Inflation watch: savers whacked with another surge in shop prices

14th July 2021 13:19

by Alex Sebastian from interactive investor

Hopes remain that another surge in the cost of living is transitory, but could interest rates rise higher and faster than expected?

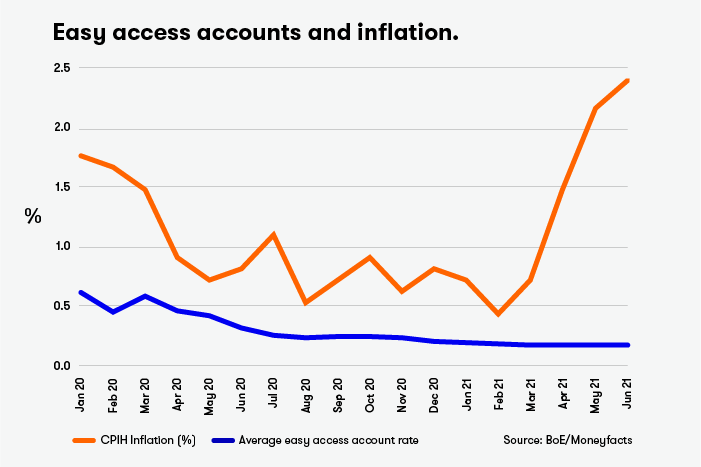

Inflation is the enemy of the saver, especially when it's impossible to find savings deals that beat it. Some of the most popular savings deals are easy access accounts, but the average deal doesn't come close to beating inflation - which is set to soar further this year.

This is the latest article in a monthly series that examines the effect of inflation on your savings.

Savers have been whacked with another higher than forecast rise in inflation today after the Office for National Statistics reported an annualised 2.5% increase in June.

Economists had been forecasting a figure of 2.1%. The ONS said the rise in prices has been broad-based, with fuel, cars and food all playing big roles in generating the overall increase.

June is the third month in a row where the figures have overshot the expected levels.

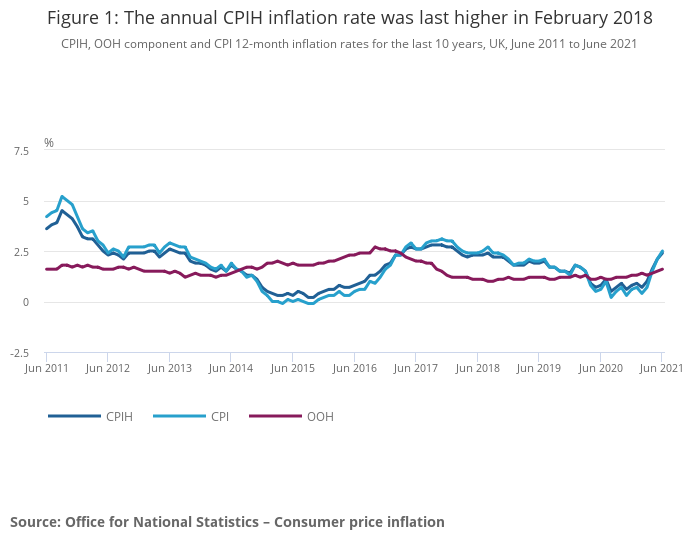

The Consumer Prices Index, including owner occupiers’ housing costs (CPIH), rose by 2.4% in the year to June, up from 2.1% in the 12 months to May.

This latest rise further undermines the view put forward by some policymakers that the increase in inflation seen since the lockdown began to lift is only ‘transitory.’

- Will ‘transitory’ inflation start to be worryingly persistent soon?

- A guide on how investors can protect against inflation

- How to invest: why you can’t ignore inflation

- Here’s how inflation slowly but surely erodes your wealth

The news follows reports in the US yesterday that inflation there has hit a 13-year high of 5.4%.

Luke Hickmore, fixed income investment director at Aberdeen Standard Investments noted the big impact central bank stimulus programmes are continuing to have.

“Markets are still supported by central banks putting more money in and even with all the ‘tapering’ talk, it is anticipated that the amount of liquidity central banks will pump into markets will remain high with another $1.5trillion likely before the end of 2021,” he said.

“We can see yield being pushed higher on treasury bonds due to rising concerns about inflation. With the currently hawkish note being struck by the Federal Reserve, the thinking is that rates will rise higher and faster than expected.”

The 2.5% consumer price index reading is the highest number recorded since summer 2018.

Savers have seen the real value of their money continuously whittled away over recent months, and the rate at which this is happening is accelerating.

The best rate currently available on an easy access account is just 0.5%, while the average rate is a paltry 0.17%.

Rachel Springall, finance expert at Moneyfacts.co.uk, said: “Despite improvements to the top savings rate deals in recent weeks, inflation is raining havoc on savers’ cash.”

“There is currently not one standard savings account that can outpace its eroding power and, according to the Bank of England, it is expected to pick up further above the target of 2%.

- The inflation-proof shares fund managers are backing

- Stockwatch: an inflation survival plan for investors

- Ian Cowie: four inflation-beating trusts yielding 4.5% or more

“One year ago, inflation sat at 0.60% and there were over 300 savings accounts which could beat this; inflation is clearly now much higher and poses a challenge to savers looking to protect their hard-earned cash from its eroding power.”

“It’s unknown how high inflation will rise in the months to come but it is still important for savers to keep on top of the changing market as rates continue to improve.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.