA

Investment platform continues to broaden reach as best value for every type of investor.

15th May 2024 10:46

by Camilla Esmund from interactive investor

interactive investor (ii), the UK’s second-largest investment platform for private investors and leading flat-fee platform, has launched the ii Managed ISA – adding a whole new dimension of simplicity, convenience, and value to the UK investing landscape.

ii Managed ISA is available to existing ii customers from today (15 May 2024), and available to new ii customers from Monday 20 May 2024.

- With the new ii Managed ISA, customers can choose expertly curated portfolios that match the level of risk they’re comfortable with and that suit their investment goals.

- There is no separate management fee – the ii Managed ISA is available within ii’s existing flat-fee subscription-based charging model.

- The portfolios – exclusive to the ii Managed ISA – are designed to keep fund charges low, making them outstanding value for investors.

- ii customers can have the best of both worlds – in addition, they can choose to manage their own investments alongside the ii Managed ISA at no extra cost (within the same flat subscription fee).

The ii Managed ISA is a great way for new investors to kick-start their investment journey. It is also well suited for investors who do not feel confident in picking or managing their own investments and want the reassurance of access to a trusted platform, and experts managing their investments for them.

Richard Wilson, chief executive, interactive investor, says: “We are always looking to do more for investors, and our new Managed ISA will be a game-changer for the many who want some support in choosing and managing their investments, or perhaps just want that extra level of convenience.

“We want to provide investors with a choice of investments to suit different needs. Manage your ISA investments yourself, have them managed for you – or have a mix of both. All at great value.”

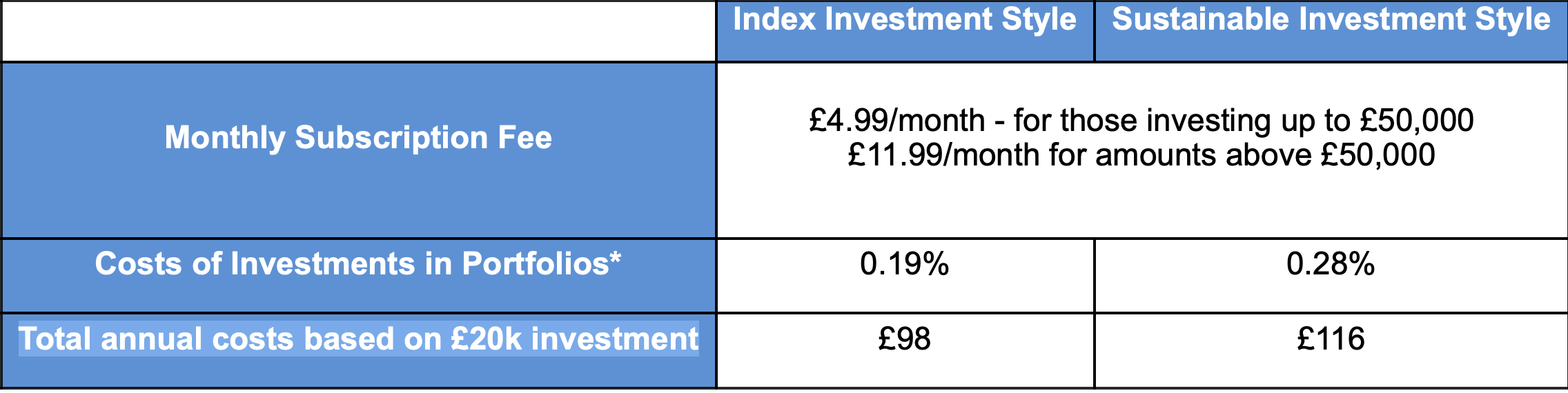

ii Managed ISA: cost breakdown

*Based on ii Managed ISA mid risk balanced portfolio. Includes OCF and Transaction Charges.

