Inflation watch: relief on price rises likely to be short-lived

18th August 2021 10:50

by Alex Sebastian from interactive investor

A dip in clothing costs has helped inflation cool, but upward pressure on prices could return as the year continues.

Inflation has fallen slightly according to the latest batch of figures from the Office for National Statistics (ONS).

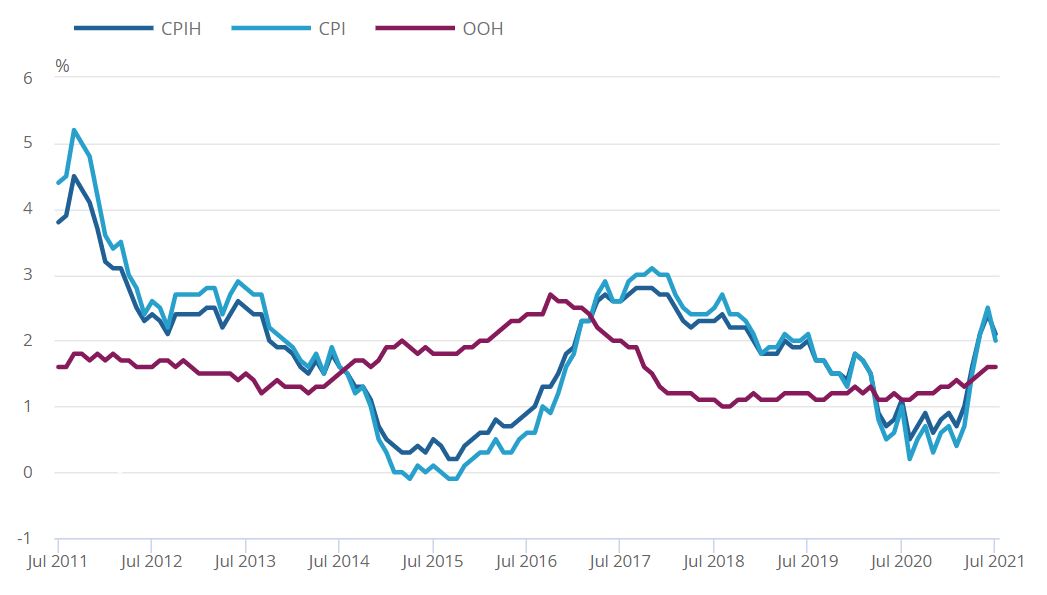

The ONS said the Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 2.1% in the 12 months to July 2021. This is down from 2.4% up to June, but significantly higher than the rise of 0.4% recorded in July 2020.

CPI inflation, without housing costs, fell to 2% from 2.5% at the last read-out.

The decline will offer some relief to households who have seen their budgets squeezed over recent months.

The fall stems in large part from a cooling of clothing and footwear prices, the ONS said. It also said the biggest upward pressure came from transportation costs and used car price rises, as the end of lockdown and arrival of summer saw people traveling more.

- Stockwatch: is there money to be made in used cars?

- A guide on how investors can protect against inflation

- How to invest: why you can’t ignore inflation

- Here’s how inflation slowly but surely erodes your wealth

This slip back in inflation may not last long however, as more upward pressure on prices looks to be on the cards later in the year.

The Bank of England will continue to face a highly difficult balancing act as it weighs-up when to raise rates from their current rock-bottom level of 0.1%.

Source: Office for National Statistics.

The fall in inflation reported today does serve to buy the UK central bank a little breathing room though.

Richard Hunter, head of markets at interactive investor, commented: “The relief of a slowdown in inflation is likely to be short-lived, with upward pressures remaining in the pipeline."

“Cost inflation is still bubbling underneath the surface, both in terms of blockages in the supply chain elevating prices, as well as pressures on the labour supply. In addition, the proposed hike in energy prices and the removal of the VAT reduction in hospitality will add some fuel to the inflationary fire as the year progresses."

“The Bank of England will not be carried away by the reduction, given its view that inflation has yet to peak before receding again, and with additional rises coming from the likes of the second-hand car market and transport costs in general, the underlying factors may yet see a significant increase from the current level of 2% before the number settles down again.”

- Will ‘transitory’ inflation start to be worryingly persistent soon?

- The inflation-proof shares fund managers are backing

- Ian Cowie: four inflation-beating trusts yielding 4.5% or more

Debapratim De, senior economist at Deloitte, added: “July's inflation figures are lower than expected. But this does not signal an easing of underlying price pressures. The sharp rise in input prices over the same month shows that supply continues to struggle to keep up with resurgent demand.”

“The data seem consistent with the Bank of England's expectations of some policy tightening over the next two years. If UK growth continues as forecast, without a major COVID-19 wave in the winter months, we are likely to see the first interest rate rise by next summer.”

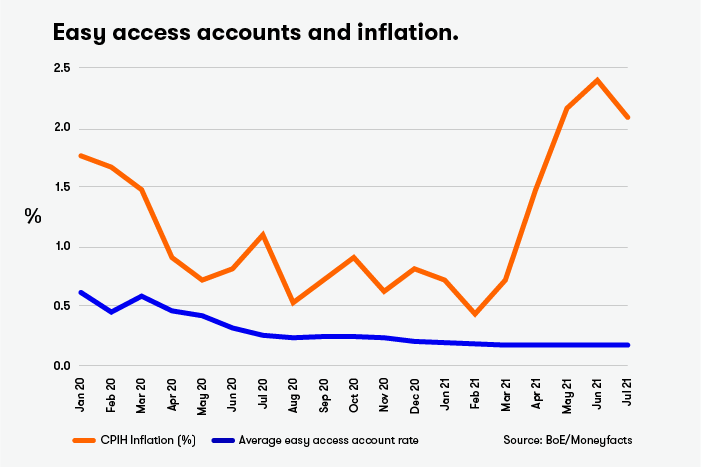

Despite the dip in inflation, savings accounts remain way off the pace. The average rate available this month is just 0.18%, according to the Moneyfacts UK Savings Trends Treasury Report. However, there is some consolation in that the average rate is up from 0.17% a month ago, and savings experts are becoming slightly more optimistic.

"After a challenging 18 months that saw saving rates fall to record lows, the fact that average rates are starting to rise offers savers hope that the market may be slowly becoming more competitive," says Rachel Springall, finance expert at Moneyfacts.co.uk.

“The consecutive rate rises across much of the savings spectrum are green shoots of life to a market that felt barren only a few months ago and there is no telling how long a good deal will last. It is evident that savers have disposable income to put aside and some may be using their pot to supplement their income, so it is hoped providers will inject more competition in the months to come to encourage consumers to take advantage.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.