Insider: heavy buying at two FTSE 100 companies and this small-cap

It’s not been the best time for shareholders at these three companies, but stakebuilding by directors might indicate better times ahead.

27th November 2023 08:43

by Lee Wild from interactive investor

New chiefs at consumer goods giant Unilever (LSE:ULVR) spent big bucks on stakes in the business last week, betting that between them they can restore the reputation of the company behind Ben & Jerry’s ice cream, Lynx deodorant and Dove soap following a difficult couple of years.

Biggest purchase was by Serrie Meakins on Wednesday 22nd. Meakins is an 'associate' of Ian Meakins, the current chair of Compass Group who was appointed non-executive director and chair designate of Unilever in September. He takes up his position officially in December.

Meakins coughed up £994,965 for 26,036 Unilever shares at £38.215 each.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

On the same day in Amsterdam, Unilever chief executive Hein Schumacher spent €61,858 on 1,411 shares at €43.84 each.

The Dutch businessman, who began his career as a finance manager at Unilever before moving on, was named the next CEO in January before taking the helm in July. His return followed the retirement of Alan Jope after 37 years at the business, marred in recent years by poor share price performance and a failed £50 billion bid for GSK's consumer healthcare division at the start of 2022.

Schumacher’s share purchase comes just weeks after the company decided to freeze his basic pay for the next two years. That followed a revolt at the AGM in May, when 58% of shareholders voted against the remuneration report.

They objected to the approach taken to setting Schumacher's remuneration on appointment. Most agreed that the salary was fair but thought that alignment with the market could have been achieved gradually, rather than giving everything in one go. Schumacher’s next salary review won’t be until 2026.

Gambling on drugs that work

Another FTSE 100 chair had their buying boots on last week. Michel Demaré paid over £200,000 for 2,000 shares in drug giant AstraZeneca (LSE:AZN), half at £101.05 and the other half at £101.70.

Much like Unilever, Astra shares trade near a 12-month low, and the Swiss national will hope that fortunes start to improve. Astra shares slumped in the middle of October following disappointing data from a late-stage trial for use of its experimental precision drug in lung cancer patients.

That followed a similar slump in July when the company said the same drug, datopotamab deruxtecan, slowed the progression of lung cancer but not by as much as hoped.

Demaré has sat on the Astra board since becoming a non-executive director in 2019 and was named Leif Johansson’s successor in July 2022. Demaré took up his new role at the conclusion of Astra’s Annual General Meeting at the end of April.

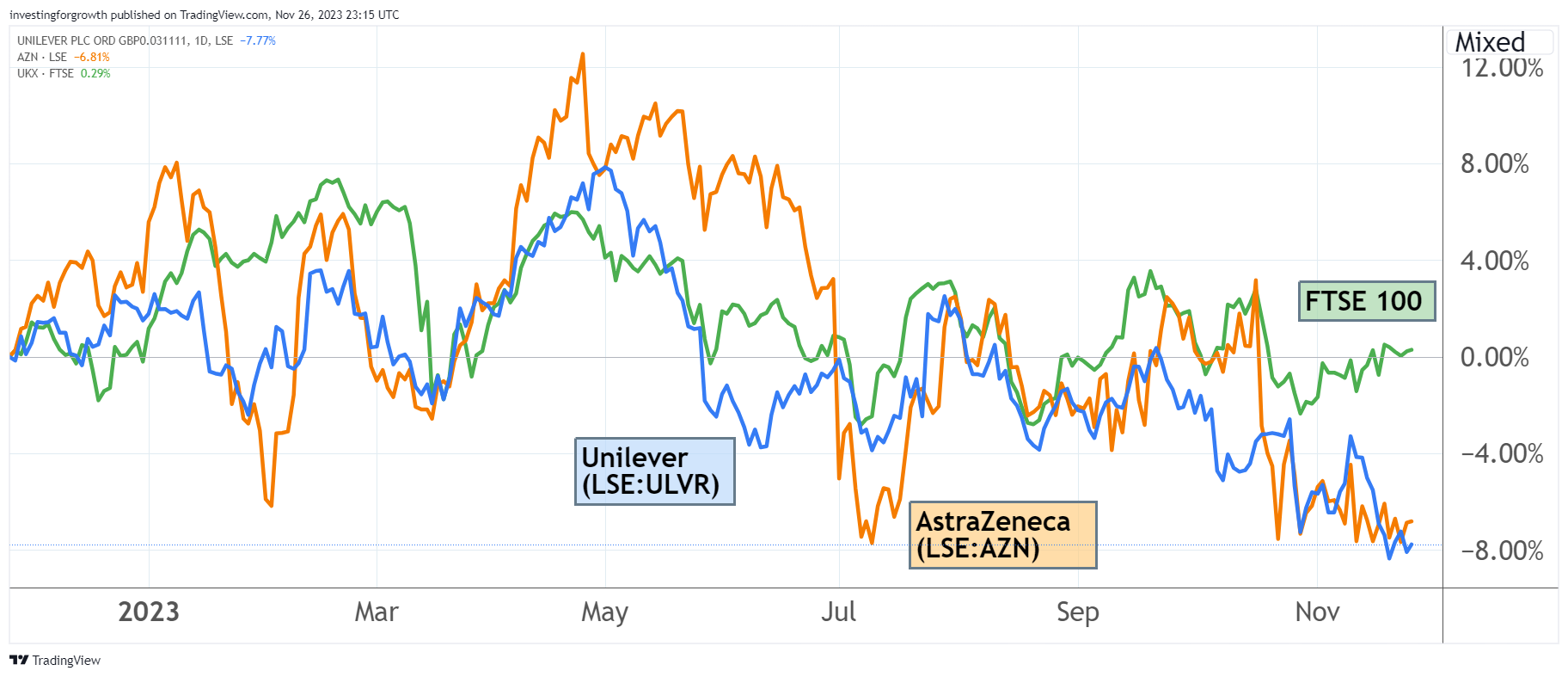

Source: TradingView. Past performance is not a guide to future performance.

A small-cap fixing its problems

Further down the stock market food chain, there have been much better returns for shareholders in recent weeks, with nuts, bolts and screws maker Trifast (LSE:TRI) up 15% since early November.

A trading update late October, ahead of this month’s half-year results, flagged weaker revenues due to lower demand at the health & home business. But there’s been a better reaction to the actual results published on Tuesday last week.

Revenue for the six months to 30 September was down a touch, but underlying operating profit rose 11% to £6.9 million, and margin increased by 60 basis points to 5.8%, with further self-help planned by new boss Iain Percival and his team expected to drive further improvement. Net debt also fell during the period.

- Five outperforming AIM shares that could keep rising

- Stockwatch: a cheap quality share predicting strong sales growth

- Sector Screener: two dirt-cheap stocks to buy low and sell high

Analysts at Cavendish have trimmed some forecasts given a more cautious view of macro conditions plus higher interest charges. But their price target of 100p still implies room for significant upside.

“The shares offer a turnaround story with a greater focus on internal operating efficiencies and cash generation,” say the broker. “Over the next few years, we see a strong investment opportunity, as operational delivery is proven and growing investor confidence confers a higher PE rating.”

A couple of days after the results, non-executive chair Serena Lang, who joined the company in August, spent over £100,000 on Trifast shares. In her maiden purchase, she bought 137,032 of them at 73.28p.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.