Convenience and expertise at unparalleled value – for every type of investor

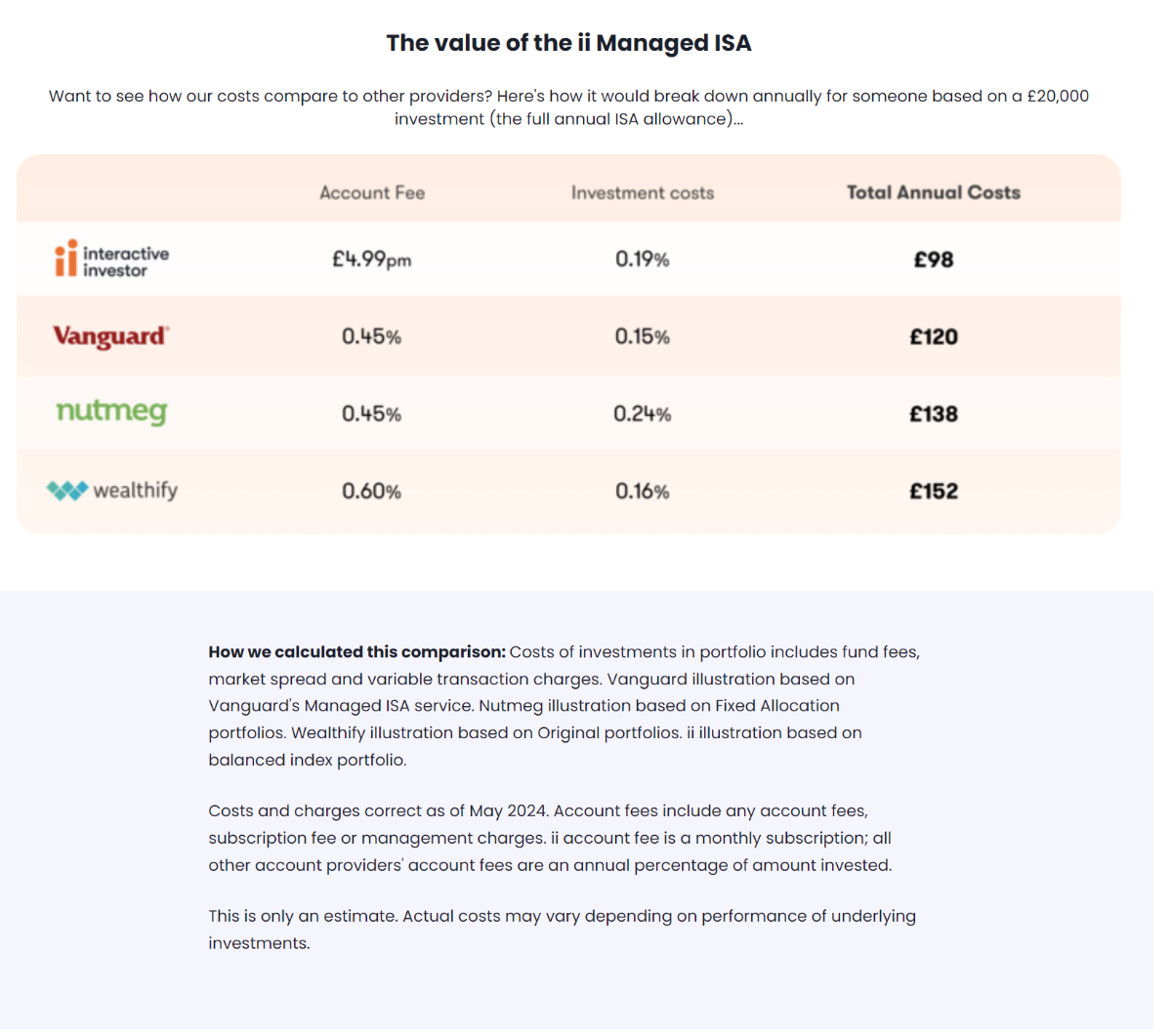

Unnecessary costs can stifle investors’ ability to build wealth over time. This is why ii continually advocates for investors to keep a close eye on fees/costs when it comes to investing – especially percentage-based platform charging which takes more of investors’ money as their pot grows.

Richard Wilson, chief executive, interactive investor, adds:“ii Managed ISA customers are much better off than they are with competitors who also have managed ISA propositions like Vanguard, Nutmeg, and Wealthify; saving up to £54 a year on unnecessary fees, and without any compromise when it comes to value and service. Over time, the difference these costs can make to investor outcomes is substantial.”

See table below.

How does the ii Managed ISA work?

ii has made it really simple for investors. Before opening their Managed ISA, they need simply to answer a few questions about how much they want to invest and the level of risk they’re comfortable with – and there is plenty of guidance to help them along this journey.

Based on the risk level and savings goals, they will then be matched to one of the managed portfolios.

All they then need to do is check they’re happy with the portfolio recommended and open their ISA – after which it’s over to the experts to manage.

While there is no minimum investment period, ii’s Managed ISA portfolios are designed for long-term growth (at least five years).

The portfolios have two distinct styles, and five levels of risk to choose from. There are therefore 10 portfolios in total, meaning investors can easily find a portfolio that matches the type of investor they are.

The two styles of investment portfolios are:

- Index investment style: this style aims to keep costs low by not making frequent changes to the investments held. The portfolio invests predominately in passively managed funds and provides exposure to a diversified range of investments.

- Sustainable investment style: this style aims to keep costs low by predominately investing in passively managed funds, in addition to seeking funds that integrate environmental, social, and governance (ESG) criteria into its investment selection. It will also invest in neutral assets such as cash and bonds.

NOTES TO EDITORS

More information about interactive investor’s subscription plans can be found here

ii Managed ISA is available to existing ii customers from today - 15 May 2024 - and will be available to new customers from Monday 20 May 2024.

Disclaimer: both DIY and managed options carry risk – whether you manage risk yourself or choose a Managed ISA, it’s important to know that the value of your investments may go down as well as up. If you are unsure about the suitability of a Stocks and Shares ISA, you should seek advice from an authorised financial adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.