Inflation watch: nowhere to hide for savers following cost of living shocker

16th June 2021 12:45

by Marc Shoffman from interactive investor

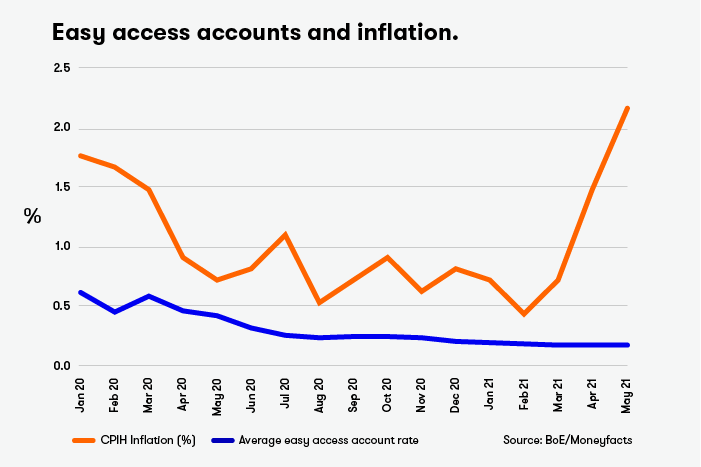

The gap between inflation and savings rates has grown significantly after the latest inflation data.

Inflation is the enemy of the saver, especially when it's impossible to find savings deals that beat it. Some of the most popular savings deals are easy access accounts, but the average deal doesn't come close to beating inflation - which is set to soar further this year.

This is the latest article in a monthly series that will examine the effect of inflation on your savings.

Savers are facing even more of a struggle to beat inflation today after a bigger-than-expected increase last month sent the cost of living measure to a two-year high.

Office for National Statistics (ONS) data shows inflation, based on the consumer prices index including owner occupiers’ housing costs (CPIH), rose 2.1% in the 12 months to May, up from 1.6% in April. CPI was also up to 2.1%, from 1.5% in April. Market experts had pencilled in a more modest increase to 1.8%.

The ONS says rising prices for clothing, motor fuel, recreational goods, and meals and drinks were the largest contributors to the rise.

- Market snapshot: US policymakers under scrutiny as UK inflation jumps

- Inflation: what it is, why it matters and what to do about it

- The inflation-proof shares fund managers are backing

- Mind & Money: understanding ourselves and our attitudes to risk

Transport costs were up the most, by 0.16 percentage points, while recreation and culture pricing rose 0.15 percentage points and clothing and footwear increased by 0.13 percentage points.

Food and alcoholic beverage prices fell 0.07 percentage points.

These changes reflect higher prices as the UK emerges from lockdown and people can now spend their money again in shops, pubs and restaurants.

The higher annual comparison also reflects that the UK was still in the midst of its first lockdown during May 2020.

“This is not a local phenomenon,” says Willem Sels, Chief Investment Officer, Private Banking and Wealth Management, HSBC.

“The rise of CPI in the UK is much less pronounced than in the US, where CPI stands at 5%, in part driven by the weak US dollar and stimulus payments to households.

“Although UK CPI may now further overshoot the Bank of England’s 2% target, we still think it will come down again to around 2% in 2022. There is significant spare capacity in labour markets, with more than two million UK workers remaining on furlough, meaning it is unlikely that a wage spiral develops, and hence CPI pressures should be temporary. This means there is no urgency for the Bank of England to hike interest rates any time soon.”

- Stockwatch: an inflation survival plan for investors

- Why Warren Buffett just rang the alarm bell on inflation

- How to be an ethical saver

- Check out our award-winning stocks and shares ISA

It is the first time the figure has been above the Bank of England’s target of 2% since July 2019 and could put pressure on its monetary policy committee (MPC) to hike interest rates from their record lows of 0.1% in response.

An interest rate rise could help manage spending and reduce price rises, but it also increases the cost of borrowing for individuals and companies, which could be bad for the stock market.

Understandably, not everyone is confident about such an approach, and many warn that runaway inflation could cool consumer spending and undermine the already fragile economy.

Comparison website Moneyfacts says no savings accounts now beat inflation, even if you are willing to lock up your cash in a long-term fixed rate account.

It could get even worse for savers next year when the predicted rate for inflation is expected to hit 2.3% in the second quarter of 2022.

Rachel Springall, finance expert at Moneyfacts, says: “Inflation is clearly unforgiving on savers cash and the rate is expected to rise further in the months to come.

“Savers who are already locked into an account that beats today’s inflation rate would be wise to see when their deal is set to mature and start to consider where to save their cash next.

“Savers who are looking to lock into the best rate regardless of the effect of inflation would be wise to act quickly, as some headline grabbing rates seen in recent weeks have since been cut.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.