Inflation watch: savings rate shortfall widest since January 2020

Savers have been dealt another blow as inflation rises again – but it’s not all bad news.

19th May 2021 15:00

by Sam Barker from interactive investor

Savers have been dealt another blow as inflation rises again – but it’s not all bad news.

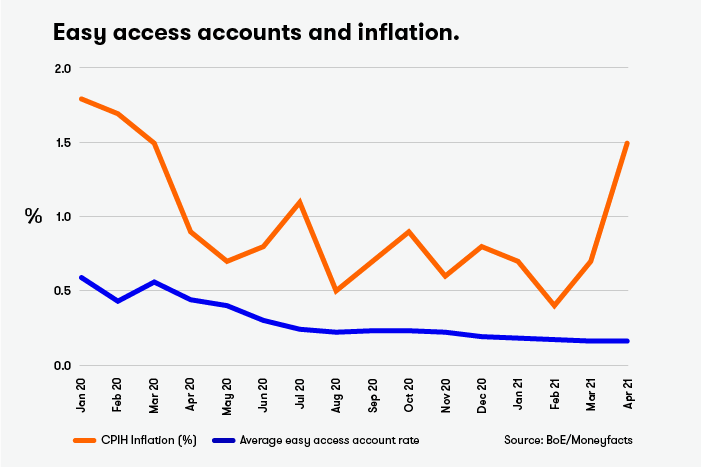

Inflation is the enemy of the saver, especially when it's impossible to find savings deals that beat it. Some of the most popular savings deals are easy access accounts, but the average deal doesn't come close to beating inflation - which is set to soar further this year.

This is the third article in a monthly series that will examine the effect of inflation on your savings.

Savers have been left high and dry as a surprise hike in the cost of clothes and energy means no savings deals currently beat the rate of inflation.

Inflation was 1.5% last month, according to latest figures from the Office for National Statistics (ONS), up from 0.7% in March.

The ONS said easing lockdown rules and shops reopening on 12 April led to a rise in the cost of clothes and shoes. Gas and electricity prices rose because the energy regulator allowed providers to increase their tariffs last month, and petrol costs increased in line with rising oil prices.

However, no savings deals in April paid more than 1.5%. This means cash held in any new savings deals will lose spending power over time.

Rachel Springall, of Moneyfacts, said: “The current level of inflation will make a clear impact on savers, as unless they have their cash already stashed away in a fixed rate account that can beat it, the spending power of their cash has been eroded in real terms.”

The typical easy access savings deal paid just 0.16% last month, the same as in March, according to financial experts Moneyfacts.

Easy access deals are popular with savers as they allow quick withdrawals of cash. But the top easy access account, from Atom Bank, pays a meagre 0.5%.

The chart below shows the widening gulf between inflation and the typical easy access deal – the widest since January 2020, before the pandemic took hold.

Experts worry that inflation outstripping savings rates will mean more consumers are taken in by fraudulent deals with enticingly inflated interest rates.

Myron Jobson, personal finance campaigner at interactive investor, said: “The worry is the paltry savings rate offered by banks and building societies because of rock bottom interest rates will drive people towards ‘too good to be true’ money making opportunities that are in fact scams. Don’t become another statistic. The usual guidance applies. If something seems too good to be true, it probably is.”

The future for savings rates and inflation looks bleak.

The Bank of England thinks inflation will hit 1.8% in 2021, and it has a general target of 2%.

But savings rates are also likely to remain low during this period, despite Moneyfacts reporting that rates rose slightly on some fixed rate bonds and ISAs in April.

- 14 investment trusts to inflation-proof your portfolio

- Gatekeepers of internet urged to do more to fight fraud

The main reason for low savings rates is that the Bank of England cut the base rate to new depths of 0.1% last March. The base rate is factored into the savings rates paid by banks, and many cut these in response.

With the Bank unlikely to raise base rate any time soon, savings rates will languish further.

But don’t be too downhearted. It’s worth remembering that inflation doesn’t treat everyone equally, and so the eroding effect some are seeing on their cash may not apply to you.

Inflation tracks the cost of a set ‘basket’ of goods and services, such as food, clothing and healthcare.

However, to make calculations simpler this basket is limited, and constantly updated depending on broad consumer trends. It includes many common purchases, but excludes most.

For example, this year the ONS added ‘men’s loungewear bottoms’ to the basket, as more of us are dressing casually due to lockdown. It also stopped tracking the price of fruit smoothies, as fruit juice has become more popular.

So, depending on what you buy, inflation may have little relevance to you and your money.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.