Inflation watch: lengthy prices boom means more misery for savers

15th December 2021 13:30

by Graeme Evans from interactive investor

The idea of transitory inflation has been well and truly put to bed, with experts predicting high inflation will last deep into 2022. Graeme Evans explains why.

Savers will see erosion of their cash last several more months after today's inflation figure jumped to a bigger-than-expected 5.1%, close to the highest level since 1992.

Economists are warning the annual rate will linger near the current level for around six months and may even go higher in April before falling back towards 2% at the end of 2022.

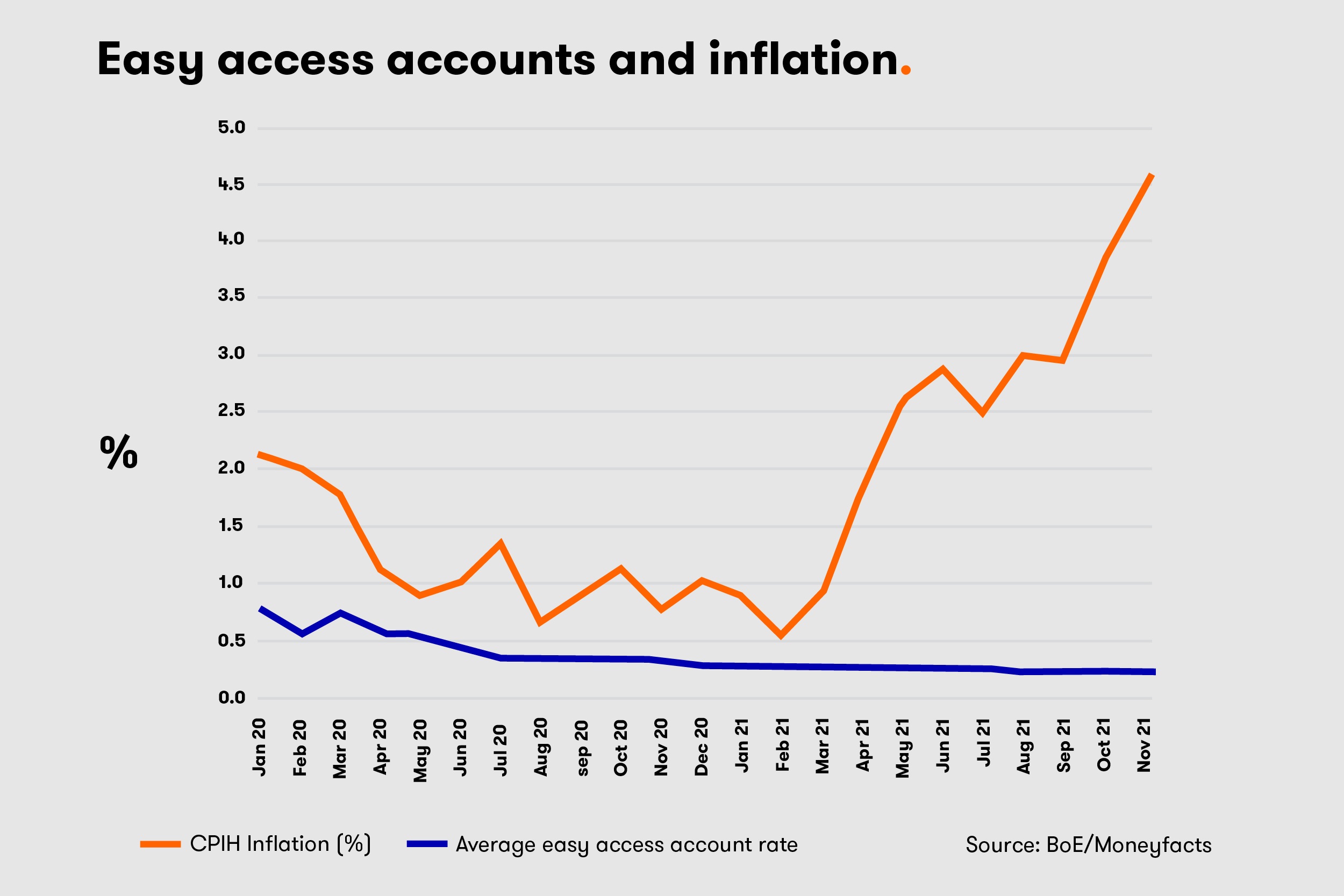

That's a depressing prospect for savers, given that the average easy access rate is currently just 0.19% and Moneyfacts reports the best on the market is 0.71% from Investec Bank.

A near-term interest rate hike from the Bank of England would be a step in the right direction, but even that's far from certain due to the worries over the Omicron variant of Covid-19.

The Bank's monetary policy committee meeting concludes tomorrow, with the City expecting policymakers to hold their nerve and keep rates at their 0.1% low for another month.

- Cost of living hits savings boom and triggers rush to credit cards

- New poll: here’s where you think the FTSE 100 will end 2022

That's despite the inflation spike and yesterday's warning from the International Monetary Fund about the dangers of being too slow tackling the dangers of rising prices.

Ellie Henderson, Investec economist, said today: “There is now the real risk of inflation becoming entrenched, especially considering the signs of second round effects in terms of rising wages, supported by a strong labour market.

“But this is balanced against the threat to the economic recovery from the new Omicron variant.”

She expects the Bank to leave rates unchanged, but adds that current price pressures may get worse if a new wave of infections leads to further labour shortages from self-isolation rules or if stricter social restrictions result in a bump in demand for goods.

The consumer prices index (CPI) measure of inflation is already much hotter than the Bank's forecasts made just a month ago, when it looked for a figure of 4.5% and a peak of 5% in April when the Ofgem price cap is reviewed.

Today's figure for November is just shy of the three-decade high of 5.2% in September 2008 and September 2011. Core inflation, however, is the highest since July 1992 after rising from 3.4% to 4% in the release from the Office for National Statistics.

Some of the jump in CPI is due to one-off factors, such as the 5.1% month-on-month rise in fuel prices, the 4.2% monthly surge in tobacco prices following duty changes in the Budget and the base effect comparisons with the sharp fall in clothing prices in 2020.

More persistent price pressures appear to include in food and second-hand car inflation after the latter jumped 27.1% due to the imbalance between high demand and low supply. CPI including owner occupiers’ housing costs (CPIH) rose by 4.6% in the 12 months to November 2021, up from 3.8% in October.

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

- Don’t be shy, ask ii…what is a 'Santa rally' in the investing world?

- Check out our award-winning stocks and shares ISA

Paul Dales, UK economist at Capital Economics, said there were also signs of pressures further up the inflation pipeline as a result of global product shortages and higher costs.

He added: “CPI inflation may linger around 5% for about six months and may even nudge up a bit in April 2022. But we still think it will start to fall sharply from June 2022, perhaps to 2%-2.5% by the end of 2022.

“So while the Bank of England won’t be able to ignore inflation for long (we wouldn’t completely rule out a hike tomorrow), we doubt it will raise interest rates next year as far as the 1% level priced into the markets.”

This signals further pain for savers, with not one standard savings account currently able to outpace inflation, compared with 496 deals in 2020 that were able to better last year's rate and the 181 in relation to the CPI figure in December 2019.

Rachel Springall, finance expert at Moneyfacts.co.uk, said: “Since the last inflation announcement, some of the top fixed rate bonds have improved, but elsewhere some fixed rate ISAs have worsened.

“These fluctuations reiterate the importance for savers to keep a close eye on the changing market and switch quickly to take advantage of a top rate.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.