The interactive investor (ii) index: Q4 2024

Seismic shift in private investors’ portfolios delivers strong performance over a five-year investment cycle amid a turbulent backdrop.

18th February 2025 11:16

by Myron Jobson from interactive investor

interactive investor (ii), the UK’s second-largest DIY investment platform, has published the latest instalment of the ii index, which provides a unique insight into how ii customers have fared and positioned their portfolios in the ever-changing investment arena.

The latest iteration of the report now includes five years of performance data, reflecting the minimum recommended time frame for investing.

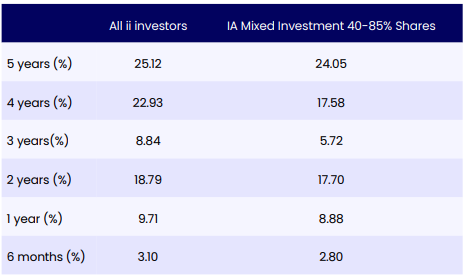

It reveals that the average ii customer performed strongly and above the IA Mixed Investment 40-85% shares sector across all time frames examined.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

The sector can be a useful comparator for private investor portfolios, given its mix of bonds, cash, and equities.

Our latest key findings:

- Over five years (to the end of 2024) the average ii customer has seen their portfolio grow by 25.12%, marginally ahead of the aggregated performance of funds in the IA Mixed Investment 40-85% Shares sector (24.05%)

- The 35-44 age cohort outperformed across most time frames tracked, leading returns over the longest horizons - delivering 31.1% and 23.47% over five and four years, respectively

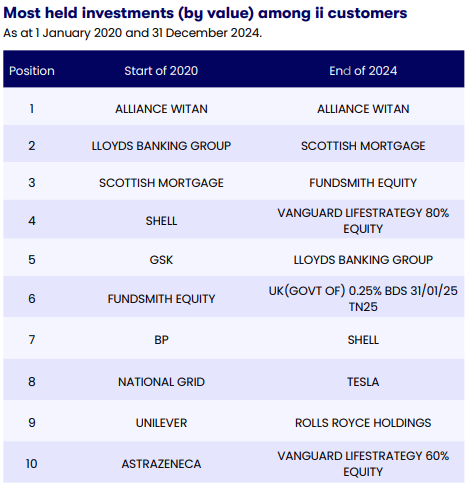

- There has been a pivot away from UK stocks five years on from Brexit

- There were seven UK stocks in the top 10 most-held list at the start of 2020, but the number fell to three by the end of 2024

- Once heavily weighted toward direct equities, the average ii investors have increasingly embraced collective investments

- Equities, which previously accounted for around 40% of the average portfolio, have seen their weighting decline to 33%

- In contrast, ETPs have gained significant traction, with their share doubling from 5% to 10%, while average weighting to funds up from 21% to 27% of portfolio allocations

- Passively managed funds have increased in popularity over the period

- At the same time, bonds (captured in the ‘other’ category) have seen renewed interest, reaching their highest portfolio weighting in recent years

- The report observes little difference between men and women when it comes to investment performance.

You can download the full report here.

Sam Benstead, Fixed Income Lead, interactive investor, says: “With most active fund managers struggling to beat their benchmark index over the past five years—particularly in US and global markets due to the relentless rise of US tech shares - it’s logical that retail investors picking their own stocks may have also faced challenges.

“This could explain the declining allocations to equities over the past five years and the increasing shift towards ETFs and open-ended funds, where passive strategies have been gaining prominence on our regular most-bought lists.

“The growing popularity of passive investments may also help explain outflows from investment trusts, which are actively managed. Disappointing returns in the sector have been exacerbated by widening discounts to net asset values.

“Direct bonds, predominantly gilts, have surged in popularity due to higher interest rates and yields. Investors have been drawn to annualised returns exceeding 4% on gilts, as well as the capital gains tax exemption on gilts. In particular, low-coupon gilts trading below their redemption value have been extremely popular.”

Date | Cash | Equity | ETP | Fund | Investment trust | Other |

01-Jan-20 | 10.30% | 40.40% | 5.30% | 20.70% | 22.40% | 0.90% |

31-Dec-24 | 8.50% | 32.80% | 10.30% | 26.60% | 18.10% | 3.70% |

Average asset portfolio weightings among ii customers by the end of 2024. Source: interactive investor.

Source: interactive investor.

Myron Jobson, Senior Personal Finance Analyst, interactive investor: “Our report provides unique insights into how private investors have performed and positioned their portfolios over a five-year investment cycle - one that has been anything but ordinary. The past five years have tested investors like few periods before, with the Covid-19 pandemic, the cost-of-living crisis, geopolitical tensions, Brexit and political instability across the globe all shaping market conditions.

“Yet, despite these challenges, investors have shown remarkable resilience, adapting their strategies and, in many cases, delivering strong performance against this turbulent backdrop. Our study sheds light on the key trends that have driven returns and how different investor groups have navigated the highs and lows of a truly eventful period for markets.”

Performance data to 31 December 2024. Source: interactive investor/Morningstar.

Notes to Editors

ii customer performances quoted are median values to avoid the influence of outlier performance skewing the data.

The performance is calculated using the Time Weighted Rate of Return with returns calculated before each money transaction, then the results compounded over the reporting period. The time-weighted rate of return (TWR) is a measure of the compound rate of growth in a portfolio. It eliminates the distorting effects on growth rates created by inflows and outflows of money.

Then median averages are calculated independently for each group we analysed – so that outlier performances did not skew the results.

Index performance, unless otherwise stated, is ii using Morningstar, total return in GBP, to end December 2024.

Portfolio values under £20,000 were stripped out to keep the sample representative of ii’s core customer base.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.